Amazon Stock Is at an Inflection Point. It's Time to Buy the Stock Like There's No Tomorrow.

It's clear that Amazon's (NASDAQ: AMZN) stock is at an inflection point. After CEO Andy Jassy took over from founder Jeff Bezos, a new emphasis on profitability and cloud computing became evident, which is a massive transformation for Amazon.

Gone are the days of haphazard spending on growth; instead, Amazon is growing even faster while generating record profits. Most of the market doesn't realize it yet, but Amazon is at a generational tipping point, and investors would be wise to pile into the stock before the rest of the market notices.

Amazon's business is thriving at all levels

Amazon's business has many moving pieces, but the least exciting is the e-commerce store. While this is the largest segment within Amazon, it's also one of the slowest growing. However, investors should pay attention to the businesses developed around its core offering.

The second-largest segment (that ties directly in with its e-commerce store) is third-party seller services. This division allows third-party sellers to sell on Amazon's platform, giving them access to Amazon's distribution warehouses and lightning-fast delivery.

However, they have to manage inventory and determine what the consumer wants. Because they are taking on this risk, not Amazon, it's a far better business model than buying the items yourself. It also helps shield Amazon from antitrust lawsuits, as it is becoming a vital business partner for much smaller businesses.

Another exciting division is Amazon's advertising wing. This has been Amazon's fastest-growing segment for some time, and includes paying extra to have a sponsored product appear in searches and Prime Video ads.

However, the biggest factor in Amazon's business is Amazon Web Services (AWS), which is its cloud computing business. AWS was one of the first cloud computing options available to businesses and quickly shot out to a market share lead. While it has maintained that first-place position, Microsoft's Azure and Alphabet's Google Cloud have been taking market share lately.

These two have been growing in the mid-to-high-25% range over the past year, but AWS has only been growing to the tune of around 10%. This is a problem, as it shows AWS isn't capturing much of the artificial intelligence (AI) business. However, with AWS revenue rising 17% in Q1, it's safe to say this segment is starting to boom again.

When you look at Amazon's business as a whole, it's clear that it is booming.

The stock may be a bit expensive, but its growth backs it up

While Amazon discloses the revenue of many of its divisions, it doesn't break out the profitability for all of them. Instead, it lumps them into three categories: North American, International, and AWS. Looking at the company this way, it's obvious that Amazon is doing well.

Segment | Revenue | YOY Revenue Growth | Operating Income | YOY Operating Income Growth |

|---|---|---|---|---|

North American | $86.3 billion | 12% | $5 billion | 455% |

International | $31.9 billion | 10% | $903 million | N/A |

AWS | $25 billion | 17% | $9.4 billion | 84% |

Data source: Amazon. YOY = Year over year. Note: International was unprofitable last year.

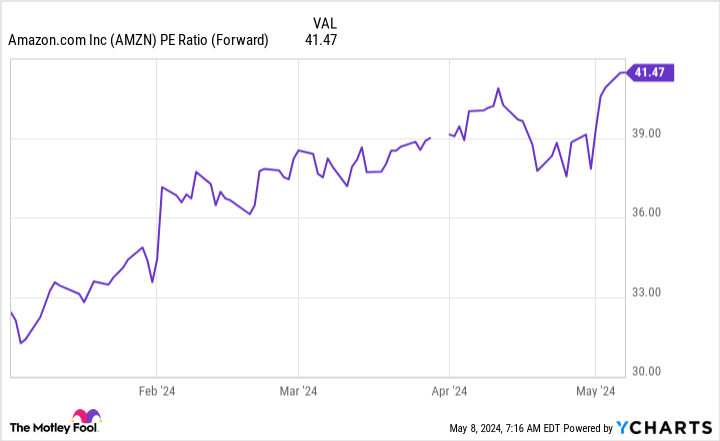

With all three divisions' profitability and growing at respectable rates, Amazon is a great growth stock to consider. However, you'll have to pay to own the stock. At more than 40 times earnings, Amazon isn't cheap.

The forward price-to-earnings ratio also doesn't do Amazon justice, as its profitability increases and growth goes far beyond 12 months. Thus, this metric is still slightly skewed. Still, it's something to consider before buying Amazon stock.

Amazon is at an inflection point because its businesses are starting to produce massive profits. This causes its profits to grow substantially faster than revenue, which will normalize the stock's valuation over the next few quarters. As a result, I'm a buyer of Amazon's stock, as I think it can go much higher from these levels if it continues delivering stellar quarters like it did in Q1.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $543,758!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Keithen Drury has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Amazon Stock Is at an Inflection Point. It's Time to Buy the Stock Like There's No Tomorrow. was originally published by The Motley Fool