Cenovus (CVE) Q1 Earnings Beat Estimates, Revenues Miss

Cenovus Energy Inc. CVE reported first-quarter 2024 adjusted earnings per share of 46 cents, which beat the Zacks Consensus Estimate of 35 cents. The bottom line also increased from the year-ago quarter’s figure of 24 cents.

Total quarterly revenues of $9.94 billion missed the Zacks Consensus Estimate of $9.98 billion. The top line, however, increased from the year-ago quarter’s level of $9.07 billion.

Strong quarterly earnings can be primarily attributed to higher contributions from the Oil Sands unit and lower expenses.

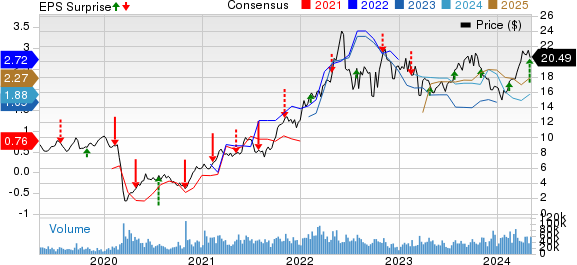

Cenovus Energy Inc Price, Consensus and EPS Surprise

Cenovus Energy Inc price-consensus-eps-surprise-chart | Cenovus Energy Inc Quote

Operational Performance

Upstream

The quarterly operating margin from the Oil Sands unit totaled C$2.24 billion, up from C$1.15 billion reported a year ago.

In the March-end quarter, the company recorded daily oil sand production of 613.3 thousand barrels, up 4.4% year over year primarily due to higher contributions from its Foster Creek, Sunrise and Lloydminster Thermal operations.

The operating margin at the Conventional unit totaled C$149 million, down from C$261 million in the year-ago quarter. The company’s daily liquid production of 27.3 thousand barrels declined 3.9% year over year.

The Offshore segment generated an operating margin of C$246 million, down from C$300 million in the year-ago quarter. CVE recorded daily offshore liquid production of 17.6 thousand barrels, down from 20.3 thousand barrels a year ago.

Downstream

The Canadian Manufacturing unit reported an operating margin of C$68 million, down from C$263 million in the year-ago quarter. It recorded Crude Oil processed volumes of 104.1 thousand barrels per day (MBbl/D).

The operating margin from the U.S. Manufacturing unit came in at C$492 million, up from the year-ago quarter’s level of C$128 million. Crude oil processed volumes totaled 551.1 MBbl/D, up from 359.2 MBbl/D in the year-ago quarter.

Expenses

Transportation and blending expenses declined to C$2.81 billion from C$3.03 billion a year ago.

Also, expenses for purchased products declined to C$771 million from C$838 million in the prior-year quarter.

Capital Investment & Balance Sheet

Cenovus made a total capital investment of C$1.04 billion in the quarter under review.

As of Mar 31, 2024, the Canada-based energy player had cash and cash equivalents of C$2.4 billion, and a long-term debt of C$7.23 billion.

Guidance

For 2024, Cenovus reiterated its estimate for total upstream production in the band of 770-810 MBoe/d, the midpoint of which suggests an increase from 778.7 MBoe/d reported in 2023.

The company provided its capital expenditure guidance of $4.5-$5 billion for the year.

Zacks Rank & Stocks to Consider

Cenovus currently carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector may look at some better-ranked stocks like Hess Corporation HES, EOG Resources Inc. EOG and Valero Energy Corporation VLO. While Hess sports a Zacks Rank #1 (Strong Buy), EOG Resources and Valero Energy carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hess operates primarily in two areas — the Bakken shale and the Stabroek project offshore Guyana. It is currently in the process of being acquired by supermajor Chevron in an all-stock deal worth $53 billion. HES currently has a Growth Score of B.

The Zacks Consensus Estimate for 2024 and 2025 EPS is pegged at $9.17 and $11.08, respectively. The company has witnessed upward earnings estimate revisions for 2024 in the past seven days.

EOG Resources, an oil and gas exploration company, boasts attractive growth prospects, top-tier returns, and a disciplined management team, leveraging highly productive acreages in prime oil shale plays like the Permian and Eagle Ford.

The Zacks Consensus Estimate for EOG’s 2024 EPS is pegged at $12.14. The company has a Zacks Style Score of B for Value and A for Momentum. It has witnessed upward earnings estimate revisions for 2024 in the past 30 days.

Valero Energy is a premier refining player with its presence across North America and the Caribbean. Its diverse network favors robust refining margins, utilizing cost-effective crude for more than half of its needs.

The Zacks Consensus Estimate for VLO’s 2024 EPS is pegged at $18.02. The company has a Zacks Style Score of A for Value. It has witnessed upward earnings estimate revisions for 2025 in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hess Corporation (HES) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Cenovus Energy Inc (CVE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance