Kimco Realty Corp (KIM) Q1 2024 Earnings: Navigating Through Challenges with Strategic Acquisitions

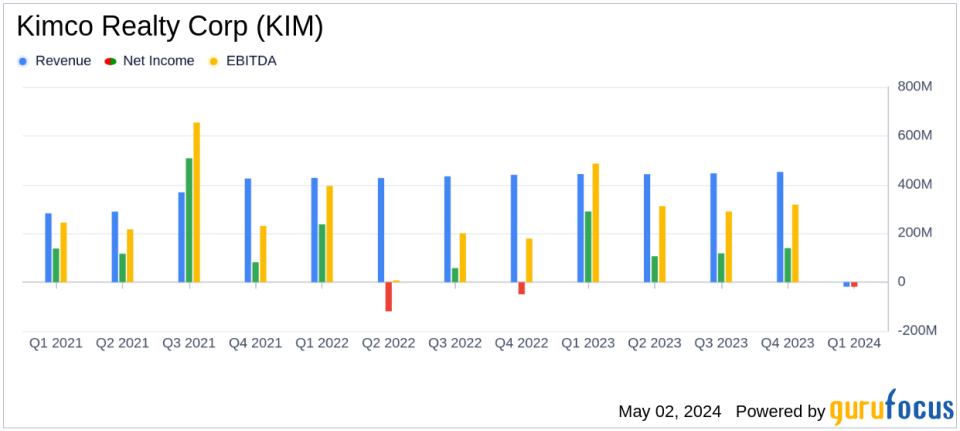

Net Loss: Reported a net loss of $18.9 million for Q1 2024, a significant downturn from a net income of $283.5 million in Q1 2023.

Earnings Per Share: EPS stood at ($0.03) for the quarter, falling short of the estimated $0.18.

Revenue: Specific revenue figures for Q1 2024 were not disclosed, making it unclear how they compared to the estimated $477.31 million.

Dividend: Declared a quarterly dividend, continuing its commitment to return value to shareholders.

Operational Highlights: Achieved four million square feet of leasing with double-digit rent spreads and strong growth in same property NOI.

Acquisition and Disposition: Successfully executed the acquisition of RPT Realty and divested ten properties not aligning with long-term strategy.

2024 Outlook: Updated full-year guidance for net income to $0.40 to $0.44 per diluted share and FFO to $1.56 to $1.60 per diluted share, reflecting adjustments for RPT merger-related charges.

On May 2, 2024, Kimco Realty Corp (NYSE:KIM), a prominent real estate investment trust (REIT) in the United States, disclosed its financial results for the first quarter ended March 31, 2024. The company released its 8-K filing, revealing a net loss of $18.9 million, or ($0.03) per diluted share, a significant shift from the net income of $283.5 million, or $0.46 per diluted share, reported in the same period last year. This performance starkly contrasts with analyst expectations, which projected earnings per share of $0.18 for the quarter.

Kimco Realty, with a history spanning over 60 years, specializes in owning, managing, and developing open-air, grocery-anchored shopping centers and mixed-use properties. As of March 31, 2024, the company's portfolio included 569 properties across major U.S. markets, totaling approximately 101 million square feet of leasable space.

Quarterly Performance Insights

The first quarter of 2024 was marked by significant activities for Kimco, including the successful acquisition of RPT Realty, which expanded its asset base and geographic footprint. Despite the net loss, the company achieved a Funds From Operations (FFO) of $261.8 million, or $0.39 per diluted share, consistent with the previous year's performance. This figure includes RPT-related merger charges of $25.2 million.

CEO Conor Flynn commented on the quarter's achievements, stating,

Our first quarter results surpassed our initial expectations and showcase the robust demand that continues to permeate our open-air, grocery-anchored shopping center portfolio, supported by the exceptional performance of our dedicated team of associates."

Flynn also highlighted the strategic divestment of ten properties that did not align with the company's long-term goals, emphasizing a focus on optimizing the portfolio's quality and growth potential.

Strategic Developments and Financial Position

The quarter also saw Kimco engaging in significant investment and disposition activities, adjusting its portfolio to better align with strategic objectives. The company reported dispositions with a cap rate of 8.50%, amounting to $248 million, and acquisitions and structured investments at a cap rate of 10.0%, totaling $76 million. These moves are part of Kimco's broader strategy to enhance its portfolio quality and income stability.

From a balance sheet perspective, Kimco ended the quarter with $19.47 billion in total assets, an increase from $18.27 billion at the end of 2023. This growth is primarily attributed to increased investments in real estate and advances to joint ventures. The company's total liabilities stood at $8.63 billion, with equity accounting for the remainder.

Outlook and Forward Guidance

Looking ahead, Kimco has updated its full-year 2024 guidance, reflecting the integration of RPT Realty and ongoing market dynamics. The company now expects net income per diluted share to range between $0.40 and $0.44, down from previous forecasts of $0.47 to $0.51. FFO per diluted share is projected to be between $1.56 and $1.60, slightly up from the earlier range of $1.54 to $1.58.

These adjustments take into account the operational synergies expected from the RPT merger and ongoing market conditions. Kimco's management remains focused on leveraging its robust portfolio and strategic acquisitions to navigate through the evolving retail landscape and deliver value to shareholders.

For more detailed information, investors and stakeholders are encouraged to review the full earnings report and tune into the earnings conference call, details of which are available on Kimco's investor relations website.

As the company continues to adapt to market conditions and refine its strategy, the coming quarters will be crucial in assessing the effectiveness of its recent acquisitions and the overall health of its portfolio. Kimco Realty's ability to maintain its dividend, manage costs, and capitalize on growth opportunities will be key factors in its ongoing success and stability.

Explore the complete 8-K earnings release (here) from Kimco Realty Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance