Oportun Financial Corp Reports Q1 2024 Results: A Turnaround in Performance

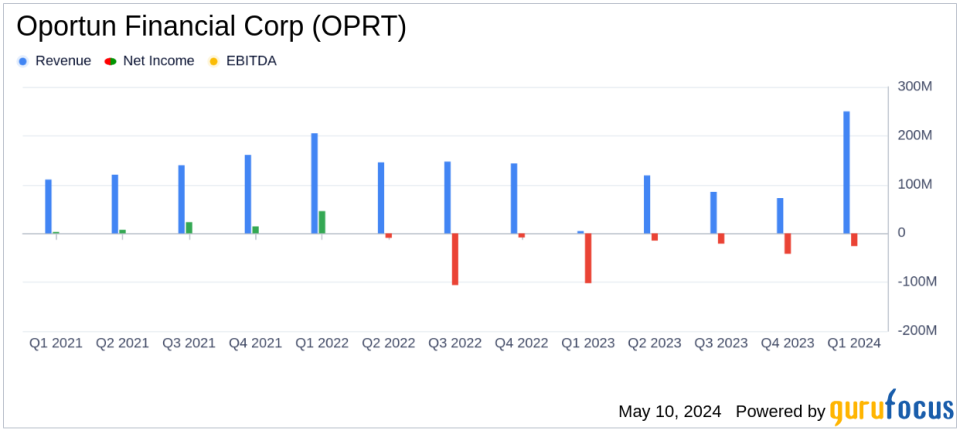

Revenue: Reported $250M, a decrease of 3% year-over-year, beating the estimated $240.52M.

Net Loss: Improved to $(26)M from $(102)M year-over-year, falling short of the estimated net income of $2.60M.

Earnings Per Share (EPS): GAAP net loss per share was $(0.68), compared to $(3.00) in the prior-year quarter; Adjusted EPS was $0.09.

Operating Expenses: Decreased by 25% year-over-year to $110M, reflecting effective cost control measures.

Adjusted EBITDA: Turned positive at $1.9M, a significant improvement from a $(20)M loss in the prior-year quarter.

Portfolio Yield: Increased to 32.5%, up by 113 basis points from the prior-year quarter.

Guidance: Raised full-year 2024 revenue and Adjusted EBITDA forecasts, indicating expected continued operational improvement.

Oportun Financial Corp (NASDAQ:OPRT) disclosed its financial outcomes for the first quarter ended March 31, 2024, through its recent 8-K filing. The company, known for providing financial services to underserved consumers, demonstrated a significant reduction in its net loss and strategic enhancements in its operational efficiency.

Company Overview

Oportun Financial Corp offers a range of financial services, including personal and auto loans, aimed at individuals with little to no credit history. The company's mission is to provide affordable and responsible credit, helping customers build a better financial future. Oportun's approach includes offering small-dollar, unsecured installment loans alongside other financial services and products.

Financial Performance Insights

For Q1 2024, Oportun reported a total revenue of $250 million, a slight decrease from $260 million in the same quarter the previous year. This decline was primarily due to a decrease in average daily principal balance, somewhat mitigated by an increase in portfolio yield. The GAAP net loss was significantly reduced to $26 million from a loss of $102 million year-over-year, marking a substantial improvement in profitability. Adjusted net income stood at $3.6 million, a stark contrast to the adjusted net loss of $58 million in Q1 2023.

Operational Highlights and Challenges

The company's operational metrics revealed a mixed performance. Aggregate originations decreased by 17% year-over-year to $338 million, influenced by a reduction in average loan size under a tightened credit posture. However, the portfolio yield increased by 113 basis points to 32.5%, reflecting higher fees on loans. The managed principal balance at the end of the period was $3.0 billion, down from $3.3 billion in the prior-year quarter. The annualized net charge-off rate slightly improved to 12.0% from 12.1%.

Strategic and Financial Achievements

Oportun's strategic initiatives, including cost reduction efforts, were highly effective. Operating expenses saw a 25% year-over-year decline. The company also executed an additional $150 million whole loan sale agreement in May and raised its full-year 2024 guidance for total revenue and adjusted EBITDA, expecting a 31% uplift at the midpoint and approximately 350% year-over-year growth in adjusted EBITDA.

Outlook and Forward Guidance

CEO Raul Vazquez expressed optimism about the company's trajectory, highlighting the effectiveness of cost reductions and operational improvements. For the upcoming quarters, Oportun has raised its full-year 2024 guidance, reflecting confidence in continued operational enhancements and profitability.

Conclusion

Oportun Financial Corp's first quarter of 2024 marks a pivotal moment in its financial and operational strategy. The significant reduction in net loss and proactive adjustments in its business operations underscore the company's resilience and adaptability in a challenging market. Investors and stakeholders might view these results as a positive indication of the company's direction and management effectiveness.

For detailed financial figures and future projections, interested parties are encouraged to view the full earnings report and listen to the upcoming earnings call, details of which can be found on Oportun's Investor Relations page.

Explore the complete 8-K earnings release (here) from Oportun Financial Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance