Exploring TSX Dividend Stocks For May 2024

As we approach May 2024, the Canadian market continues to reflect a complex interplay of global economic trends and domestic fiscal policies, influencing investor strategies and portfolio adjustments. In this environment, understanding the characteristics that define resilient dividend stocks becomes crucial for those looking to enhance their long-term financial stability through steady income streams.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.45% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.13% | ★★★★★★ |

Savaria (TSX:SIS) | 3.00% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.52% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.48% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.52% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.31% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.02% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.86% | ★★★★★☆ |

Sun Life Financial (TSX:SLF) | 4.50% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Aecon Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aecon Group Inc. operates in construction and infrastructure development, serving both private and public sectors in Canada, the U.S., and internationally, with a market capitalization of approximately CA$1.07 billion.

Operations: Aecon Group Inc. generates its revenue primarily through two segments: Concessions, which brought in CA$59.50 million, and Construction, contributing CA$4.33 billion.

Dividend Yield: 4.4%

Aecon Group Inc. reported a decrease in Q1 2024 sales to CAD 846.59 million from CAD 1,107.16 million year-over-year and reduced its net loss to CAD 6.12 million from CAD 9.44 million, indicating some operational improvements despite lower revenue figures. The company recently increased its quarterly dividend to CAD 0.19 per share, reflecting a commitment to returning value to shareholders amidst financial fluctuations and challenging market conditions. However, with a high cash payout ratio of over 4000%, the sustainability of such dividends could be under pressure unless cash flow improves significantly.

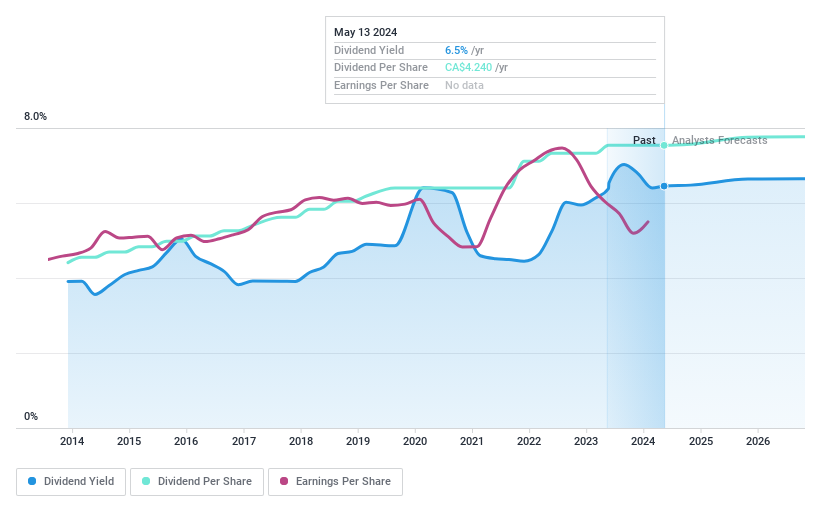

Bank of Nova Scotia

Simply Wall St Dividend Rating: ★★★★★★

Overview: The Bank of Nova Scotia, operating internationally with a focus on the Americas, offers a wide range of banking products and services and has a market capitalization of CA$80.82 billion.

Operations: The Bank of Nova Scotia generates revenue through its Canadian Banking segment at CA$11.46 billion, International Banking at CA$9.48 billion, Global Wealth Management at CA$5.32 billion, and Global Banking and Markets at CA$5.34 billion.

Dividend Yield: 6.5%

Bank of Nova Scotia has demonstrated a consistent commitment to its dividends, with stable and reliable payments over the last decade, supported by a reasonable payout ratio of 68.1%. The dividend yield stands at an attractive 6.45%, ranking in the top 25% among Canadian dividend payers. Earnings are projected to grow annually by 6.82%, ensuring future dividends remain covered with an anticipated payout ratio of 61% in three years. However, shareholder dilution occurred over the past year, which could influence future payouts and shareholder value.

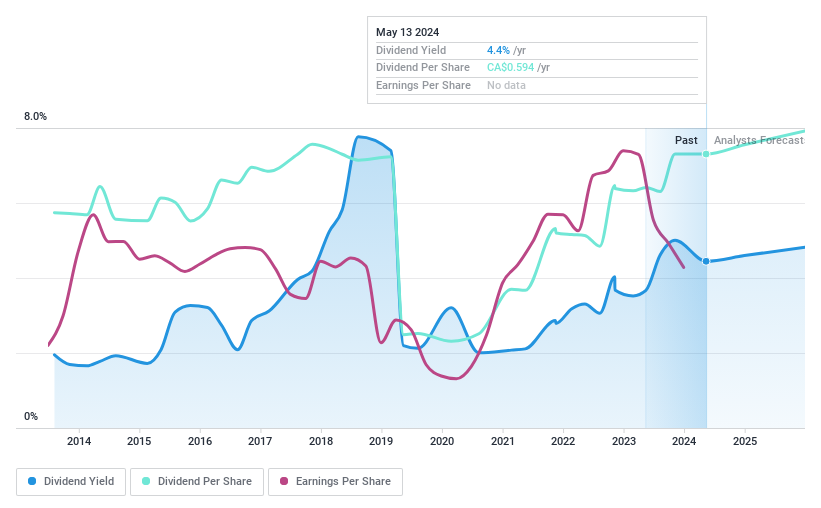

High Liner Foods

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: High Liner Foods Incorporated is a company that processes and markets frozen seafood products across North America, with a market capitalization of approximately CA$439.37 million.

Operations: High Liner Foods generates CA$1.08 billion from the manufacturing and marketing of prepared and packaged frozen seafood.

Dividend Yield: 4.4%

High Liner Foods has shown a mixed performance in its dividend offerings. Over the past decade, dividends have seen both increases and volatility. Currently, the dividend yield is 4.45%, which is lower than many top Canadian dividend stocks. Despite this, the dividends are well-supported financially; they are covered by both earnings with a payout ratio of 43.5% and cash flows with an 8.9% cash payout ratio. However, recent financials indicate a drop in net income from US$54.73 million to US$31.68 million year-over-year, alongside reduced profit margins from 5.1% to 2.9%, raising concerns about sustained profitability and future dividend reliability.

Click here to discover the nuances of High Liner Foods with our detailed analytical dividend report.

Our valuation report here indicates High Liner Foods may be overvalued.

Turning Ideas Into Actions

Embark on your investment journey to our 31 Top TSX Dividend Stocks selection here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:ARE TSX:BNS and TSX:HLF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance