Sometimes, you have to wonder what it takes to give some stocks extra life. Healthcare company Johnson & Johnson (NYSE:JNJ) recently announced some exciting news about a possible treatment for prostate cancer. Yet, this development didn’t have much impact on its shares, which were down fractionally in Friday afternoon’s trading.

The latest treatment in question, known as Erleada, was run through phase 2 testing, and the results were reasonably sound. A combination of Erleada and androgen deprivation therapy produced surprising results over the long term. Those who used that combination produced no “…increase in prostate-specific antigen levels in the blood at 24 months.”

Of course, this was used on patients who had their prostates removed outright, so that may have skewed some results. However, there was a 100% rate of “biochemical recurrence-free” conditions, which also helped. As it turns out, even removing the prostate outright doesn’t often help much long term; the disease often comes back in less than two years after prostate removal.

Taking on Government Challenges

While a lot of Johnson & Johnson watchers are keeping their eyes on that recent talc settlement, there’s one other point some may have missed. Johnson & Johnson just got some legal challenges to the Medicare negotiation program tossed out by a federal court. The recently-created negotiation program, Johnson & Johnson noted, violated their constitutional rights, and at least one other drug maker joined them in that assertion. A federal judge, meanwhile, decided that wasn’t the case as Johnson & Johnson couldn’t show how it had been “…legally compelled to participate in the Program.”

Is JNJ Stock a Buy or Sell?

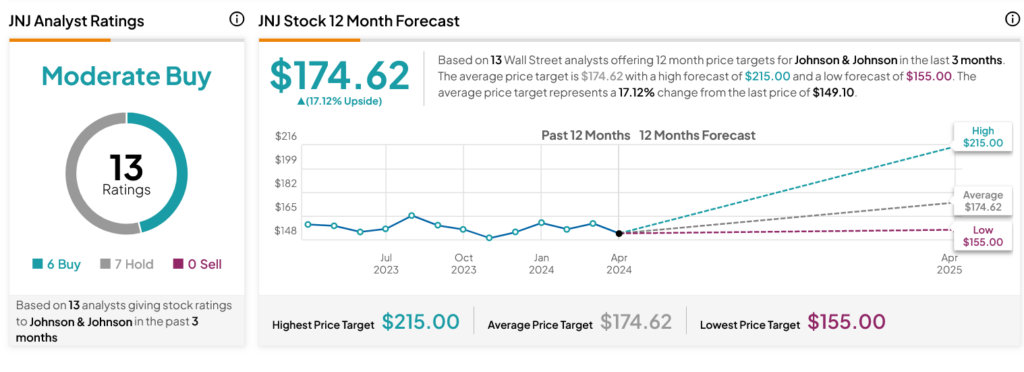

Turning to Wall Street, analysts have a Moderate Buy consensus rating on JNJ stock based on six Buys and seven Holds assigned in the past three months, as indicated by the graphic below. After a 5.25% loss in its share price over the past year, the average JNJ price target of $174.62 per share implies 17.12% upside potential.