Lincoln National Corp (LNC) Surpasses EPS Estimates with Strong Q1 2024 Performance

Net Income: Reported at $1.2 billion, surpassing the estimated $197.54 million.

Earnings Per Share (EPS): Achieved $6.93 per diluted share, significantly exceeding the estimated $1.10.

Revenue: Details not provided in the text, comparison to the estimated $4584.10 million cannot be made.

Adjusted Operating Income: Totaled $71 million, or $0.41 per diluted share, impacted by significant items totaling $164 million.

Significant Financial Items: Included a legal accrual of $90 million and severance expenses of $39 million.

Market Risk Benefits: Gained $1.1 billion primarily from changes in interest rates and equity markets, influencing net income.

RBC Ratio: Estimated to be between 400-410% at the end of the quarter.

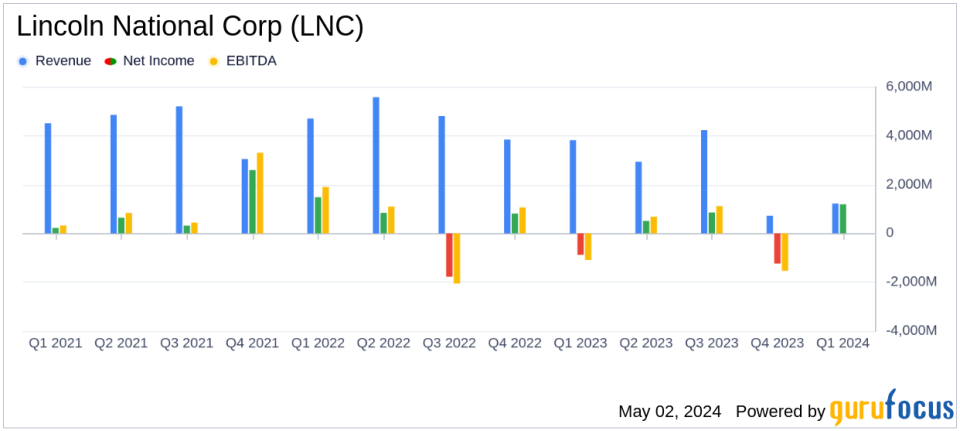

On May 2, 2024, Lincoln National Corp (NYSE:LNC) released its 8-K filing, announcing a robust start to the year with its first-quarter financial results. The company reported a substantial net income of $1.2 billion, translating to $6.93 per diluted share, significantly outperforming the analyst's EPS estimate of $1.10. This stark increase was primarily attributed to favorable market conditions impacting market risk benefits.

Lincoln National Corp, a leader in the insurance and retirement sectors, operates through various segments including Annuities, Retirement Plan Services, Life Insurance, and Group Protection. The company's products range from various types of life insurance to employer-sponsored retirement plans and services.

Comprehensive Financial Overview

The reported adjusted operating income was $71 million, or $0.41 per diluted share, impacted by significant items totaling $164 million. These included a legal accrual and expenses related to organizational restructuring. Despite these challenges, the company's leadership remains optimistic about its strategic realignment and the ongoing execution across its business segments.

Particularly noteworthy was the Annuities segment, which, despite a 5.5% decrease in operating income due to specific balance sheet adjustments, saw its highest earnings quarter in nearly two years when excluding these impacts. The Group Protection segment also showed strong performance with a 13% increase over the prior-year period in operating income and an expanded margin.

Conversely, the Life Insurance segment faced a downturn, with a reported operating loss of $35 million, exacerbated by the impacts from a reinsurance transaction. The Retirement Plan Services witnessed a decline in operating income by 16%, primarily due to lower spread income, although it achieved a significant 53% year-over-year increase in first-year sales growth.

Strategic Moves and Market Position

Ellen Cooper, Chairman, President, and CEO of Lincoln Financial Group, highlighted the strategic progress made across the company's segments. She emphasized the solid foundation laid for the year 2024, focusing on positioning the businesses for profitable growth and optimizing the operating model.

The company also reported an estimated Risk-Based Capital (RBC) ratio between 400 - 410% and an increase in book value per share to $38.46, up from $34.81 at the end of the previous year. These metrics underscore Lincoln National Corp's strong capital position and its resilience in face of market fluctuations.

Despite the mixed results in some segments, the overall financial health of Lincoln National Corp appears robust, particularly considering the substantial net income this quarter. The strategic adjustments and operational optimizations currently underway promise to reinforce its market position in the competitive insurance and financial services industry.

For a detailed breakdown of Lincoln National Corp's first quarter financials and strategic initiatives, refer to their investor relations site.

Explore the complete 8-K earnings release (here) from Lincoln National Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance