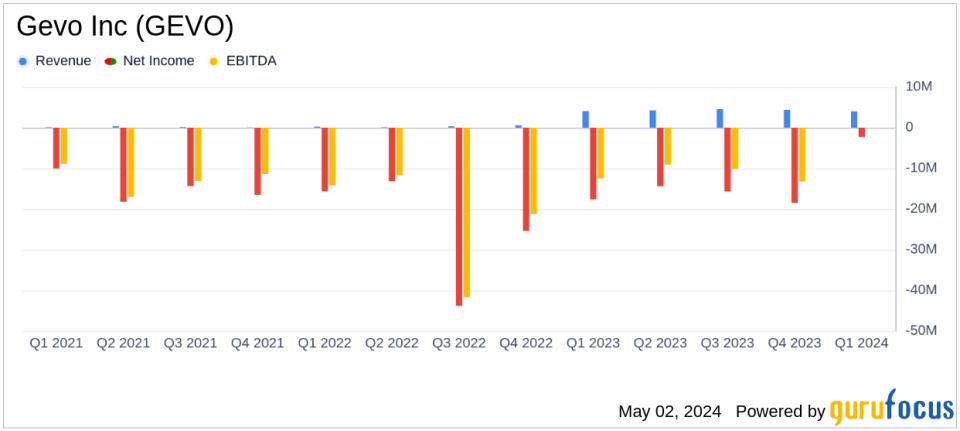

Gevo Inc (GEVO) Q1 2024 Earnings: Misses Revenue Estimates Amidst Strategic Adjustments

Revenue: Reported $3.99 million, slightly below the estimated $4.40 million.

Net Loss: Recorded at $18.88 million, exceeding the estimated loss of $14.54 million.

Earnings Per Share (EPS): Reported a loss of $0.08 per share, slightly worse than the estimated loss of $0.07 per share.

Operating Expenses: Increased to $27.13 million from $24.92 million year-over-year, driven by higher project development and general administrative costs.

Research and Development Expenses: Rose by $0.35 million compared to the same period last year, reflecting ongoing investment in innovation.

Interest and Investment Income: Increased by $0.81 million year-over-year, benefiting from higher interest rates on cash equivalent investments.

Project Development Costs: Increased significantly by $2.36 million, primarily due to patent-related costs and consulting fees.

On May 2, 2024, Gevo Inc (NASDAQ:GEVO) disclosed its financial outcomes for the first quarter of 2024 through an 8-K filing. The company, a pioneer in renewable chemicals and advanced biofuels, reported operating revenues of $3.99 million, slightly below the analyst's expectation of $4.40 million. The net loss widened to $18.875 million, or -$0.08 per share, which is slightly higher than the anticipated -$0.07 per share.

Company Overview

Gevo Inc operates through multiple segments including the Gevo segment, Renewable Natural Gas Segment, Net-Zero Segment, and the Agri-Energy segment. The company is at the forefront of developing renewable alternatives to petroleum-based products, focusing on the commercialization of isobutanol, sustainable aviation fuel (SAF), and other renewable hydrocarbons.

Operational Highlights and Financial Performance

During the quarter, Gevo's RNG operations outperformed volume expectations, generating $0.2 million in RNG sales and $3.8 million from environmental attributes. Despite these gains, total operating revenue saw a marginal decline from the previous year's comparable quarter. The cost of production notably decreased by $1.8 million due to increased output from the RNG project post its ramp-up phase.

General and administrative expenses rose by $1.4 million, reflecting intensified efforts in carbon sequestration initiatives and hiring activities. Project development costs also surged by $2.4 million, attributed to patent-related costs and consulting fees. These increases were partially offset by a stable depreciation and amortization expense.

Strategic Developments and Market Positioning

Dr. Patrick R. Gruber, CEO of Gevo, emphasized the strategic management of cash to enhance business plans and stakeholder value. The company is making significant progress in its Net-Zero projects and RNG business, with additional growth in Verity through new partnerships and products. The recent clarity around the Inflation Reduction Act and its implications for SAF tax credits was also highlighted as a positive development for Gevo's operational framework.

Financial Health and Future Outlook

Gevo's balance sheet remains robust with $270.642 million in cash and cash equivalents, although this is a decrease from the $298.349 million reported at the end of 2023. The total assets stood at $633.571 million. The company's strategic initiatives, including the ongoing development of its Net-Zero projects and enhancements in its RNG operations, are integral to its long-term financial strategy aimed at achieving profitability and reducing carbon intensity in fuel production.

Investor and Analyst Perspectives

Despite missing revenue estimates this quarter, Gevo's strategic advancements and operational improvements position it as a key player in the renewable energy sector. The company's focus on innovative technologies and market expansion through sustainable practices aligns with growing investor interest in environmentally responsible and sustainable investments.

For detailed financial figures and future projections, interested parties are encouraged to view the full earnings report and listen to the webcast replay available on Gevos website under the Investor Relations section.

As Gevo continues to navigate the complexities of the renewable energy market, its ability to adapt and innovate will be crucial in driving future growth and achieving its long-term financial and environmental goals.

Explore the complete 8-K earnings release (here) from Gevo Inc for further details.

This article first appeared on GuruFocus.