Dnow Inc (DNOW) Q1 2024 Earnings: Meets Revenue Expectations, Misses EPS Estimates

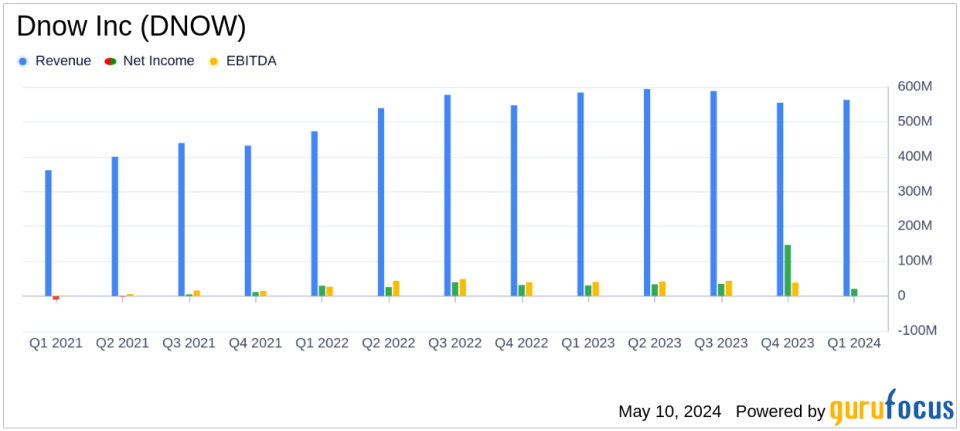

Revenue: $563 million for Q1 2024, falling short of estimates of $569.15 million.

Net Income: $21 million, below the estimated $24.60 million.

Earnings Per Share (EPS): Reported $0.20 (basic) and $0.19 (diluted), below the estimated $0.23.

Free Cash Flow: Generated $80 million, progressing towards an increased full-year target of $200 million.

Acquisitions: Integrated Whitco Supply, enhancing service capabilities and customer support in the energy sector.

Balance Sheet: Ended the quarter debt-free with $188 million in cash, despite a decrease from $299 million at the end of the previous quarter.

Outlook: Upgraded 2024 revenue growth forecast to mid-to-high single digits, with Q2 revenue expected to increase by 10-15%.

On May 10, 2024, Dnow Inc (NYSE:DNOW), a global supplier of energy and industrial products, released its financial results for the first quarter ended March 31, 2024, through an 8-K filing. The company reported a revenue of $563 million, aligning with analyst expectations but showcased a slight dip in earnings per share (EPS) at $0.20 compared to the anticipated $0.23.

Company Overview

Dnow Inc is renowned for its extensive history spanning over 160 years in supplying energy and industrial products and engineered equipment. With a robust digital platform named DigitalNOW, Dnow Inc enhances its supply chain solutions, supporting a diverse range of industries including exploration, production, and renewable energy sectors.

Financial Highlights and Strategic Developments

The first quarter of 2024 was marked by significant achievements and challenges for Dnow Inc. The company generated a robust free cash flow of $80 million, progressing well towards its elevated full-year target of $200 million. This quarter also saw the integration of Whitco Supply, a major acquisition poised to enhance Dnow Inc's service capabilities and support its expansion in midstream and energy sectors.

Despite facing a slow start due to reduced U.S. well completions and low natural gas prices, Dnow Inc remains optimistic about its growth prospects, expecting a revenue increase of 10-15% in the second quarter. The company's balance sheet remains strong with $188 million in cash and no debt, even after the acquisition.

Detailed Financial Analysis

The company's net income for the quarter stood at $21 million, a decrease from the previous quarter's $32 million. This decline is partly attributed to transaction-related charges and the cost of inventory adjustments following the Whitco acquisition. The operating profit was reported at $28 million, with total assets increasing to $1,594 million from $1,529 million at the end of December 2023.

The balance sheet reflects a healthy financial position with an increase in total stockholders' equity from $1,063 million to $1,079 million. The detailed financial statements indicate a well-managed cost structure and an effective integration of new acquisitions, setting a positive tone for the fiscal year.

Outlook and Future Prospects

David Cherechinsky, President and CEO of Dnow Inc, expressed satisfaction with the quarters outcomes and optimism for the future, citing the strategic acquisition and strong financial fundamentals as key drivers for sustained growth. The company's proactive approach in expanding its customer base and seizing market opportunities, especially in evolving energy sectors, underscores its strategic direction and potential for long-term value creation.

As Dnow Inc continues to navigate market fluctuations and integrate its new acquisitions, investors and stakeholders can anticipate a focus on innovation, operational efficiency, and strategic growth initiatives to bolster its market position and financial health.

Explore the complete 8-K earnings release (here) from Dnow Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance