Artivion Inc (AORT) Surpasses Analyst Revenue Forecasts with Strong Q1 2024 Performance

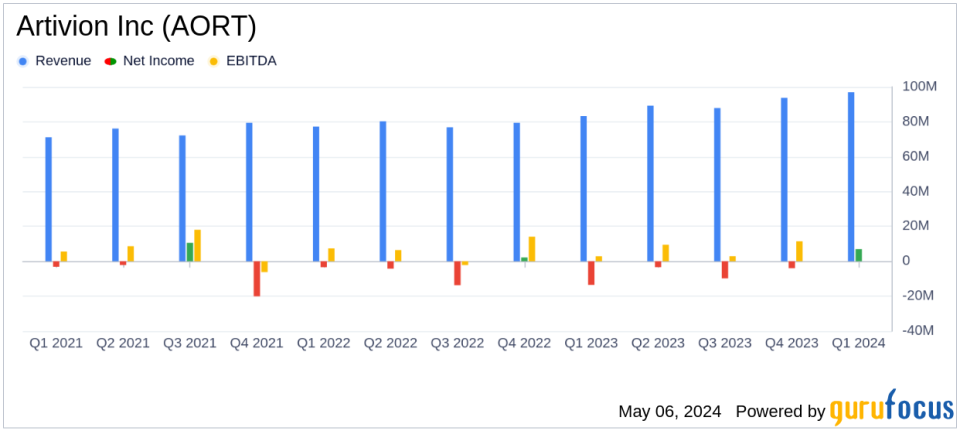

Revenue: Reported $97.4 million in Q1 2024, a 17% increase year-over-year, surpassing estimates of $91.98 million.

Net Income: Achieved $7.5 million in Q1 2024, significantly exceeding the estimated $4.70 million.

Earnings Per Share (EPS): Recorded $0.18 per fully diluted share, outperforming the estimated $0.11 per share.

Adjusted EBITDA: Non-GAAP adjusted EBITDA rose by 60% to $17.3 million in Q1 2024 from $10.8 million in Q1 2023.

Annual Revenue Guidance: Revised FY24 revenue growth forecast to 9%-12% on a constant currency basis, indicating increased optimism.

Product Performance: Tissue processing and stent grafts saw significant growth, with year-over-year increases of 26% and 19% respectively.

Regional Growth: Notable revenue strength in Latin America, which grew 22% on a constant currency basis compared to the previous year.

Artivion Inc (NYSE:AORT), a leader in cardiac and vascular surgery solutions, announced its first quarter financial results for 2024 on May 6, 2024, revealing substantial growth and operational achievements. The company's detailed performance was disclosed in its 8-K filing. Artivion's reported revenue of $97.4 million for Q1 2024 not only represents a 17% increase from the previous year but also significantly exceeds the analyst's expectation of $91.98 million. Moreover, the company achieved a net income of $7.5 million, or $0.18 per fully diluted share, a notable improvement from a net loss of $13.5 million in Q1 2023, and surpassing the anticipated net loss of $4.7 million.

Company Overview and Market Performance

Headquartered in suburban Atlanta, Georgia, Artivion Inc specializes in providing innovative solutions for aortic diseases. The company's product portfolio includes aortic stent grafts, surgical sealants, On-X mechanical heart valves, and implantable cardiac and vascular human tissues. These products are crucial for cardiac and vascular surgeons worldwide, addressing complex medical challenges in aortic disease treatment.

The impressive revenue growth in Q1 2024 was primarily driven by significant year-over-year constant currency growth in tissue processing and stent grafts, which saw increases of 26% and 19%, respectively. Additionally, the Latin America region exhibited a robust growth of 22% in the same period. These figures underline Artivion's expanding market presence and operational efficiency in key geographical areas.

Strategic Developments and Financial Outlook

Artivion's strategic initiatives and clinical achievements have been pivotal in its growth trajectory. According to Pat Mackin, Chairman, President, and Chief Executive Officer of Artivion, the positive outcomes from the On-X aortic valve post-market clinical study presented at AATS in April 2024 have reinforced the clinical superiority of the company's aortic portfolio. These results showed an 87% reduction in major bleeding risks compared to historic controls.

"We are very pleased with our first quarter results as we maintained growth momentum and executed on key operational priorities," stated Mr. Mackin. He further added, "In light of our strong first quarter performance, we are raising the midpoint of our full year revenue expectations and remain confident in our ability to meet or exceed our adjusted EBITDA target for 2024."

For the full year 2024, Artivion has revised its revenue guidance to a growth of 9% to 12% on a constant currency basis, with expected revenues ranging between $386 million and $396 million. The company also anticipates a non-GAAP adjusted EBITDA increase of 26% to 34%, projecting an EBITDA between $68 million and $72 million.

Conclusion

Artivion Inc's first quarter results for 2024 highlight a resilient and growing company that is not only meeting but exceeding financial expectations. With strategic advancements and a strong product portfolio, Artivion is well-positioned to continue its growth trajectory and enhance shareholder value. Investors and stakeholders may look forward to continued progress and financial stability from the company in the upcoming quarters.

For further details on Artivion's financial performance and future outlook, interested parties can access the full earnings report and additional information on the company's website or contact their investor relations team.

Explore the complete 8-K earnings release (here) from Artivion Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance