NuScale Power Corp (SMR) Reports Q1 2024 Earnings: Misses Revenue and Earnings Estimates

Revenue: Reported $1.4 million, significantly below the estimated $5.71 million.

Net Loss: Reported a net loss of $48.1 million,

exceedingbelow the estimated loss of $41.85 million.Earnings Per Share: Details not provided, comparison with estimated EPS of -$0.17 not possible.

Cash Position: Improved to $137.1 million from $125.4 million at year-end 2023.

Cost Savings: Implemented strategic initiatives expected to generate $50 to $60 million in annualized savings starting Q2 2024.

Debt Status: Maintained a debt-free status.

Operational Highlights: Advanced in the commercialization of SMR technology and continued manufacturing partnerships.

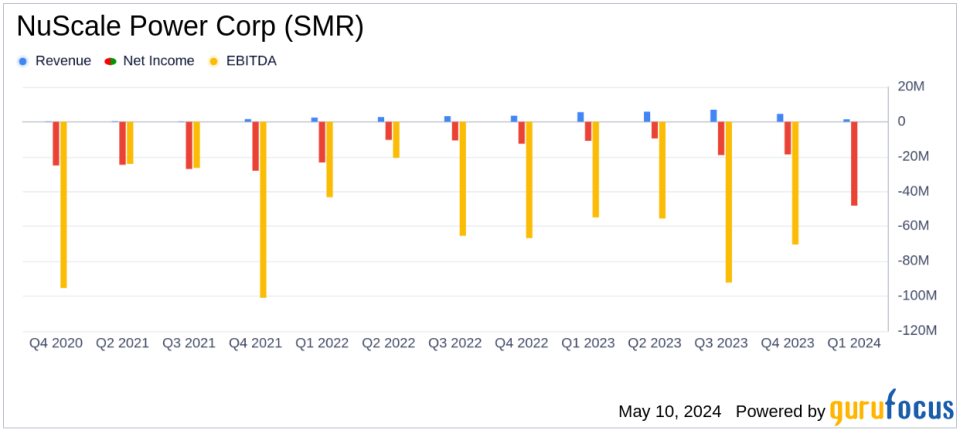

On May 9, 2024, NuScale Power Corp (NYSE:SMR) released its 8-K filing, disclosing its financial results for the first quarter ended March 31, 2024. The company, a pioneer in modular light water reactor nuclear power technology, reported a net loss of $48.1 million on revenues of $1.4 million, a significant deviation from analyst expectations of a net loss of $41.85 million on revenues of $5.71 million.

Company Overview and Market Dynamics

NuScale Power Corp is at the forefront of developing small modular reactor (NYSE:SMR) technology, approved by the U.S. Nuclear Regulatory Commission (NRC). This technology is critical in meeting the growing demand for reliable, carbon-free baseload power. The company's SMR technology is currently the only one with NRC design approval, positioning NuScale as a key player in the global energy transition.

Operational Highlights and Strategic Developments

The first quarter saw NuScale advancing the production of its NuScale Power Modules in collaboration with Doosan Enerbility and progressing in the Phase 2 Front-End Engineering and Design (FEED) work for the RoPower project. These developments are part of NuScale's strategic initiatives to transition from research and development to commercial operations, aiming for long-term financial stability and the fulfillment of commercial contracts.

Financial Performance Analysis

NuScale's financial results for Q1 2024 reflect a challenging period, with a reported revenue of $1.4 million, a stark decrease from $5.5 million in the same period last year. The increased net loss of $48.1 million, compared to last year's $35.6 million, included a one-time $3.2 million charge related to the transition to commercial operations and a $9.0 million non-cash adjustment due to the fair value change of warrants. Despite these challenges, NuScale has improved its cash position, ending the quarter with $137.1 million in cash and equivalents, and maintains a debt-free status.

Looking Forward

Despite the financial setbacks in this quarter, NuScale remains optimistic about its strategic direction, focusing on aligning resources with commercialization and revenue generation. The company expects to generate $50 to $60 million in annualized savings starting from the second quarter of 2024, which could help mitigate some of the financial pressures and aid in stabilizing the company's financial footing as it scales up operations.

NuScale's pioneering technology and strategic advancements hold significant potential for the energy sector, particularly in providing scalable and reliable carbon-free energy solutions. However, the company must navigate financial challenges and market dynamics carefully to capitalize on its technological edge and fulfill its commercial potential.

For more detailed information and updates, investors and interested parties are encouraged to refer to the full 8-K filing and follow developments through NuScale Power Corp's official communications.

Explore the complete 8-K earnings release (here) from NuScale Power Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance