D-Wave Quantum Inc. Reports First Quarter 2024 Earnings: A Detailed Analysis

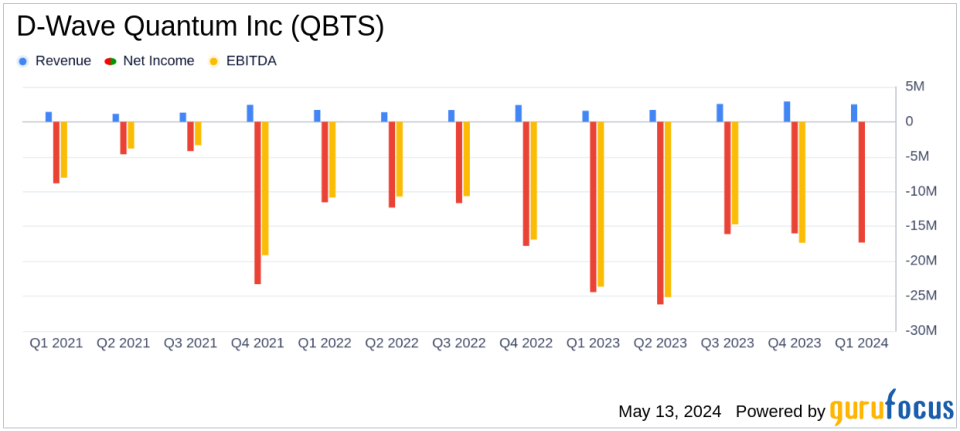

Revenue: $2.5 million, up 56% year-over-year, falling short of estimates of $3.07 million.

Net Loss: $17.3 million, an improvement from the previous year's $24.4 million, but above the estimated net loss of $15.07 million.

Earnings Per Share (EPS): Reported a loss of $0.11 per share, a decrease from last year's $0.20 per share, yet above the estimated loss of $0.09 per share.

Gross Margin: GAAP gross margin improved significantly to 67.3%, up from 26.6% year-over-year.

Bookings: Increased by 54% to $4.5 million, indicating strong demand for quantum computing solutions.

Operating Expenses: GAAP operating expenses decreased by 24% to $19.2 million, reflecting more efficient operations.

Cash Position: Ended the quarter with $27.3 million in cash, a substantial increase from the previous year's $9.0 million.

On May 13, 2024, D-Wave Quantum Inc. (NYSE:QBTS), a pioneer in the quantum computing industry, disclosed its financial outcomes for the first quarter of the fiscal year 2024 through its 8-K filing. The company, renowned for its development and delivery of quantum computing systems, software, and services, reported significant growth in revenue and bookings, indicating robust demand for its quantum and hybrid quantum solutions.

Financial Performance Highlights

For Q1 2024, D-Wave announced a revenue of $2.5 million, marking a 56% increase from the previous year's $1.6 million. This growth is a testament to the company's expanding influence in the quantum computing sector. Bookings for the quarter stood at $4.5 million, up 54% year over year, reflecting the eighth consecutive quarter of growth in this metric.

The company also reported a substantial increase in gross profit, which soared by 294% to $1.7 million from $0.4 million in Q1 2023. The gross margin improved dramatically to 67.3%, up from 26.6% in the prior year, primarily due to increased revenue and enhanced operational efficiencies.

Despite these positive trends in revenue and profitability metrics, D-Wave experienced a net loss of $17.3 million, or $0.11 per share, which did not align with analyst expectations of a $0.09 loss per share. This discrepancy underscores the challenges the company faces in managing its bottom line amidst its growth trajectory.

Operational and Strategic Developments

During the quarter, D-Wave made significant strides in product development and strategic partnerships. The introduction of the fast-anneal feature in its systems represents a breakthrough in reducing the impact of external disturbances on quantum computations. The company also progressed in its hardware development, announcing the production of 4800+ qubit processors for its forthcoming Advantage2 system.

Moreover, D-Wave renewed its multiyear partnership with the University of Southern California, ensuring continued access to cutting-edge quantum computing resources for a variety of sectors, including logistics and cybersecurity.

Financial Health and Future Outlook

As of March 31, 2024, D-Wave's consolidated cash balance was $27.3 million, significantly higher than the $9.0 million recorded in the first quarter of the previous year. This increase in liquidity positions the company well to support its ongoing projects and research initiatives.

Looking forward, D-Wave has reiterated its financial guidance for the full year 2024, projecting an Adjusted EBITDA Loss less than the $54.3 million reported in fiscal 2023. This outlook reflects the company's expectation of continued growth and operational improvements.

Conclusion

While D-Wave Quantum Inc. demonstrates compelling growth in revenue and gross profit, its net losses exceeding analyst expectations highlight the persistent challenges it faces. The company's strategic advancements and robust product pipeline, however, provide a solid foundation for future growth and profitability. Investors and stakeholders will likely watch closely as D-Wave continues to navigate the complex landscape of quantum computing.

For further details on D-Wave's financial performance and strategic initiatives, interested parties can access the full earnings report and join the upcoming earnings conference call.

Explore the complete 8-K earnings release (here) from D-Wave Quantum Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance