Barrow, Hanley, Mewhinney & Strauss Bolsters Portfolio with Strategic Additions in Q1 2024

Highlighting a Significant Stake in Jacobs Solutions Inc

Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio), under the leadership of Executive Director Mr. Barrow, has made notable investment moves in the first quarter of 2024. The Dallas-based firm, known for its value investment philosophy, focuses on acquiring stocks with below-market price-to-earnings ratios, robust dividend yields, and substantial price-to-book ratios. Their strategic acquisitions and adjustments reflect a keen adherence to this philosophy, aiming to outperform the market even in fluctuating conditions.

New Additions to the Portfolio

During the first quarter of 2024, Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio) expanded its portfolio by adding 31 new stocks. Noteworthy among these are:

Jacobs Solutions Inc (NYSE:J), with 3,134,267 shares, making up 1.62% of the portfolio and valued at $481.83 million.

Mid-America Apartment Communities Inc (NYSE:MAA), comprising 1,599,701 shares or approximately 0.71% of the portfolio, with a total value of $210.49 million.

Sanofi SA (NASDAQ:SNY), holding 2,779,455 shares, accounting for 0.45% of the portfolio and valued at $135.08 million.

Key Position Increases

The firm also increased its stakes in several key holdings, including:

Keurig Dr Pepper Inc (NASDAQ:KDP), which saw an addition of 2,823,953 shares, bringing the total to 13,024,928 shares. This adjustment increased the share count by 27.68%, impacting the portfolio by 0.29%, and bringing the total value to $399.47 million.

Humana Inc (NYSE:HUM), with an additional 240,184 shares, bringing the total to 884,058 shares. This represents a 37.3% increase in share count, with a total value of $306.52 million.

Positions Completely Exited

In the same quarter, Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio) decided to exit completely from 28 holdings, including:

Exelon Corp (NASDAQ:EXC), where all 2,253,628 shares were sold, impacting the portfolio by -0.28%.

AutoNation Inc (NYSE:AN), with all 414,366 shares liquidated, causing a -0.22% impact on the portfolio.

Significant Reductions in Holdings

The firm also reduced its positions in several stocks, notably:

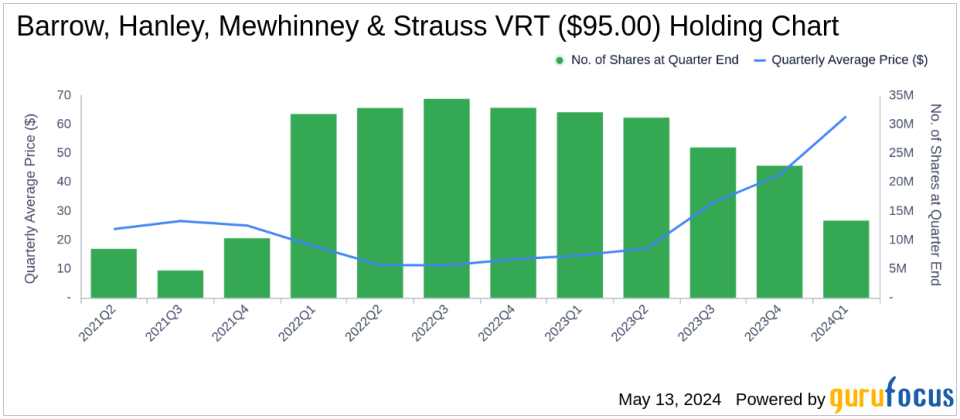

Vertiv Holdings Co (NYSE:VRT), reduced by 9,496,387 shares, resulting in a -41.52% decrease in shares and a -1.6% impact on the portfolio. The stock traded at an average price of $62.83 during the quarter and has returned 51.79% over the past 3 months and 97.61% year-to-date.

U.S. Bancorp (NYSE:USB), reduced by 5,554,543 shares, marking a -51.48% reduction in shares and a -0.84% impact on the portfolio. The stock traded at an average price of $42.20 during the quarter and has returned 6.48% over the past 3 months and -1.76% year-to-date.

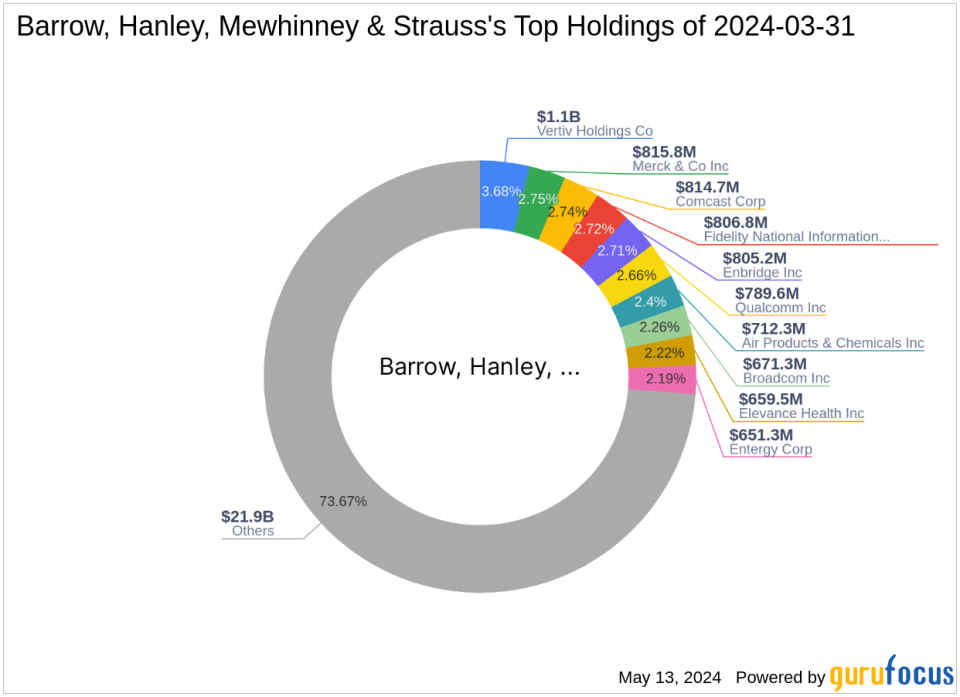

Portfolio Overview and Sector Allocation

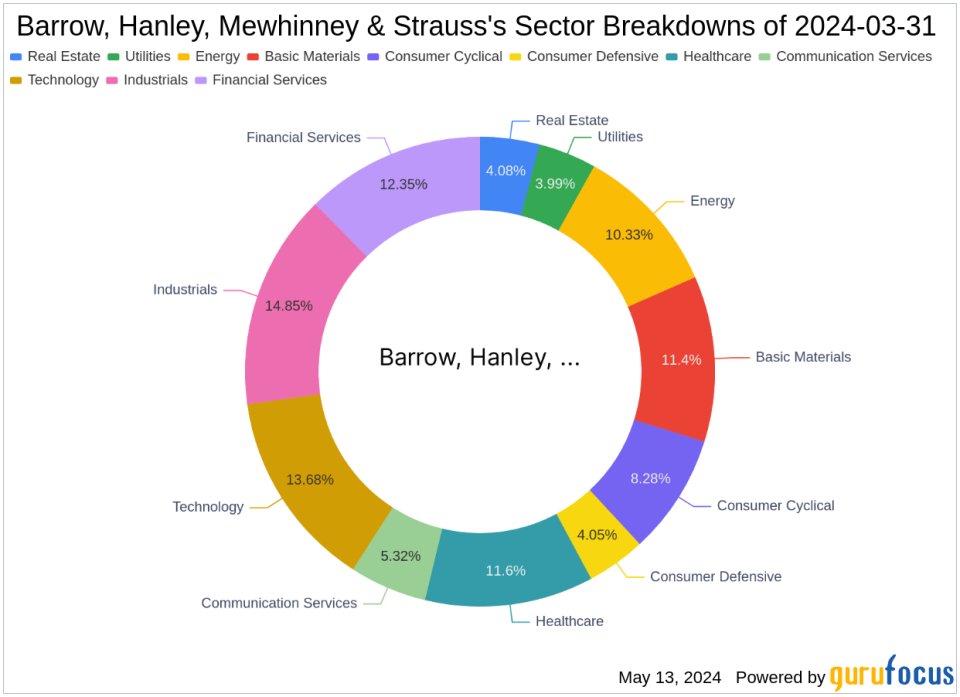

As of the first quarter of 2024, the portfolio of Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio) included 290 stocks. The top holdings were 3.68% in Vertiv Holdings Co (NYSE:VRT), 2.75% in Merck & Co Inc (NYSE:MRK), 2.74% in Comcast Corp (NASDAQ:CMCSA), 2.72% in Fidelity National Information Services Inc (NYSE:FIS), and 2.71% in Enbridge Inc (NYSE:ENB). The investments are well-diversified across all 11 industry sectors, demonstrating a balanced approach to sector allocation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance