KVH Industries Inc (KVHI) Q1 2024 Earnings: Revenue and Earnings Miss Analyst Forecasts

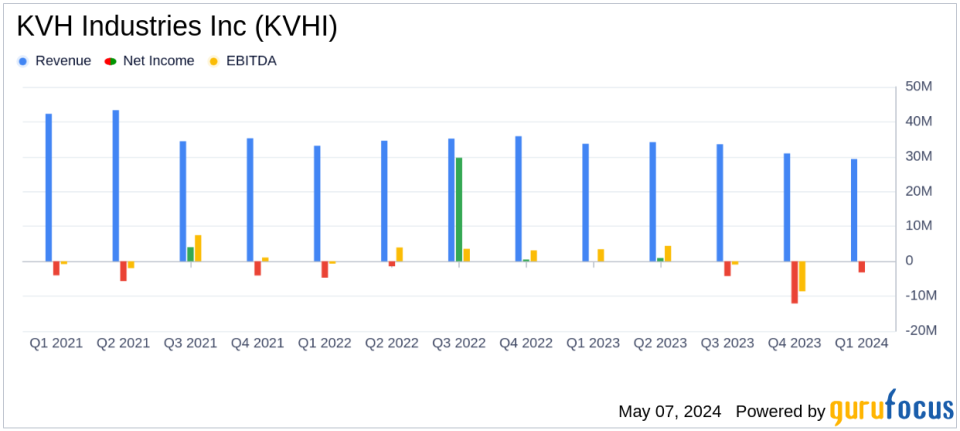

Revenue: $29.3M for Q1 2024, a decrease of 14% year-over-year, falling short of estimates of $31.88M.

Net Loss: Reported a net loss of $3.2M in Q1 2024, compared to a net income of $0.4M in Q1 2023, exceeding estimates of a $3.58M loss.

Earnings Per Share: Reported EPS of -$0.16, exceeding estimates of -$0.19.

Operating Expenses: Increased by $0.8M to $13.7M in Q1 2024, driven by costs related to workforce reductions.

Adjusted EBITDA: Non-GAAP adjusted EBITDA was $2.0M in Q1 2024, down from $3.7M in Q1 2023.

Product Revenue: Decreased by 22% to $4.2M, with a notable decline in VSAT and TracVision sales, partially offset by an increase in Starlink product sales.

Service Revenue: Decreased by $3.7M to $25.0M, primarily due to a $3.5M decrease in airtime service sales.

KVH Industries Inc (NASDAQ:KVHI) released its 8-K filing on May 6, 2024, disclosing its financial results for the first quarter ended March 31, 2024. The company reported a revenue of $29.3 million, a 14% decrease from the previous year's $34.1 million, falling short of the estimated $31.88 million. The net loss widened to $3.2 million, or $0.16 per share, compared to a net income of $0.4 million, or $0.02 per share in the first quarter of 2023, also missing the estimated earnings per share of -$0.19.

KVH Industries Inc, a global leader in maritime and mobile connectivity, has been navigating significant industry shifts, particularly with the emergence and expansion of Low Earth Orbit (LEO) networks. This period of transition has influenced the company's strategic decisions, including the wind-down of manufacturing activities in Rhode Island, which incurred $2.2 million in employee termination costs.

Financial Performance Analysis

The company's total revenue decline was primarily driven by a $3.5 million decrease in airtime revenue, reflecting intensified competition and a shift in the industry landscape. Product revenues also saw a decrease, dropping by 22% due to lower sales in VSAT and TV products, although this was partially offset by an increase in Starlink product sales.

Operating expenses rose to $13.7 million, up from $12.9 million in the same quarter last year, largely due to restructuring costs. Despite these challenges, KVH managed to post a non-GAAP adjusted EBITDA of $2.0 million, although this was a decrease from $3.7 million in the prior year's quarter.

Strategic Initiatives and Future Outlook

CEO Brent C. Bruun highlighted the company's proactive adjustments to the evolving market dynamics, including the doubling of Starlink shipments and the anticipated launch of OneWeb LEO services. These initiatives are expected to open new revenue streams and contribute to future growth. Furthermore, the reorganization efforts are projected to yield annualized savings of approximately $9 million, with benefits expected to materialize in the third quarter of 2024.

However, KVH has revised its 2024 revenue expectations to between $117 million and $127 million and adjusted its EBITDA forecast to range from $6 million to $12 million, reflecting the ongoing challenges and market pressures.

Conclusion

The first quarter of 2024 was a challenging period for KVH Industries as it navigated through significant industry disruptions and internal restructuring. While facing a decline in traditional revenue streams, the company is focusing on new technologies and market opportunities to drive future growth. Investors and stakeholders will be watching closely to see if KVH's strategic initiatives can stabilize the company's financial performance in the competitive connectivity landscape.

Explore the complete 8-K earnings release (here) from KVH Industries Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance