Financial giants have made a conspicuous bullish move on Newmont. Our analysis of options history for Newmont (NYSE:NEM) revealed 33 unusual trades.

Delving into the details, we found 63% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $178,973, and 28 were calls, valued at $2,388,993.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $25.0 to $47.5 for Newmont over the recent three months.

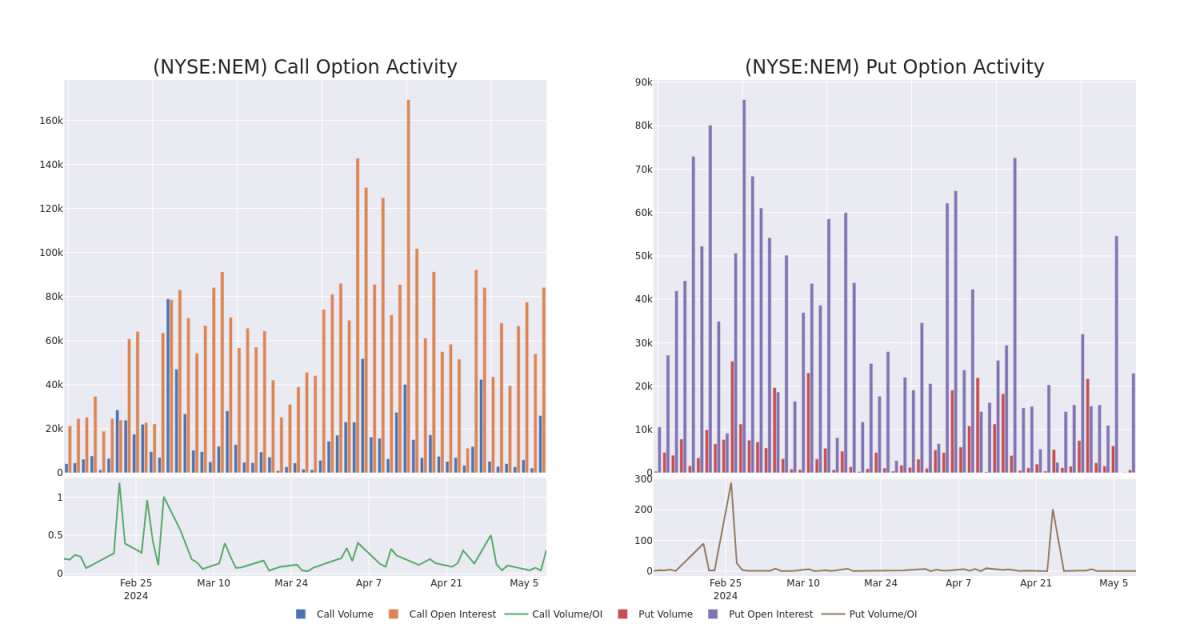

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Newmont's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Newmont's substantial trades, within a strike price spectrum from $25.0 to $47.5 over the preceding 30 days.

Newmont 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEM | CALL | TRADE | BULLISH | 01/17/25 | $3.8 | $3.65 | $3.75 | $45.00 | $699.3K | 26.6K | 635 |

| NEM | CALL | SWEEP | BEARISH | 01/16/26 | $9.2 | $9.1 | $9.1 | $40.00 | $285.7K | 3.2K | 314 |

| NEM | CALL | SWEEP | BEARISH | 01/17/25 | $3.8 | $3.75 | $3.75 | $45.00 | $238.1K | 26.6K | 0 |

| NEM | CALL | SWEEP | BEARISH | 07/19/24 | $5.25 | $4.65 | $5.15 | $37.50 | $139.0K | 755 | 271 |

| NEM | CALL | SWEEP | BEARISH | 01/17/25 | $3.75 | $3.7 | $3.7 | $45.00 | $96.2K | 26.6K | 2.5K |

About Newmont

Newmont is the world's largest gold miner. It bought Goldcorp in 2019, combined its Nevada mines in a joint venture with competitor Barrick later that year, and also purchased competitor Newcrest in November 2023. Its portfolio includes 17 wholly or majority owned mines and interests in two joint ventures in the Americas, Africa, Australia and Papua New Guinea. The company is expected to produce roughly 6.9 million ounces of gold in 2024. However, after buying Newcrest, Newmont is likely to sell a number of its higher cost, smaller mines accounting for 20% of forecast sales in 2024. Newmont also produces material amounts of copper, silver, zinc, and lead as byproducts. It had about two decades of gold reserves along with significant byproduct reserves at end December 2023.

Present Market Standing of Newmont

- Currently trading with a volume of 4,364,045, the NEM's price is up by 0.14%, now at $41.6.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 70 days.

What The Experts Say On Newmont

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $50.0.

- Consistent in their evaluation, an analyst from BMO Capital keeps a Outperform rating on Newmont with a target price of $54.

- An analyst from TD Securities persists with their Hold rating on Newmont, maintaining a target price of $48.

- Maintaining their stance, an analyst from TD Securities continues to hold a Hold rating for Newmont, targeting a price of $48.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Newmont options trades with real-time alerts from Benzinga Pro.