Acadian Timber And Two More Premier Dividend Stocks In Canada

As the Canadian market navigates through a mixed economic landscape, with resilient corporate profits and ongoing debates about interest rates, investors are keenly observing how different sectors respond. In this context, dividend stocks like Acadian Timber offer a compelling focus for those looking to potentially enhance portfolio stability amidst market fluctuations. A good dividend stock typically combines reliable payouts with strong business fundamentals, which can be particularly attractive in the current environment of economic resilience and cautious monetary policy adjustments.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.70% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.27% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.54% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.51% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.88% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.03% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.10% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 4.07% | ★★★★★☆ |

Sun Life Financial (TSX:SLF) | 4.38% | ★★★★★☆ |

Acadian Timber (TSX:ADN) | 6.56% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

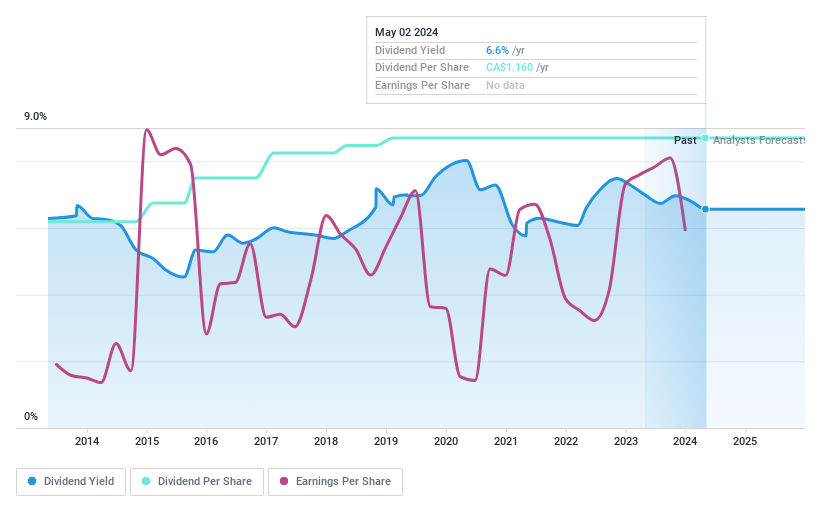

Acadian Timber

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Acadian Timber Corp. operates in Eastern Canada and the Northeastern U.S., supplying primary forest products, with a market capitalization of approximately CA$302.65 million.

Operations: Acadian Timber Corp. generates its revenue primarily from two segments: Maine Timberlands, which contributed CA$16.38 million, and New Brunswick Timberlands, with CA$77.10 million in revenues.

Dividend Yield: 6.6%

Acadian Timber, with a P/E ratio of 10.4x below the Canadian market average, offers a dividend yield of 6.56%, ranking in the top 25% of Canadian dividend payers. Despite its attractive yield and a history of stable dividends over the past decade, challenges remain as its dividends are not fully covered by cash flows, with a high cash payout ratio of 204.4%. Recent strategic acquisitions like the $9 million purchase in New Brunswick could enhance future revenue streams but earnings are projected to decline significantly over the next three years.

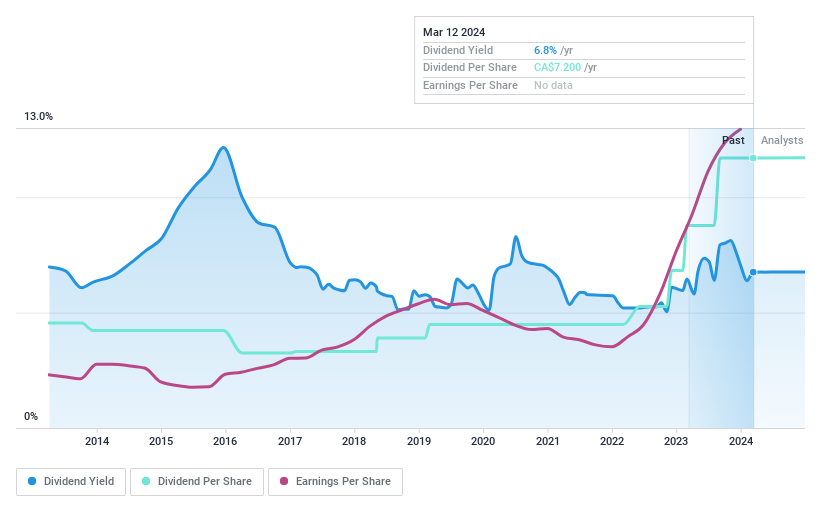

Olympia Financial Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Olympia Financial Group Inc., operating through its subsidiary Olympia Trust Company, serves as a non-deposit taking trust company in Canada, with a market capitalization of approximately CA$264.70 million.

Operations: Olympia Financial Group Inc. generates revenue through several segments, including Health (CA$10.03 million), Corporate (CA$0.19 million), Exempt Edge (CA$1.31 million), Investment Account Services (CA$75.70 million), Currency and Global Payments (CA$8.44 million), and Corporate and Shareholder Services (CA$4.13 million).

Dividend Yield: 6.5%

Olympia Financial Group has maintained a consistent monthly dividend of CA$0.60, with recent affirmations underscoring stability. In 2023, the company reported substantial revenue and net income growth to CA$99.82 million and CA$23.96 million respectively, reflecting a strong financial year. However, despite a competitive dividend yield of 6.55%, which places it in the top quartile for Canadian stocks, concerns about sustainability arise from its high cash payout ratio (94.5%) and forecasted earnings decline over the next three years.

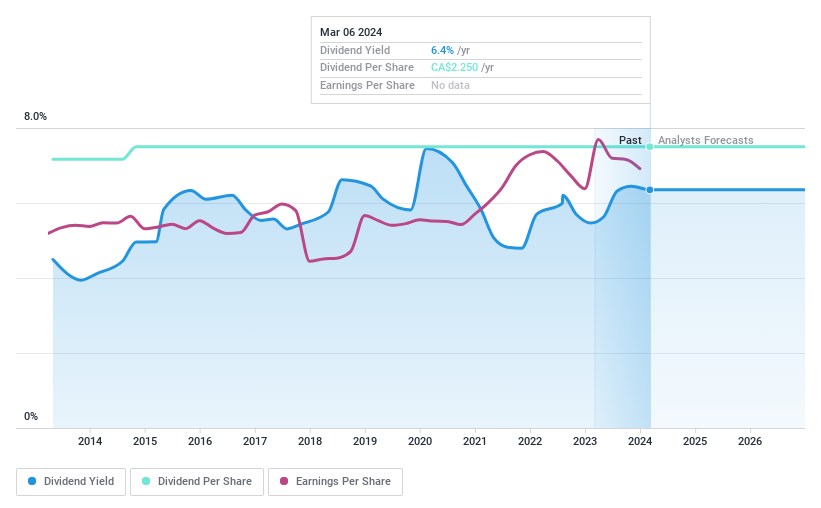

IGM Financial

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IGM Financial Inc. is a Canadian wealth and asset management company with a market capitalization of approximately CA$8.28 billion.

Operations: IGM Financial Inc. primarily generates its revenue through two key segments: Asset Management, which brought in CA$1.18 billion, and Wealth Management, contributing CA$2.22 billion.

Dividend Yield: 6.3%

IGM Financial offers a stable dividend of 6.3%, though slightly below the top Canadian payers. It trades at 44.5% under its estimated fair value, suggesting potential undervaluation. Dividends have grown consistently over a decade, supported by both earnings and cash flows with payout ratios of 57.9% and 78.3%, respectively. Despite recent earnings growth (8.2% last year), projections indicate a slight decline in future earnings (1.9% annually over three years). Recent drops from the FTSE All-World Index could impact investor perception negatively.

Summing It All Up

Embark on your investment journey to our 34 Top Dividend Stocks selection here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:ADN TSX:OLY and TSX:IGM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance