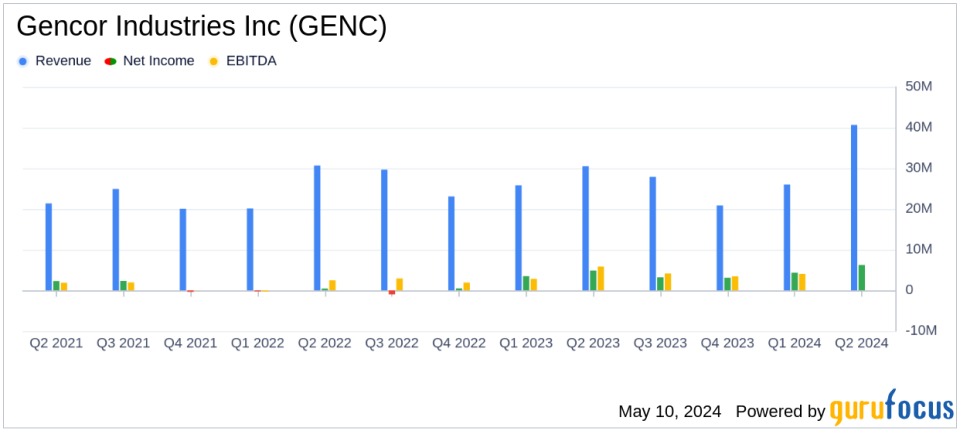

Gencor Industries Inc (GENC) Reports Strong Second Quarter Fiscal 2024 Results

Revenue: $40,676,000 for Q2 2024, up 33.4% from $30,501,000 in Q2 2023.

Gross Profit Margin: Increased to 30.3% in Q2 2024 from 29.8% in Q2 2023.

Operating Income: Rose 37.0% to $7,072,000 in Q2 2024 from $5,161,000 in Q2 2023.

Net Income: Increased 27.7% to $6,222,000 in Q2 2024, with EPS of $0.42, up from $4,873,000 and EPS of $0.33 in Q2 2023.

SG&A Expenses: Increased by $1,295,000 to $4,357,000 in Q2 2024, primarily due to higher trade show costs and professional fees.

Backlog: As of March 31, 2024, stood at $50.4 million, up 34.8% from $37.4 million as of March 31, 2023.

Cash and Marketable Securities: Increased to $117,107,000 as of March 31, 2024, from $101,283,000 as of March 31, 2023.

On May 10, 2024, Gencor Industries Inc (GENC) released its 8-K filing, announcing robust financial results for the second quarter of fiscal year 2024. The manufacturer of heavy machinery used in highway construction and environmental control equipment reported a notable 33.4% increase in net revenues, reaching $40.676 million up from $30.501 million in the same quarter the previous year.

The company, which specializes in equipment for the highway construction industry, saw its gross profit margins improve slightly from 29.8% to 30.3% due to better absorption on increased production and favorable price realization. However, this period also saw a rise in selling, general and administrative expenses by $1.295 million, primarily due to increased trade show expenses and professional fees.

Financial Performance Overview

Operating income for the quarter surged by 37.0%, amounting to $7.072 million, driven by significantly higher net revenue. Despite a decrease in non-operating income due to lower gains on marketable securities, net income still increased by 27.7% to $6.222 million, or $0.42 per share, compared to $4.873 million, or $0.33 per share, in the prior year's quarter.

For the six months ended March 31, 2024, Gencor reported net revenue of $66.694 million and net income of $10.548 million, or $0.72 per diluted share, compared to net revenue of $56.327 million and net income of $8.349 million, or $0.57 per diluted share, for the same period in 2023.

Balance Sheet and Market Position

As of March 31, 2024, Gencor held $117.107 million in cash and marketable securities, an increase from $101.283 million as of September 30, 2023. The company's net working capital stood at $176.523 million, with no short-term or long-term debt outstanding. The backlog increased by 34.8% year-over-year to $50.4 million, reflecting continued optimism in the infrastructure sector.

Marc Elliott, Gencors President, commented on the results: "Second quarter results were strong across the board, further demonstrating our successful strategy centered on top-line growth and solid margin performance. During the quarter, we continued to see healthy demand for our equipment despite the high-interest rate environment. Our backlog of $50.4 million is 34.8% higher than the prior year. It represents continued optimism from highway contractors that the Federal government and many states continue to focus on investing in Americas infrastructure."

Elliott also highlighted the company's strong presence at the World of Asphalt show in March, which saw higher-than-normal attendance, signaling continued industry confidence supported by the Infrastructure Investment and Jobs Act.

Looking Ahead

With a solid financial foundation and a growing market demand, Gencor Industries Inc remains well-positioned to capitalize on new opportunities and maintain its growth trajectory in the competitive heavy machinery manufacturing sector.

Explore the complete 8-K earnings release (here) from Gencor Industries Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance