Arcturus Therapeutics (NASDQ:ARCT) is making significant strides across different aspects of its operations. The company’s collaboration with Meiji is taking a crucial step forward as it prepares to manufacture 4 million doses of the Kostaive® COVID-19 vaccine, a venture anticipated to boost its revenue substantially.

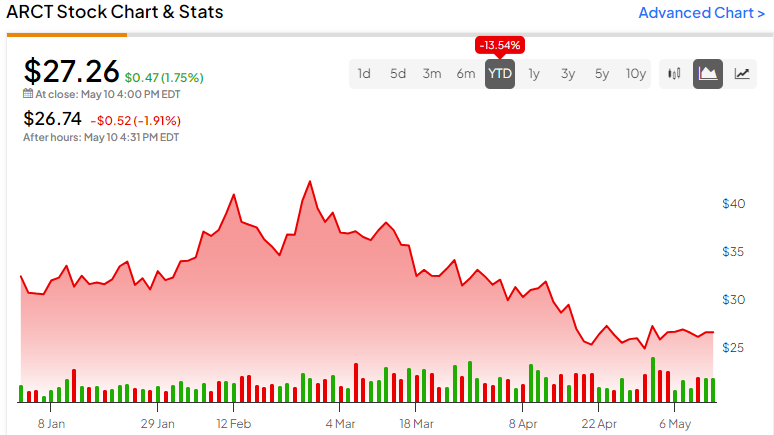

The stock is down -13.54% year-to-date, though it has shown a positive turn since the recent announcement of Q1 earnings, with expectations for further upside. Investors interested in biopharma stocks with growth potential may find this one compelling.

Arcturus COVID-19 Vaccine Approved

Arcturus Therapeutics Holdings is a biopharmaceutical company that focuses on discovering, developing, and commercializing treatments for infectious diseases and rare genetic disorders. It has a solid pipeline of promising research findings, strong distribution partnerships with CSL and Meiji, and a strong financial position.

The company developed the world’s first approved self-amplifying mRNA COVID-19 vaccine, known as Kostaive®. It recently reported the successful completion of a Phase III clinical trial for the vaccine as a booster vaccination in Japan. The company is on track to provide Japan with the initial 4 million vaccine doses in the third quarter of the year.

Furthermore, the company’s pipeline includes RNA therapeutic candidates to treat conditions such as Ornithine transcarbamylase deficiency and cystic fibrosis. Interim data from Phase 1b and Phase 2 studies of ARCT-810, targeted at cystic fibrosis patients, shows promising results. This development could signify a substantial progression of its therapeutic pipeline.

Arcturus Recent Financial Results & Outlook

Arcturus’s revenue significantly increased for Q1 2024, growing to $38.0M from $30.9M the previous quarter, and exceeded consensus expectations for $17.54M. This success can be attributed to the increased activities in all CSL programs, particularly in preparation for Kostaive’s commercialization. Arcturus’ partnership with CSL has yielded approximately $420.1 million in upfront payments and milestones achieved by Q1 2024.

Despite this revenue growth, Arcturus reported a net loss of around -$26.8M for Q1 2024 compared to a net loss of -$11.7M for Q4 2023. However, EPS of -$1.00 beat expectations of -$1.19.

The company maintained a substantial cash reserve, with cash, cash equivalents, and restricted cash totaling $345.3 million at the end of Q1 2024, a slight decrease from Q4 2023’s $348.9 million. Based on the current pipeline and programs, Arcturus expects its cash runway to last at least three years into the start of the 2027 fiscal year.

Is ARCT Stock a Buy?

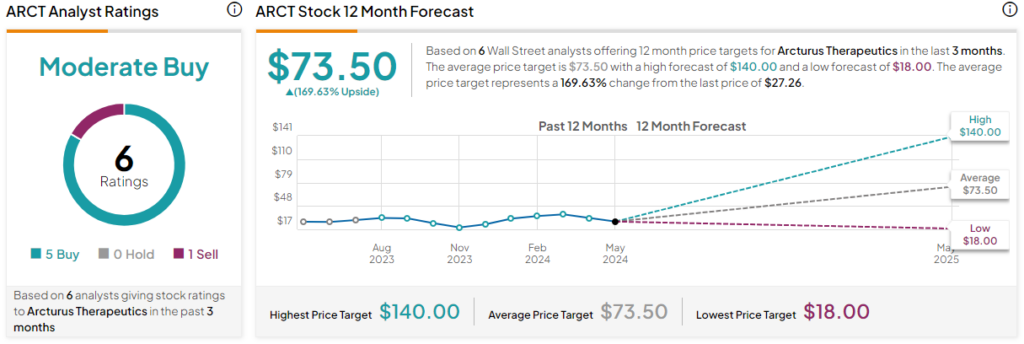

Analysts following the company have been bullish on the stock. For example, Wells Fargo analyst Yanan Zhu recently reiterated a Buy rating on the stock with a price target of $58. He notes that the anticipated delivery of Kostaive doses in Japan will trigger milestone payments and likely catalyze the stock higher.

Arcturus Therapeutics is rated a Moderate Buy based on the recommendations and 12-month price targets issued by six Wall Street analysts over the past three months. The average price target for ARCT stock is $73.50, representing a 169.63% upside from current levels.

Final Analysis on ARCT Stock

Arcturus Therapeutics seems to be well-positioned for substantial expansion as it continues to make strides in developing the Kostaive COVID-19 vaccine. With an expected production of 4 million doses, the company is poised to experience a significant revenue increase. Also, interim data from their clinical studies shows promising signs for the evolution of the company’s therapeutic pipeline towards addressing other medical conditions.

Despite a recent stock downturn, its Q1 earnings and growing revenue from CSL programs have set the stage for a potential market rally. ARCT presents a promising prospect for investors interested in biopharma stocks with growth potential.