RXO Inc (RXO) Reports Q1 2024 Earnings: Misses Analyst Revenue and EPS Projections

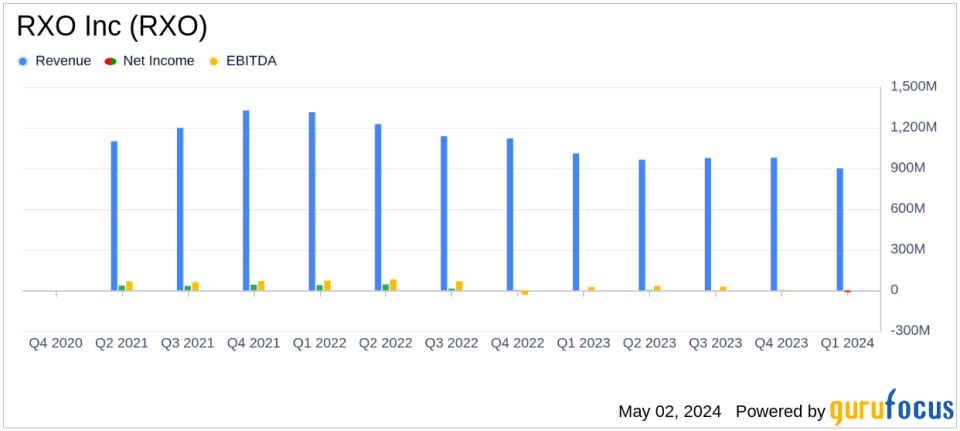

Revenue: Reported at $913 million, falling short of the estimated $929.48 million.

Net Loss: Recorded a GAAP net loss of $15 million, significantly above the estimated net loss of $4.24 million.

Earnings Per Share (EPS): GAAP diluted loss per share was $0.13, adjusted diluted loss per share was $0.03, both above the estimated EPS of -$0.04.

Gross Margin: Companywide gross margin was 17.4%, a decrease from 18.7% in the previous year.

Brokerage Volume: Increased by 11% year-over-year, with full-truckload volume up by 8% and less-than-truckload volume up by 29%.

Adjusted EBITDA: Totaled $15 million, a significant decrease from $37 million in the prior year, with an adjusted EBITDA margin of 1.6%, down from 3.7%.

Future Outlook: Second-quarter companywide adjusted EBITDA is expected to be between $24 million and $30 million.

RXO Inc (NYSE:RXO) disclosed its first-quarter financial results on May 2, 2024, revealing significant challenges despite growth in brokerage volumes. The company's earnings report, detailed in its 8-K filing, showed a miss on both revenue and earnings per share (EPS) estimates set by analysts. RXO reported a revenue of $913 million against an expected $929.48 million and an adjusted diluted loss per share of $0.03, compared to the anticipated $-0.04.

RXO Inc, a leader in the asset-light transportation sector, operates primarily in North America, focusing on tech-enabled truck brokerage along with managed transportation, freight forwarding, and last mile delivery services. This quarter, the company saw an 11% year-over-year increase in brokerage volume, driven by an 8% rise in full truckload volumes and a notable 29% increase in less-than-truckload volumes.

Financial Performance and Market Challenges

The company's financial health has been impacted by several factors. RXO reported a net loss of $15 million for the quarter, a stark contrast to the break-even net income of the previous year. The loss includes $12 million in transaction, integration, and restructuring costs. Adjusted EBITDA stood at $15 million, down from $37 million year-over-year, with the margin shrinking from 3.7% to 1.6%. These figures reflect the ongoing pressures in the freight market, despite the company's efforts to expand its market share and improve operational efficiency.

Strategic Moves and Forward Outlook

CEO Drew Wilkerson highlighted the company's strategic focus on gaining profitable market share and making disciplined cost and strategic investments. "RXO continued to deliver exceptional brokerage volume growth and strong margin performance in the first quarter of 2024, despite persistent softness in the freight market," Wilkerson stated. Looking ahead, RXO anticipates an increase in adjusted EBITDA for Q2 2024, projecting it to be between $24 million and $30 million, with expected brokerage gross margins ranging from 13% to 15%.

Analysis of Financial Statements

The company's balance sheet shows a slight decrease in total assets from $1,825 million at the end of 2023 to $1,799 million as of March 31, 2024. The cash flow statement reveals a modest net cash provided by operating activities amounting to $7 million, down from $42 million in the same quarter the previous year. These figures suggest a tightening financial operation amidst challenging market conditions.

RXO's efforts to navigate a turbulent market are evident in its strategic adjustments and operational focus. However, the financial outcomes of this quarter highlight the significant impact of external market pressures and internal restructuring costs on its overall performance. As RXO continues to adapt and strategize for better financial health, investors and market watchers will be keenly observing its ability to translate operational growth into improved financial metrics.

For detailed insights into RXO Inc's financials and strategic direction, stakeholders are encouraged to review the full earnings release and stay tuned for the upcoming quarterly forecasts and strategic updates.

Explore the complete 8-K earnings release (here) from RXO Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance