Sterling Check Corp (STER) Q1 2024 Earnings: Misses Analyst Forecasts with Net Loss Despite ...

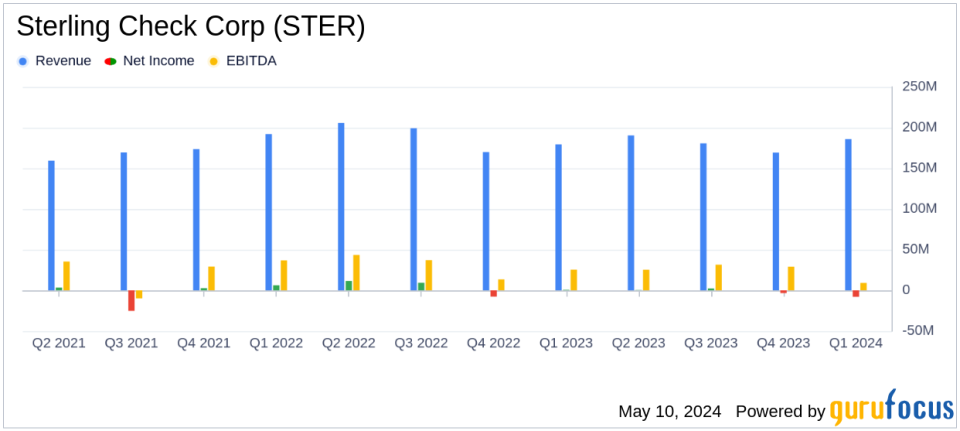

Revenue: Reported at $186.0 million, marking a 3.8% increase year-over-year, but fell short of the estimated $193.82 million.

Net Loss: Posted a net loss of $7.955 million, a significant drop from a net income of $0.591 million in the previous year, and well above the estimated net income of $27.51 million.

EPS: Recorded a loss of $0.09 per diluted share, contrasting sharply with the estimated earnings of $0.29 per share.

Adjusted EBITDA: Decreased by 15.5% to $38.5 million, with the margin also contracting by 470 basis points to 20.7%.

Free Cash Flow: Turned negative at $(1.9) million compared to $7.0 million in the prior year, reflecting lower operating income and higher cash taxes paid.

Inorganic Growth: Contributed 8.7% to revenue growth, driven by recent acquisitions, despite a 4.9% decline in organic constant currency revenue.

Market Position: Despite current financial setbacks, continued strategic acquisitions and a focus on cost optimization are expected to improve margins and operational efficiency in upcoming quarters.

Sterling Check Corp (NASDAQ:STER), a leading global provider of technology-enabled background and identity verification services, released its 8-K filing on May 9, 2024, detailing its financial results for the first quarter ended March 31, 2024. The company reported a challenging quarter with a net loss despite achieving modest revenue growth, primarily driven by its recent mergers and acquisitions.

Company Overview

Sterling Check Corp offers a comprehensive suite of background and identity services, providing over 50,000 clients with solutions that enhance hiring and risk management processes. Through its advanced, proprietary technology platform, Sterling delivers services that include criminal background screening, identity verification, drug and health screening, and more, helping organizations build trust and safety in their employment and business operations.

Financial Performance Highlights

For Q1 2024, Sterling reported revenues of $186.0 million, marking a 3.8% increase from $179.3 million in the same quarter the previous year. This growth was attributed to an 8.7% increase from inorganic sources like acquisitions, although organic constant currency revenue saw a decline of 4.9%. Despite the revenue increase, the company faced a significant downturn in profitability, with a GAAP net loss of $8.0 million, or $0.09 per diluted share, compared to a net income of $0.6 million, or $0.01 per diluted share, in Q1 2023.

Adjusted EBITDA also fell by 15.5% to $38.5 million, with the margin contracting by 470 basis points to 20.7%. This decline in profitability was largely due to increased costs associated with mergers and acquisitions and a shift in revenue mix towards lower-margin product categories.

Operational and Strategic Developments

Sterling's quarter was notably impacted by its strategic acquisitions, including the purchase of Vault Workforce Screening, which was integrated into its operations during the period. The company highlighted the organic revenue growth driven by new business and up/cross-selling, although it was offset by declines in its base business revenue, reflecting ongoing challenges in the hiring market.

CEO Josh Peirez emphasized the company's focus on product innovation and technology excellence, which continues to attract new clients and retain existing ones. He also noted the expected improvement in margins through ongoing cost optimization efforts and synergies from recent acquisitions.

Financial Position and Cash Flow

As of March 31, 2024, Sterling's balance sheet showed $67.0 million in cash and cash equivalents, with total debt standing at $559.2 million. The company's net leverage ratio was 2.8x net debt to Adjusted EBITDA. For the quarter, Sterling generated $3.7 million in net cash from operations, a decrease from $11.3 million in the prior year, and reported a free cash flow of $(1.9) million.

Market and Forward-Looking Statements

While Sterling did not host an earnings conference call due to its pending merger with First Advantage, the company's disclosures suggest cautious optimism. Management expects the hiring market dynamics to moderate and is focused on leveraging its strategic initiatives to enhance shareholder value. However, the company also acknowledges the risks associated with its ongoing integration activities and market volatility.

In conclusion, Sterling Check Corp's first quarter of 2024 reflected a mix of growth challenges and strategic advancements. As the company continues to navigate its extensive integration processes and market fluctuations, investors and stakeholders will be keenly watching its ability to turn around profitability and cash flow metrics in upcoming quarters.

Explore the complete 8-K earnings release (here) from Sterling Check Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance