Brunswick Corp's Dividend Analysis

Exploring the Sustainability and Growth of Brunswick Corp's Dividends

Brunswick Corp (NYSE:BC) has recently declared a dividend of $0.42 per share, scheduled for payment on June 14, 2024, with shareholders required to be on record by May 10, 2024. This announcement has drawn attention not only to the upcoming dividend but also to Brunswick Corp's historical dividend performance, including its yield and growth rates. Utilizing comprehensive data from GuruFocus, this analysis delves into the sustainability and potential growth of Brunswick Corp's dividends.

Company Overview

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

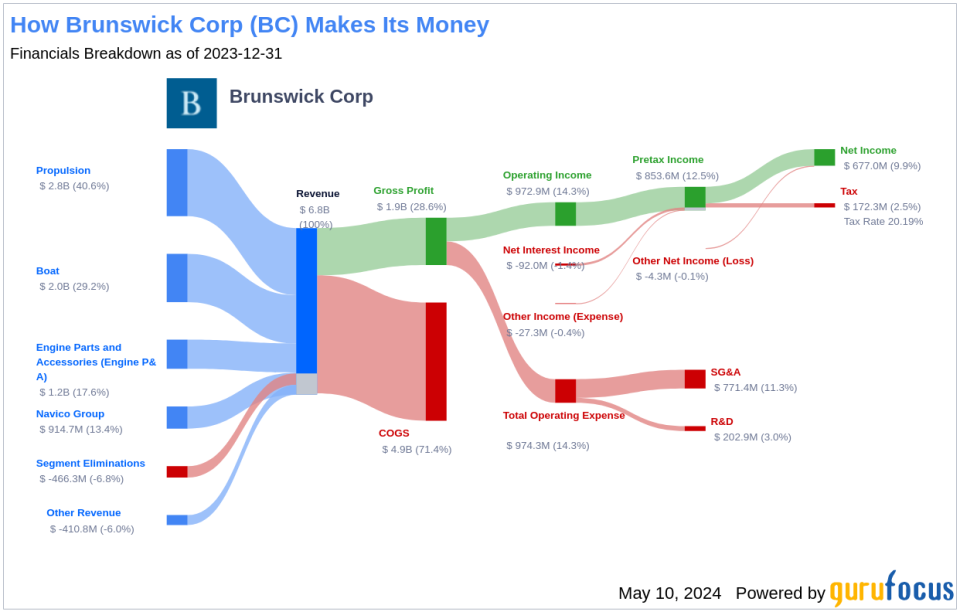

Brunswick Corp, a stalwart in the marine recreation industry, boasts a diverse portfolio of over 60 brands. These brands span various segments including propulsion systems like outboard, sterndrive, and inboard engines; parts and accessories; and boats with renowned names like Boston Whaler and Sea Ray. Additionally, Brunswick owns several Freedom Boat Club locations and operates Boateka, a platform in the used boat market. The company is committed to pioneering new marine and recreational experiences and technologies, underpinned by a relentless focus on innovation and quality.

Reviewing Brunswick Corp's Dividend History

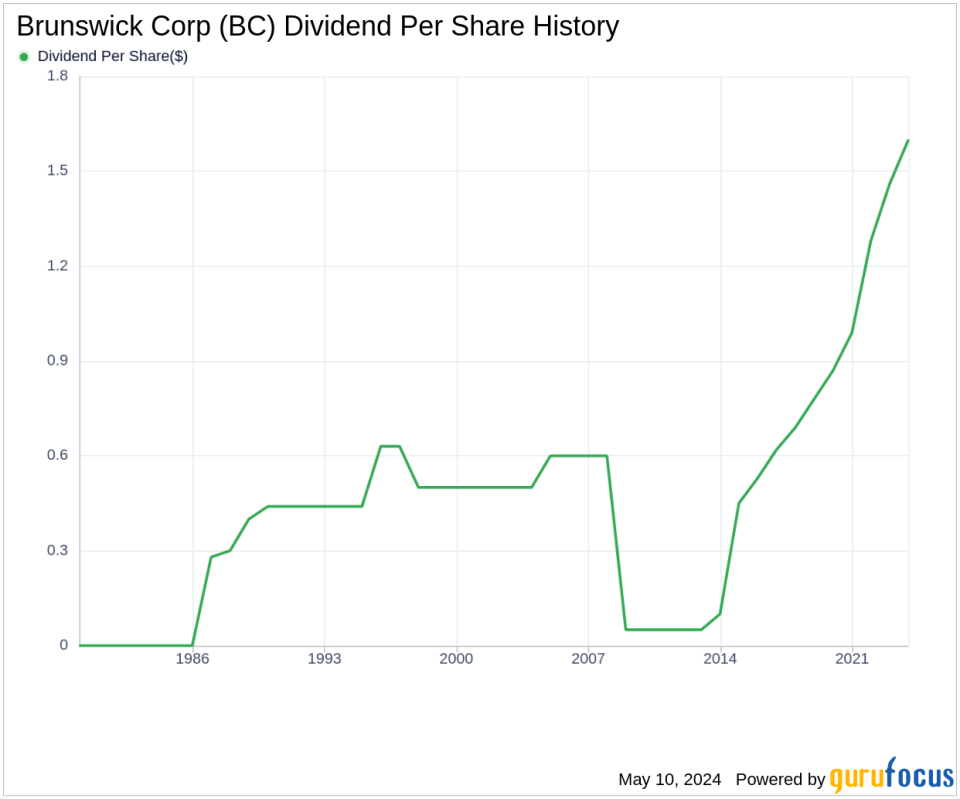

Since 1986, Brunswick Corp has upheld a consistent record of dividend payments, distributed quarterly. Remarkably, since 2008, the company has increased its dividend annually, earning it the status of a dividend achievera distinction awarded to companies that have consistently raised their dividends for at least 16 consecutive years.

Below is a visual representation of Brunswick Corp's annual Dividends Per Share to illustrate historical trends.

Analyzing Brunswick Corp's Dividend Yield and Growth

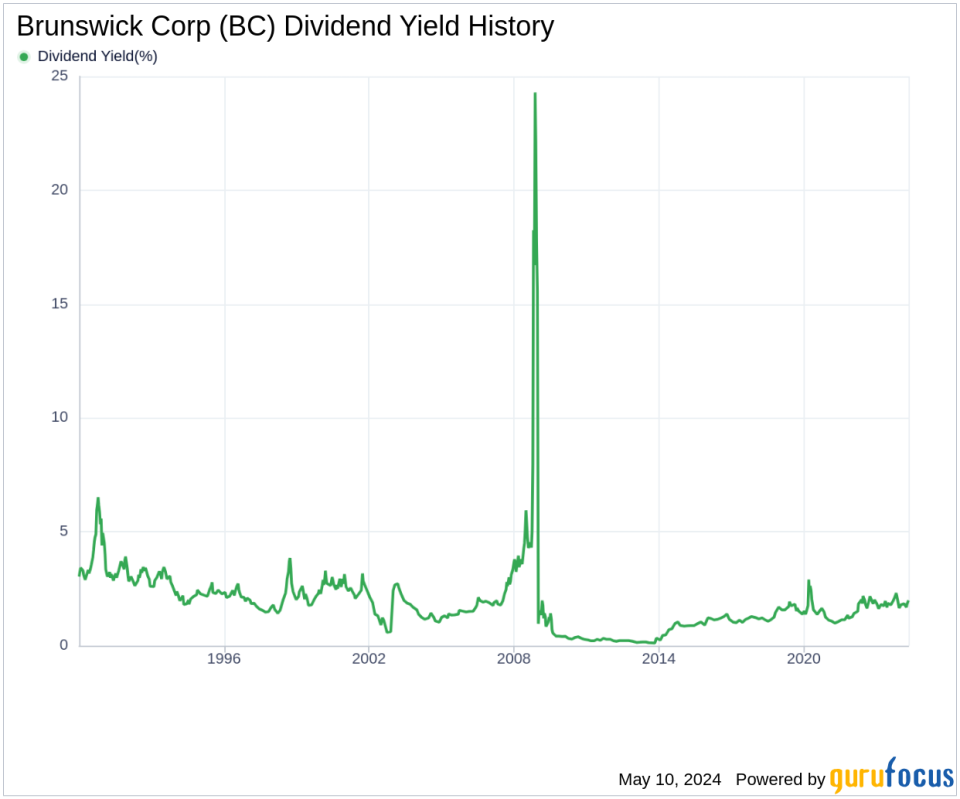

Brunswick Corp currently posts a 12-month trailing dividend yield of 1.93% and a forward dividend yield of 2.02%, indicating an anticipated increase in dividend payouts over the next year. Over the past three years, the annual dividend growth rate was 17.40%, which slightly tapers to 16.70% over a five-year period, and impressively expands to 22.60% over the last decade. As of today, the 5-year yield on cost for Brunswick Corp stock is approximately 4.18%.

Evaluating Dividend Sustainability: Payout Ratio and Profitability

The dividend payout ratio, which stands at 0.21 as of March 31, 2024, is crucial for assessing dividend sustainability. This ratio indicates that Brunswick retains a significant portion of its earnings, which supports future growth and buffers against economic downturns. Furthermore, Brunswick's profitability rank of 8 out of 10 underscores its strong earnings capability relative to industry peers, with consistent net profits reported in 9 out of the past 10 years.

Future Growth Prospects

Brunswick's robust growth metrics are vital for sustaining its dividends. With a growth rank of 8, the company demonstrates a promising growth trajectory. Its revenue per share and 3-year revenue growth rate of 18.50% annually outperform approximately 77.41% of global competitors. Additionally, Brunswick's 3-year EPS growth rate of 20.20% and 5-year EBITDA growth rate of 21.40% further validate its growth potential, surpassing 55.87% and 76.28% of global competitors, respectively.

Conclusion and Next Steps

In conclusion, Brunswick Corp's strategic financial management, consistent dividend growth, and robust profitability and growth metrics paint a promising picture for current and potential investors. These factors not only ensure the sustainability of dividends but also hint at potential growth, making Brunswick an attractive option for those seeking stable dividend income. For further exploration of high-dividend yield opportunities, GuruFocus Premium users may use the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance