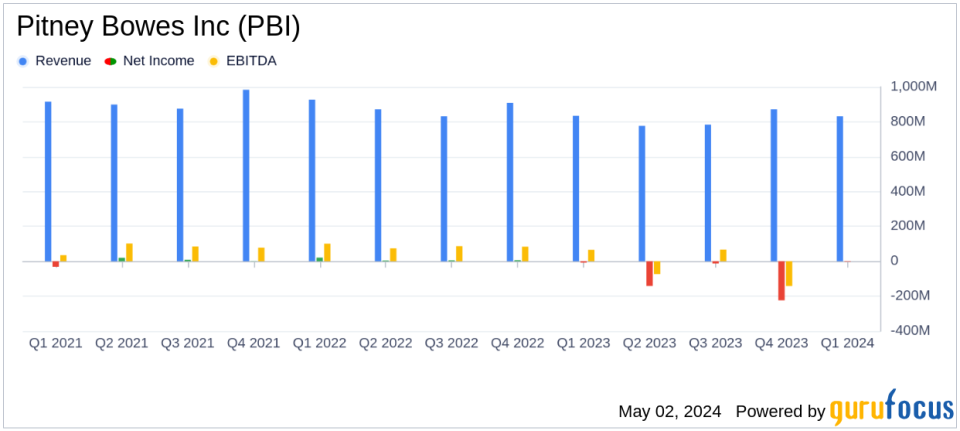

Pitney Bowes Inc (PBI) Q1 2024 Earnings: Mixed Results Amidst Challenging Market Conditions

Revenue: Reported at $831 million, remaining flat year-over-year, and surpassing the estimated $797 million.

GAAP EPS: Improved by $0.02 to ($0.02), exceeding the estimated ($0.05).

Net Loss: Recorded at $3 million, an improvement of $5 million from the previous year, indicating progress despite higher interest and tax expenses.

Free Cash Flow: Showed significant improvement with a reduction in usage by $43 million year-over-year, though still a use of $17 million.

Cost Reduction: Actions from the 2023 restructuring plan generated substantial benefits, with expected savings to exceed the $75 to $85 million target.

Global Ecommerce: Faced a 2% decline in revenue, primarily due to a 49% drop in cross-border revenue, partially offset by a 20% increase in domestic parcel volumes.

Presort Services: Achieved record revenue and EBIT, with revenue increasing by 7% due to higher revenue per piece and improved operational efficiencies.

Pitney Bowes Inc (NYSE:PBI), a global shipping and mailing company, disclosed its financial outcomes for the first quarter of 2024 on May 2, 2024. The company reported a slight improvement in net income and significant cost reductions, although revenues remained flat year-over-year. For a detailed view, refer to the company's 8-K filing.

Company Overview

Pitney Bowes is a renowned technology company offering comprehensive e-commerce solutions, including domestic delivery, cross-border shipping, and sorting services for postal mails. Operating primarily in the United States, the company segments its operations into Global E-commerce, Presort Services, and SendTech Solutions, focusing on leveraging technology to streamline mailing and shipping processes for its clients.

Financial Performance Insights

For Q1 2024, Pitney Bowes reported revenues of $831 million, consistent with the previous year, and slightly above the estimated $797 million. The GAAP earnings per share (EPS) saw an improvement from -$0.04 in Q1 2023 to -$0.02 in Q1 2024, although it missed the estimated EPS of -$0.05. The net loss narrowed to $3 million, a $5 million improvement from the prior year, driven by a 71% increase in adjusted EBIT to $56 million.

Segment Performance

The Presort Services segment excelled with a 7% increase in revenue and a 50% jump in adjusted segment EBIT, achieving record figures. Conversely, the Global Ecommerce segment faced challenges, with a 2% decline in revenue influenced by a significant drop in cross-border revenue, despite a 20% increase in domestic parcel volumes. The SendTech Solutions segment experienced a slight revenue decline but managed a 6% increase in both adjusted segment EBITDA and EBIT, thanks to favorable revenue mix and cost efficiencies.

Strategic Cost Management

Cost reduction initiatives from the 2023 restructuring plan played a crucial role in this quarter's financial performance, with savings expected to exceed the initial target of $75 to $85 million. These efforts contributed to an 8% reduction in operating expenses and a significant improvement in free cash flow, which was a use of $17 million, marking a $43 million enhancement year-over-year.

Outlook and Future Directions

Looking ahead, Pitney Bowes maintains its 2024 guidance, anticipating revenue growth ranging from flat to a low-single digit decline and stable EBIT margins. The company plans to continue its focus on cost management and operational efficiencies to navigate the ongoing market challenges effectively.

Conclusion

While the flat revenue points to a challenging market environment, Pitney Bowes' ability to improve its bottom line and reduce costs reflects a resilient operational strategy. Investors and stakeholders may find reassurance in the company's proactive measures to enhance profitability and maintain financial health amidst uncertain economic conditions.

For further details on Pitney Bowes' financial performance and strategic initiatives, interested parties are encouraged to review the full earnings report and join the upcoming webcast discussion hosted by the management.

Explore the complete 8-K earnings release (here) from Pitney Bowes Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance