Cambium Networks Corp (CMBM) Reports Q1 2024 Results: A Deep Dive into Financial Performance

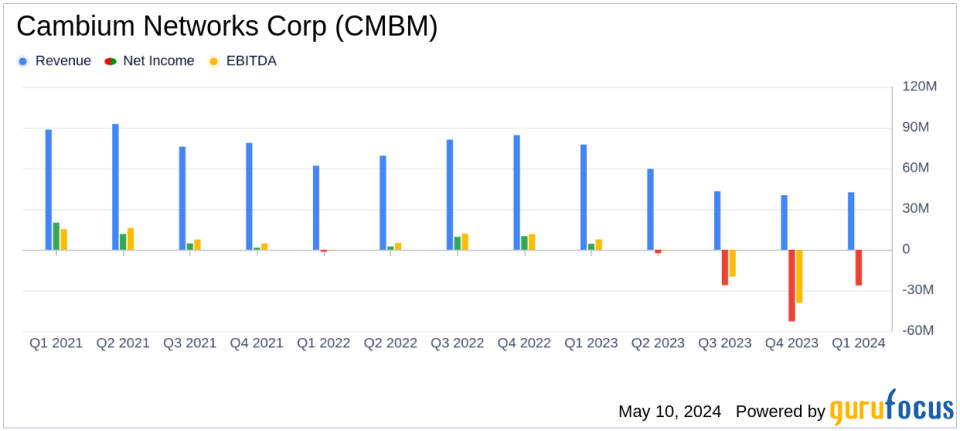

Revenue: Reported at $42.3 million, marking a 5% increase sequentially but a 45% decrease year-over-year, falling short of the estimated $45.38 million.

Net Loss: Substantial net loss of $26.4 million, significantly above the estimated net loss of $6.69 million.

Earnings Per Share (EPS): Recorded a loss of $0.95 per diluted share, considerably above the estimated loss of $0.24 per share.

Gross Margin: GAAP gross margin stood at 20.5%, showing a drastic reduction from 51.2% in the previous year.

Operating Loss: Reported a GAAP operating loss of $21.0 million, an improvement from the $41.6 million loss in the previous quarter.

Adjusted EBITDA: Posted an adjusted EBITDA loss of $15.5 million, representing (36.7)% of revenues, indicating a significant downturn from a positive 13.4% in the prior year.

Cash Position: Ended the quarter with $38.7 million in cash, up from $18.7 million at the end of the previous quarter.

Cambium Networks Corp (NASDAQ:CMBM) released its 8-K filing on May 9, 2024, revealing a challenging first quarter for the year. The company, known for its wireless broadband networking infrastructure solutions, reported a substantial decrease in revenue and increased losses compared to the previous year. This summary provides an in-depth analysis of Cambium's latest financial results, highlighting key performance metrics, challenges, and the company's outlook.

Company Overview

Cambium Networks Corp operates globally, offering wireless broadband solutions that cater to ISPs, enterprises, and government sectors. With a significant portion of its revenue generated from North America, Cambium's solutions are crucial for enhancing network performance and connectivity across various regions.

Financial Performance Analysis

For Q1 2024, Cambium reported revenues of $42.3 million, a sharp 45% decline from $77.4 million in Q1 2023. This decrease is primarily attributed to reduced sales across all product families. Despite a sequential increase from Q4 2023's $40.2 million, the year-over-year drop highlights ongoing challenges in the market and operational areas.

The company's gross margin significantly decreased to 20.5% in Q1 2024 from 51.2% in the same quarter the previous year. This decline reflects higher costs and lower revenue bases. Similarly, Cambium's operating loss widened to $21.0 million from an operating income of $5.6 million in Q1 2023, underscoring increased financial pressure.

Net loss deepened to $26.4 million, or $0.95 per diluted share, compared to a net income of $4.3 million, or $0.15 per diluted share, in Q1 2023. This deterioration is partly due to higher operating expenses and a challenging economic environment impacting the tech sector broadly.

Challenges and Strategic Adjustments

The significant financial downturn can be attributed to multiple factors including delays in government funding for defense orders and approval delays for new products in the U.S. However, Cambium's management remains focused on navigating these challenges by enhancing operational efficiency and launching new products following recent FCC approvals.

President and CEO Morgan Kurk emphasized the recovery in the Enterprise business and reduction in channel inventories as positive steps, though he acknowledged the hard work ahead to achieve sequential growth and improve cash generation throughout 2024.

Future Outlook and Investor Insights

Looking ahead to Q2 2024, Cambium anticipates revenues between $43.0 million and $48.0 million. The company also expects improvements in both GAAP and non-GAAP gross margins, reflecting ongoing efforts to optimize operations and cost structures.

The financial trajectory and strategic initiatives of Cambium Networks suggest a critical period of restructuring and adaptation. As the company aims to stabilize and grow amidst market and operational pressures, investors and stakeholders will closely monitor its ability to navigate these challenges.

Conclusion

While Cambium Networks faces significant hurdles, the steps being taken to address operational inefficiencies and market challenges are crucial. The company's ability to adapt to changing market conditions and innovate in its product offerings will be key to its recovery and future success.

For detailed financial figures and further information, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Cambium Networks Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance