Atlassian (NASDAQ:TEAM) delivers shareholders notable 8.7% CAGR over 5 years, surging 3.6% in the last week alone

While Atlassian Corporation (NASDAQ:TEAM) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 13% in the last quarter. But the silver lining is the stock is up over five years. Unfortunately its return of 52% is below the market return of 92%.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

See our latest analysis for Atlassian

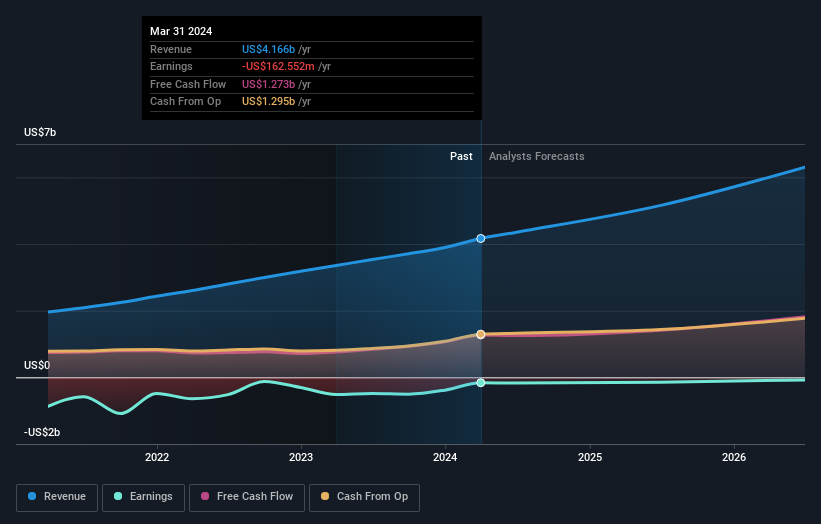

Given that Atlassian didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last 5 years Atlassian saw its revenue grow at 25% per year. Even measured against other revenue-focussed companies, that's a good result. It's nice to see shareholders have made a profit, but the gain of 9% over the period isn't that impressive compared to the overall market. You could argue the market is still pretty skeptical, given the growing revenues. It could be that the stock was previously over-priced - but if you're looking for underappreciated growth stocks, these numbers indicate that there might be an opportunity here.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Atlassian will earn in the future (free profit forecasts).

A Different Perspective

It's good to see that Atlassian has rewarded shareholders with a total shareholder return of 41% in the last twelve months. That's better than the annualised return of 9% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Atlassian better, we need to consider many other factors. Even so, be aware that Atlassian is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.