PayPal Stock Is a No-Brainer Buy Right Now

PayPal (NASDAQ: PYPL) has been a turnaround investment opportunity for some time, but the reversal is taking longer than many would like. Still, that doesn't discount how great of an investment PayPal could be once the rest of the market finally gets on the same page.

PayPal gained momentum in the first quarter, and I wouldn't be surprised if it's in the beginning stages of a rally, making the stock a no-brainer buy.

PayPal's Q1 was a great sign for investors

PayPal's fall from grace has been a long and drawn-out process. Since peaking during the summer of 2021, the stock has fallen more than 70% and has stayed relatively flat over the past year.

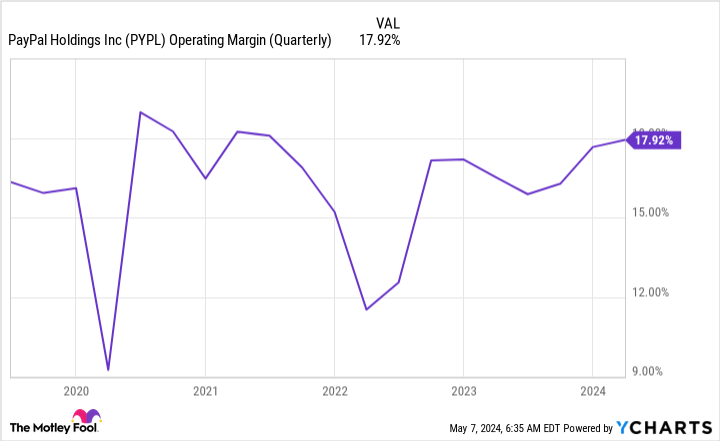

But that doesn't mean PayPal has been doing nothing. Within that year, a new CEO took over for longtime frontman Dan Schulman. Alex Chriss has been at the helm for a little under a year but has actively sought opportunities to transform the business, focusing on where PayPal can operate more efficiently. This has worked, as PayPal's operating margin in Q1 was close to its highest for a few years.

Additionally, PayPal's products continue to see strong use. Total payment volume rose 14% year over year to $404 billion, and the revenue scrapped from that total increased by 9% to $7.7 billion.

PayPal's growth and improved efficiency dramatically helped the company's profits. Generally accepted accounting principles (GAAP) earnings per share (EPS) rose 18% to $0.83. That's strong growth by itself, but it's even more impressive when you consider that management was only guiding for mid-single-digit EPS growth. It also beat on revenue guidance, as it only expected 6.5% to 7% revenue growth.

For the second quarter, it brought back its projection for 6.5% to 7% revenue growth and flat earnings growth (when investment portfolio gains are accounted for), but it raised full-year guidance from flat to mid- to high-single-digit growth.

Those are significant results, yet the market responded by selling the stock off by 2% the following day.

This doesn't make sense, and it shows how entrenched most of the investors in the stock market are against PayPal stock. But when you look at the valuation, you'll see it's just a matter of time before this stock pops.

The stock is still cheap

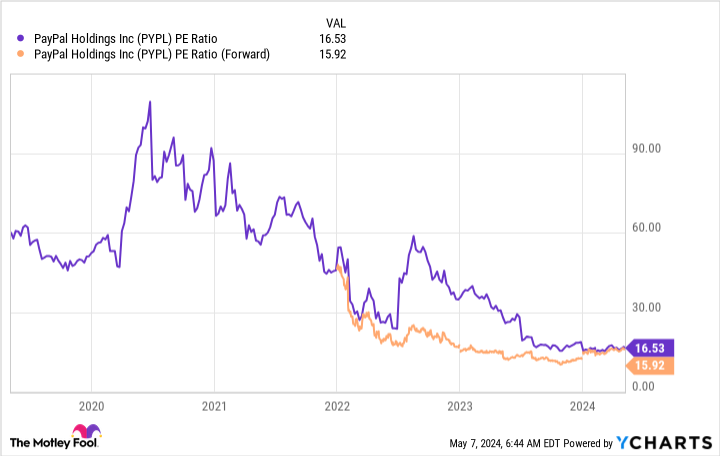

During its decline, PayPal's valuation has reached unbelievable lows. PayPal's stock now trades for about 16 times earnings, regardless of whether forward earnings are used or not.

This indicates Wall Street analysts believe that PayPal won't grow that much, although it has already beaten expectations in one quarter in 2024.

Additionally, the S&P 500 trades at 22.6 times trailing and 20.7 times forward earnings, which means PayPal trades at a sizable discount to the market.

Very few times can investors buy a company with PayPal's footprint that's growing at a respectable rate and trading well below the market's price. Chriss and his team have shown investors that they are looking all over the business for improvement opportunities and are finding plenty of them.

PayPal's turnaround is far from complete, and with a lot of room left to go, PayPal's stock looks like a fantastic buy, although the market has yet to get on board.

Should you invest $1,000 in PayPal right now?

Before you buy stock in PayPal, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PayPal wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Keithen Drury has positions in PayPal. The Motley Fool has positions in and recommends PayPal. The Motley Fool recommends the following options: short June 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

PayPal Stock Is a No-Brainer Buy Right Now was originally published by The Motley Fool