Air Lease Corp (AL) Q1 2024 Earnings: Misses Analyst EPS Projections Amid Rising Costs

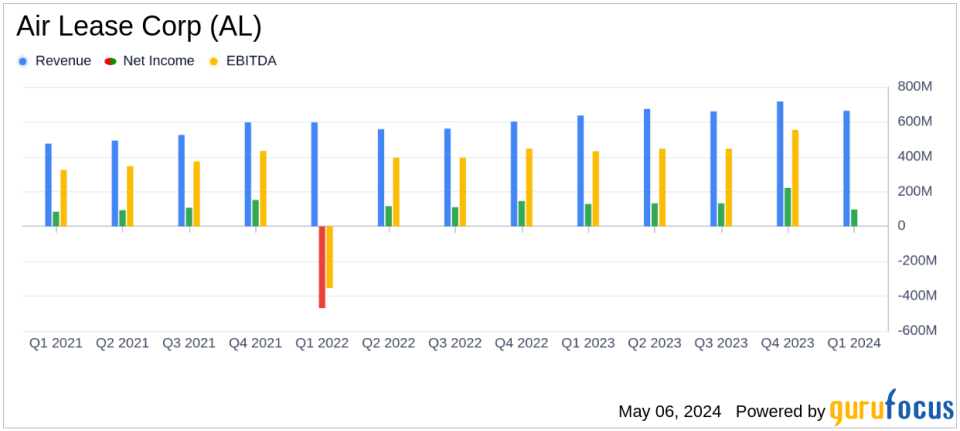

Revenue: Reported at $663.3 million for Q1 2024, marking a 4.3% increase from $636.1 million in Q1 2023, falling short of the estimated $677.21 million.

Net Income: Decreased by 17.7% to $97.4 million in Q1 2024 from $118.3 million in Q1 2023, below the estimated $112.48 million.

Earnings Per Share (EPS): Recorded at $0.87 per diluted share, down from $1.06 in the previous year and below the estimate of $0.91.

Pre-Tax Margin: Dropped to 20.4% in Q1 2024 from 24.9% in Q1 2023.

Adjusted Pre-Tax Return on Common Equity: Improved slightly to 11.6% over the last twelve months, up from 11.0%.

Fleet Expansion: Took delivery of 14 new aircraft, increasing owned fleet to 472 aircraft with a net book value of $26.5 billion.

Dividend: Declared a quarterly cash dividend of $0.21 per share, payable on July 8, 2024.

Air Lease Corp (NYSE:AL) released its 8-K filing on May 6, 2024, revealing its financial results for the first quarter ended March 31, 2024. The company reported a net income of $97.4 million, or $0.87 per diluted share, falling short of analyst estimates of $0.91 per share. However, revenues saw a 4.3% increase year-over-year, reaching $663.3 million, which was slightly below the estimated $677.21 million.

Air Lease Corp, a leading aircraft leasing company, is based in the United States but derives significant revenue from the Asia region. The company specializes in purchasing aircraft from major manufacturers like Boeing and Airbus and leasing them to airlines globally. Its diverse fleet includes both narrow-bodied and wide-bodied jets, generating revenue primarily through aircraft rentals.

Financial Performance Analysis

The first quarter of 2024 saw Air Lease Corp navigate a challenging environment marked by increased operating expenses, which rose by 10.5% to $528 million. This increase significantly impacted the companys profitability, with income before taxes dropping by 14.5% to $135.3 million. The adjusted net income before taxes also saw a decline, falling by 12.3% to $146.3 million.

Despite these challenges, the company achieved a pre-tax margin of 20.4% and an adjusted pre-tax margin of 22.1%. The pre-tax return on common equity improved slightly from 10.2% to 11.2% over the trailing twelve months, indicating a resilient capital efficiency in a volatile market.

Operational Highlights and Future Outlook

During the quarter, Air Lease Corp continued to expand its fleet, taking delivery of 14 new aircraft and selling five older models, generating $240 million in sales proceeds. The company ended the period with 472 aircraft in its owned fleet and assets totaling $31 billion. Looking ahead, Air Lease has secured placements for 100% of its committed order book for deliveries through the end of 2025, reflecting strong market demand for its aircraft.

The company also bolstered its financial position by issuing $1.4 billion in Medium-Term Notes and enhancing its credit facility to $7.8 billion, ensuring robust liquidity and financial flexibility moving forward.

Strategic Moves and Market Positioning

Air Lease Corps strategic actions, including fleet optimization and capital market activities, position it well to capitalize on the ongoing recovery in global air travel. However, the increase in composite cost of funds, which rose to 4.03% from 3.77%, underscores the challenges of managing financing costs against a backdrop of rising interest rates.

The companys focus on maintaining a young and fuel-efficient fleet aligns with the broader industry shift towards sustainability and efficiency, potentially offering a competitive edge as airlines renew their fleets amidst stricter environmental regulations.

Conclusion

While Air Lease Corp faced headwinds in the first quarter of 2024, its strategic fleet and financing decisions provide a foundation for navigating the complexities of the global aviation market. Investors and stakeholders will likely watch closely how the company manages its operational costs and financing needs in an evolving economic landscape.

For detailed insights and further information, you can access the full earnings report through the provided 8-K filing.

Explore the complete 8-K earnings release (here) from Air Lease Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance