Examining 3 Top Canadian Growth Companies With Insider Ownership And A Minimum 15% Earnings Increase

Amidst a backdrop of shifting economic indicators and mixed signals from the U.S. Federal Reserve, the Canadian market continues to navigate through uncertain waters influenced by both domestic and international events. In this environment, examining growth companies with substantial insider ownership can offer investors insights into firms where leadership has a vested interest in driving and sustaining performance, particularly when these companies also demonstrate robust earnings growth.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

goeasy (TSX:GSY) | 21.7% | 15.9% |

Aritzia (TSX:ATZ) | 19% | 51.6% |

Rivalry (TSXV:RVLY) | 11.7% | 61.8% |

Payfare (TSX:PAY) | 15% | 63.7% |

Allied Gold (TSX:AAUC) | 22.4% | 71.9% |

ROK Resources (TSXV:ROK) | 16.6% | 135.9% |

Lion Electric (TSX:LEV) | 12% | 64.3% |

Artemis Gold (TSXV:ARTG) | 31.8% | 58.9% |

Ivanhoe Mines (TSX:IVN) | 13.1% | 36.4% |

UGE International (TSXV:UGE) | 35.4% | 57.8% |

Here's a peek at a few of the choices from the screener.

Colliers International Group

Simply Wall St Growth Rating: ★★★★☆☆

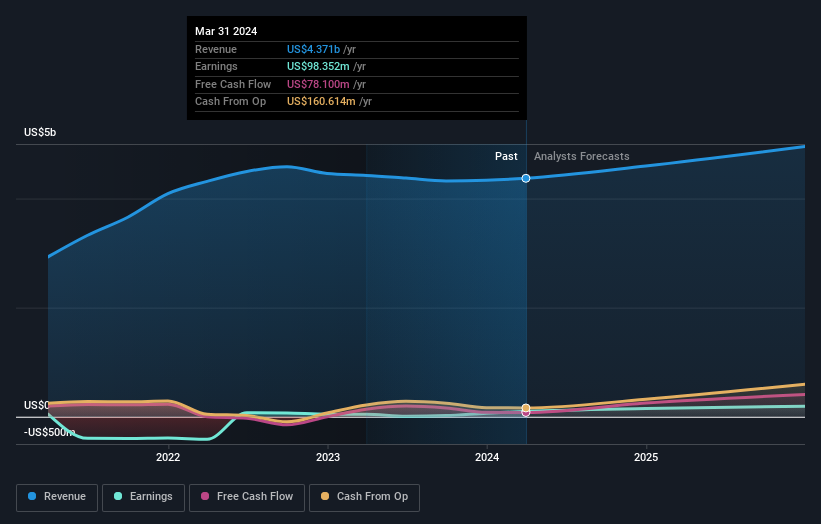

Overview: Colliers International Group Inc. operates globally, offering commercial real estate professional and investment management services, with a market capitalization of approximately CA$7.72 billion.

Operations: The company generates revenue across several regions with CA$2.53 billion from the Americas, CA$616.58 million from the Asia Pacific, and CA$730.10 million from Europe, the Middle East & Africa, alongside CA$489.23 million from its investment management services.

Insider Ownership: 14.2%

Earnings Growth Forecast: 36% p.a.

Colliers International Group, despite trading 61.9% below its estimated fair value, shows promising growth with a significant forecasted earnings increase of 36% per year. However, the company's revenue growth at 7.2% annually is slower compared to more aggressive market benchmarks. Recent financials indicate a strong rebound with first-quarter sales reaching US$1 billion and net income at US$12.66 million, recovering from a previous loss. The firm has also been active in financing activities to bolster future acquisitions and growth initiatives, highlighted by a recent equity offering raising approximately US$300 million.

goeasy

Simply Wall St Growth Rating: ★★★★★☆

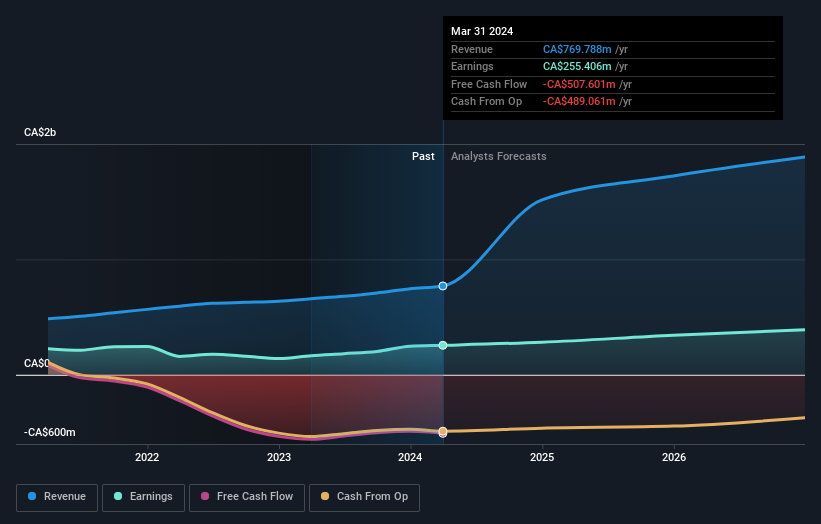

Overview: goeasy Ltd., operating under the easyhome, easyfinancial, and LendCare brands, offers non-prime leasing and lending services in Canada with a market capitalization of approximately CA$3.09 billion.

Operations: The company generates its revenue through non-prime leasing and lending services across three brands, specifically easyhome, easyfinancial, and LendCare in Canada.

Insider Ownership: 21.7%

Earnings Growth Forecast: 15.9% p.a.

goeasy Ltd., a notable player in the Canadian market, has demonstrated robust growth with a significant increase in net income from CAD 140.16 million to CAD 247.9 million year-over-year as of December 2023. The company's strong performance is reflected in its high insider ownership, aligning management’s interests with shareholders. However, despite these strengths, goeasy faces challenges with debt levels not well covered by operating cash flow and dividends not adequately covered by cash flows. Recent strategic moves include a US$400 million senior unsecured notes offering aimed at refinancing efforts, showcasing proactive financial management amidst its rapid growth trajectory.

Artemis Gold

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company engaged in the identification, acquisition, and development of gold properties, with a market capitalization of approximately CA$1.96 billion.

Operations: The company's revenue segments are not specified in the provided text.

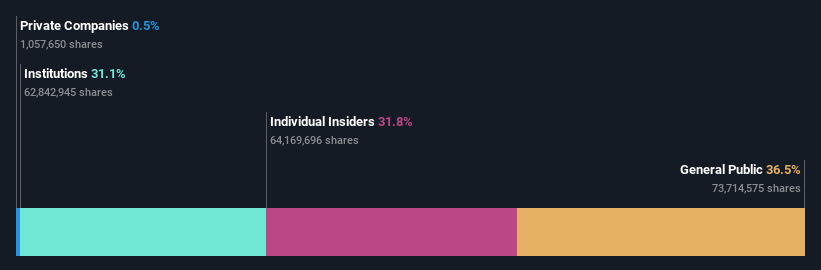

Insider Ownership: 31.8%

Earnings Growth Forecast: 58.9% p.a.

Artemis Gold, a growth-oriented company with high insider ownership, is advancing its Blackwater Mine project in British Columbia. Despite a recent increase in net loss to CAD 6.65 million for Q1 2024, the project remains on budget and on schedule for its first gold pour in late 2024. The construction progress stands at about 73%, with significant infrastructure developments completed. Artemis's strategic focus includes expanding production capacity significantly by advancing phases of operation, funded from future operating cash flows.

Delve into the full analysis future growth report here for a deeper understanding of Artemis Gold.

Upon reviewing our latest valuation report, Artemis Gold's share price might be too optimistic.

Seize The Opportunity

Delve into our full catalog of 37 Fast Growing TSX Companies With High Insider Ownership here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:CIGI TSX:GSY and TSXV:ARTG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance