MeridianLink Inc (MLNK) Q1 2024 Earnings: Performance Aligns with Analyst Revenue Forecasts

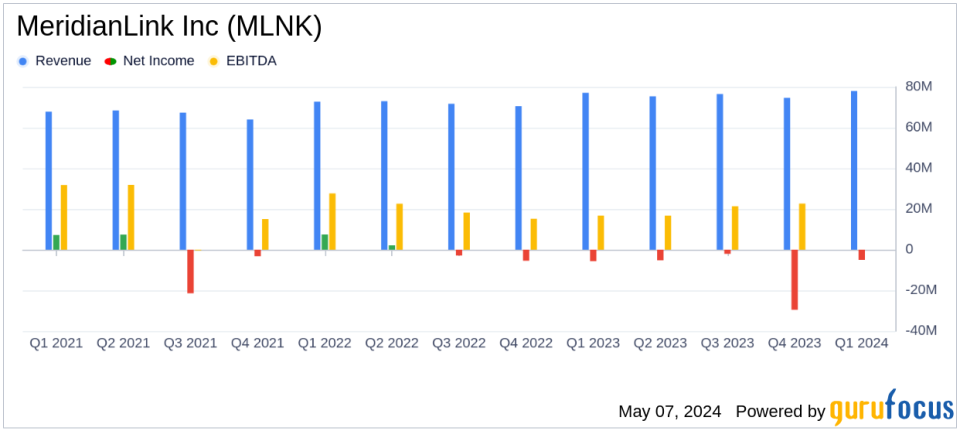

Revenue: Reported $77.8 million, a 1% increase year-over-year, surpassing the estimated $76.93 million.

Net Loss: Recorded a net loss of $5.3 million, contrasting with an estimated net gain of $5.26 million.

Earnings Per Share (EPS): Reported a loss of $0.07 per share, falling short of the estimated earnings of $0.07 per share.

Free Cash Flow: Achieved $27.1 million, demonstrating strong cash generation capabilities.

Lending Software Solutions Revenue: Grew by 5% to $60.9 million, indicating robust demand for this segment.

Adjusted EBITDA: Stood at $31.8 million, representing 41% of revenue, highlighting efficient operational management.

Operational Highlights: Introduced Larry Katz as new CFO and launched MeridianLink Insight Lite, enhancing data analytics offerings.

On May 7, 2024, MeridianLink Inc (NYSE:MLNK), a prominent provider of cloud-based software solutions for financial institutions, released its 8-K filing, announcing the financial outcomes for the first quarter ended March 31, 2024. The company reported a revenue of $77.8 million, marking a 1% increase year-over-year, primarily driven by its lending software solutions, which saw a 5% growth to $60.9 million.

Company Overview

MeridianLink Inc specializes in offering advanced, integrated software solutions to banks, credit unions, mortgage lenders, and other financial institutions. Its main revenue generator, the lending software solutions, plays a crucial role in facilitating digital lending and account opening services. This sector's growth is pivotal as it directly impacts the company's market position and revenue streams.

Financial Performance and Key Metrics

The company's financial performance this quarter reflects a stable growth trajectory with total revenue slightly surpassing the analyst's estimate of $76.93 million. However, MeridianLink faced a net loss of $5.3 million, which contrasts with the estimated net income of $5.26 million. This loss equates to a net loss per share of $0.07, aligning with the expected earnings per share. Operating income stood at $3.4 million, or 4% of the revenue, with a non-GAAP operating income of $16.3 million, or 21% of the revenue.

Adjusted EBITDA was reported at $31.8 million, representing 41% of the revenue, highlighting efficient operational management despite the net losses. The company also reported robust cash flows from operations amounting to $29.0 million, or 37% of the revenue, and a healthy free cash flow of $27.1 million, or 35% of the revenue.

Operational Highlights and Strategic Moves

During the quarter, MeridianLink welcomed Larry Katz as the new CFO, enhancing the financial leadership team. The company also noted significant demand for its MeridianLink One platform, which supports diverse lending needs. Notably, Space Coast Credit Union implemented MeridianLinks Advanced Decisioning capabilities, improving loan decisioning efficiency significantly.

Furthermore, MeridianLink launched Insight Lite, a new data analytics tool aimed at boosting data-driven decision-making for its customers. These strategic initiatives are crucial for maintaining competitive advantage and driving user engagement.

Future Outlook and Guidance

Looking ahead, MeridianLink projects Q2 revenues to be between $76.0 million and $79.0 million and anticipates adjusted EBITDA to range from $29.0 million to $32.0 million. For the full year 2024, the company expects revenue to be between $311.0 million and $319.0 million with adjusted EBITDA forecasted between $123.0 million and $130.0 million.

Conclusion

Despite facing a net loss this quarter, MeridianLink's slight revenue growth and strategic advancements lay a solid foundation for future profitability. The companys focus on enhancing its software solutions and expanding its technological capabilities should help in navigating the competitive landscape and achieving long-term growth. Investors and stakeholders will likely keep a close watch on how these strategies unfold in the coming quarters.

For more detailed information, you can access the full earnings report here.

Explore the complete 8-K earnings release (here) from MeridianLink Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance