Al Gore's Strategic Moves in Q1 2024: A Closer Look at Applied Materials Inc

Insights into Generation Investment Management's Latest 13F Filing

Al Gore (Trades, Portfolio)'s investment firm, Generation Investment Management, has recently disclosed its 13F filing for the first quarter of 2024. Founded in 2004 by Al Gore (Trades, Portfolio) and David Blood, the firm is renowned for its commitment to long-term investments and sustainability research. With headquarters in London and additional offices globally, Generation Investment Management serves a diverse clientele, focusing on integrated sustainability within its investment approach. The firm's strategy emphasizes the importance of environmental, social, and governance (ESG) factors in investing, aiming to identify companies that are well-positioned to address global challenges such as climate change, resource scarcity, and demographic shifts.

Key Position Increases

During the first quarter of 2024, Al Gore (Trades, Portfolio)'s firm increased its stakes in several companies, highlighting a strategic adjustment in its portfolio. Notably:

Becton Dickinson & Co (NYSE:BDX) saw an addition of 1,338,273 shares, bringing the total to 3,200,346 shares. This adjustment represents a significant 71.87% increase in share count and a 1.51% impact on the current portfolio, with a total value of $791,925,620.

Accenture PLC (NYSE:ACN) also experienced a substantial increase, with an additional 709,341 shares, bringing the total to 1,524,991. This adjustment represents an 86.97% increase in share count, totaling a value of $528,577,130.

Summary of Sold Out Positions

Al Gore (Trades, Portfolio) also made decisive exits from certain investments in the same quarter:

Palo Alto Networks Inc (NASDAQ:PANW) was completely sold off with all 449,032 shares liquidated, resulting in a -0.6% impact on the portfolio.

Veralto Corp (NYSE:VLTO) saw a complete exit as well, with all 901,343 shares sold, causing a -0.34% impact on the portfolio.

Key Position Reductions

Significant reductions were also made in several holdings:

Applied Materials Inc (NASDAQ:AMAT) was reduced by 2,243,623 shares, resulting in a -30.49% decrease in shares and a -1.65% impact on the portfolio. The stock traded at an average price of $183.46 during the quarter and has returned 12.57% over the past 3 months and 29.33% year-to-date.

Gartner Inc (NYSE:IT) saw a reduction of 592,872 shares, resulting in a -29% reduction in shares and a -1.21% impact on the portfolio. The stock traded at an average price of $460.24 during the quarter and has returned -3.05% over the past 3 months and -3.32% year-to-date.

Portfolio Overview

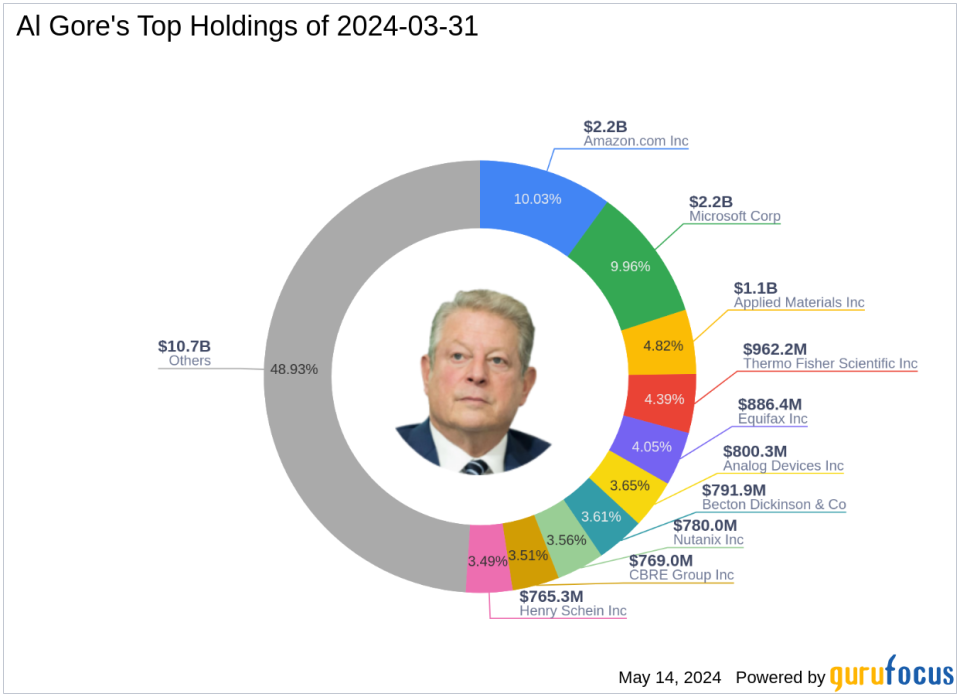

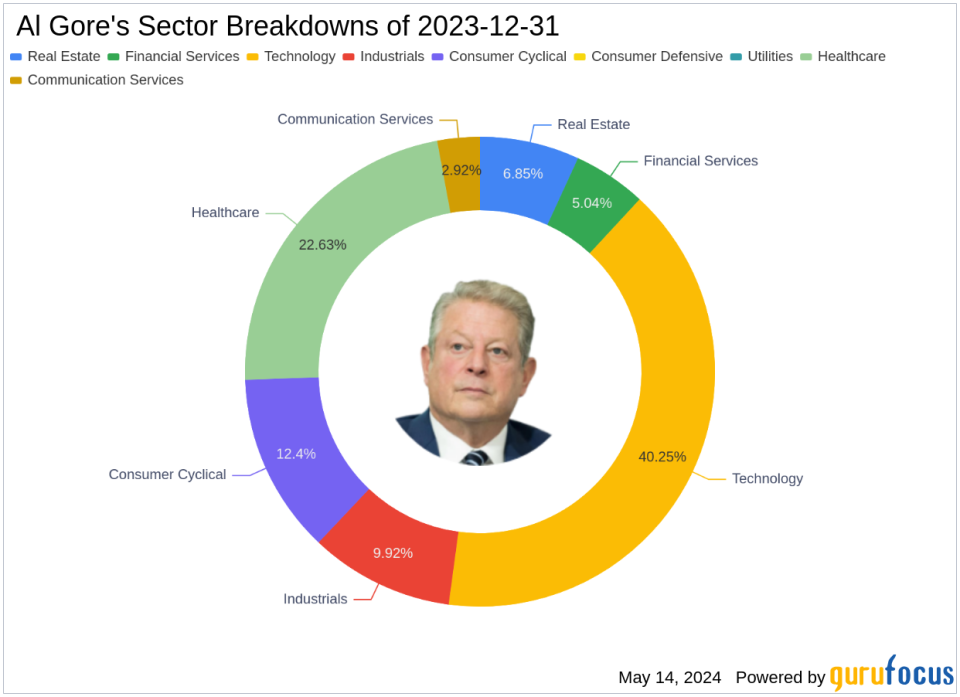

As of the first quarter of 2024, Al Gore (Trades, Portfolio)'s portfolio included 42 stocks. The top holdings were 10.03% in Amazon.com Inc (NASDAQ:AMZN), 9.96% in Microsoft Corp (NASDAQ:MSFT), 4.82% in Applied Materials Inc (NASDAQ:AMAT), 4.39% in Thermo Fisher Scientific Inc (NYSE:TMO), and 4.05% in Equifax Inc (NYSE:EFX). The holdings are mainly concentrated in 7 of all the 11 industries: Technology, Healthcare, Consumer Cyclical, Industrials, Real Estate, Financial Services, and Communication Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance