To call the real estate market struggling right now is probably not a bridge too far. If anything, it might be understating things a bit. But real estate brokerage services firm Redfin (NASDAQ:RDFN) managed to blast up over 11% in Monday afternoon’s trading, and it’s largely thanks to some kind words from analysts in the middle of a very tough market for real estate.

The kind word in question came from Susquehanna analyst Shyam Patil, who took notice of Redfin’s “good execution” overall. Patil also pointed out Redfin’s ability to “…scale the core business in new markets” and its tendency toward “…improving traction in higher-margin segments.”

Plus, with market share trends on an upward slope, despite the difficulties in the overall real estate market, things are actually looking up for Redfin, all told. That was enough for Patil to kick Redfin’s price target from $7 per share to $8, though the rating is left at Neutral. It’s worth noting that, so far, Patil has enjoyed a 54% overall success rate, with an average return of 9.6% per rating.

Redfin Is Operating in Extremely Difficult Conditions

Redfin is operating in extremely difficult conditions right now. Just a couple weeks ago, Redfin’s CEO, Glenn Kelman, detailed that things are rough not only for Redfin, but for the industry as a whole. With Redfin’s revenue in decline and agents actually losing jobs as existing home sales hit their lowest point in around 30 years, it’s clear that the market is not what it was even two years ago. That makes any achievement that much better, by extension, and Redfin’s win today just a little bigger.

Is Redfin a Good Stock Buy?

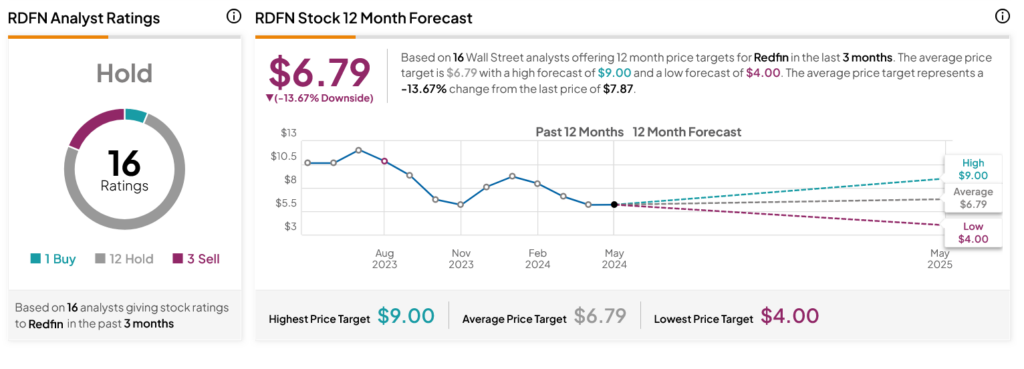

Turning to Wall Street, analysts have a Hold consensus rating on RDFN stock based on one Buy,12 Holds, and three Sells assigned in the past three months, as indicated by the graphic below. After a 23.92% loss in its share price over the past year, the average RDFN price target of $6.79 per share implies 13.67% downside risk.