Howard Schultz, the former CEO of coffee giant Starbucks (NASDAQ:SBUX), is urging the company to get its act right. Schultz’s advice comes in the wake of heightened China competition and a disappointing second-quarter performance from Starbucks.

Schultz Urges Starbucks to Fix Up

Last week, Starbucks posted one of its largest sales misses in years and slashed its full-year outlook owing to sales and margin headwinds. Schultz, who virtually built Starbucks from the ground up, has urged the company to own its shortcomings without any excuse and fix its operations.

Furthermore, Schultz has expressed that the stores “require a maniacal focus on the customer experience.” He said that the company’s commitment should be to focus on being “experiential, not transactional.” He advised that the go-to-market strategy should be overhauled and led by “coffee-forward innovation.” This is because it would create differentiation in the marketplace.

The company is struggling to keep footfalls flowing at its stores amid persistent inflation and shrinking consumer wallets. Its global comparable store sales declined by nearly 4% in the second quarter. To improve this performance, Schultz wants Starbucks’ top brass to spend more time with the company’s customer-facing employees and shake up its mobile ordering, payment platform, and go-to-market strategy.

Starbucks’ China Woes

In recent times, Starbucks has undertaken a major leadership reshuffle globally. The company is shaking up its menu and is working to tap into the increased customer demand in the mornings. However, its China business is bleeding. In Q2, the company’s China comparable sales contracted by 11%. Starbucks operates nearly 16,600 stores in the U.S. and around 7,093 stores in China. It operated roughly 6,243 stores in China a year ago.

This weak performance comes just as domestic Chinese names such as Luckin Coffee (OTC:LKNCY) clock rapid gains. Luckin opened over 2,300 net new stores in China in Q1, taking its total store count in the country to over 18,500. Last week, it reported a nearly 41.5% jump in its Q1 top line, with the number of its average monthly transacting customers expanding by a massive 103.2% to around 59.5 million.

Is SBUX Stock a Buy, Sell, or a Hold?

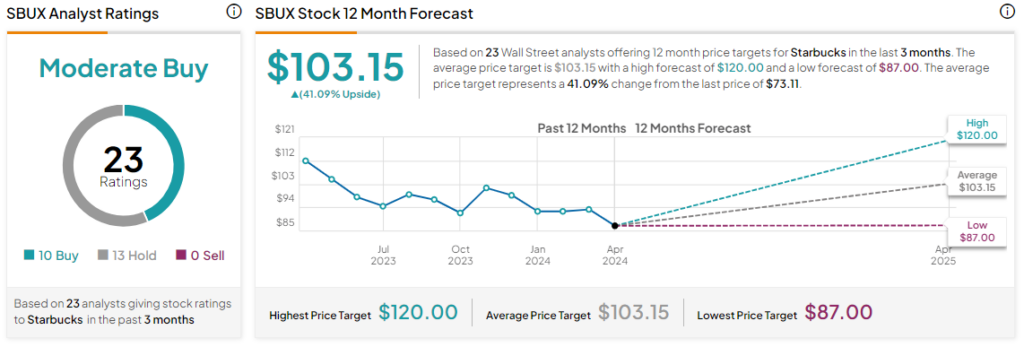

Amid this dynamic, improving its performance could prove to be an uphill task for Starbucks. Shares of the company have plunged by nearly 23% year-to-date. Overall, the Street has a Moderate Buy consensus rating on the stock, alongside an average SBUX price target of $103.15.

Read full Disclosure