There has been loads of talk and speculation about the many ways AI will influence our world. However, at the recent Special Competitive Studies Project (SCSP) AI Expo for National Competitiveness in Washington, D.C., there was unanimous consensus among industry leaders, experts, and government representatives: AI and advanced tech will determine the outcome of future wars.

Bank of America’s Mariana Perez Mora, who attended the event, emphasized this point, bringing Palantir (NYSE:PLTR) into the conversation as a key player in the development of AI solutions for national defense.

“In our discussions with Palantir, the sense of urgency for the Government to rapidly adopt and deploy AI-enhanced products was palpable,” said the 5-star analyst. “PLTR showcased products which support advancing and increasing the efficiency of the U.S. industrial base (AIP), AI for battlefield awareness and decision making on Project Maven, joint mission planning, and enabling JADC2 with intelligence at the edge.”

Palantir’s CEO, Alex Karp, emphasized the crucial advantage the U.S. holds in software development. However, he stressed that for this advantage to continue as a vital strategic deterrent, the U.S. government must “move faster” in its adoption of AI.

That opinion is one Perez Mora reiterates, while also highlighting how important it is for the U.S Government and Silicon Valley to work together on achieving this. The analyst likens the current situation to the early days of Silicon Valley, an era “rife with fierce competition between start-ups, investments from the DoD, a growing threat from the Soviet Union, and the U.S. spreading commercial diplomacy.” Given a dearth of entrepreneurialism and a culture lacking invention and more intent on copying, during the period, the Soviet Union couldn’t keep up with the “rapid advancements” made in the U.S.

Now, at the dawn of AI, Perez Mora thinks the U.S. is in a similar predicament. “In our view,” she said, “it’s paramount the government support further investments in AI and spur competition. Additionally, we see PLTR as primed to meet the increased demand and advance AI-enabled products further.”

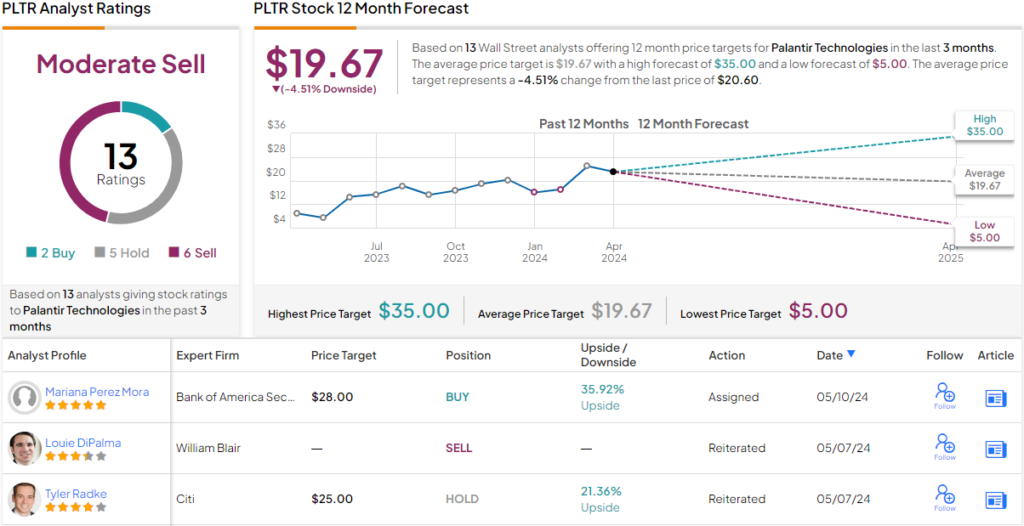

Therefore, given Palantir is “uniquely positioned to capture the growing commercial and government demand for AI products,” Perez Mora rates the stock a Buy, backed by a price objective of $28. This figure suggests the stock will surge ~36% over the coming months. (To watch Perez Mora’s track record, click here)

However, this bullish outlook from the Bank of America analyst is not a popular one on Wall Street; only one other analyst shares this optimism. In contrast, 6 analysts recommend selling the stock, and five maintain a neutral stance, leading to a Moderate Sell consensus rating. Going by the $19.67 average target, a year from now, shares will be changing hands for a 4.5% discount. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.