Manitex International Inc (MNTX) Surpasses Analyst Revenue Forecasts in Q1 2024

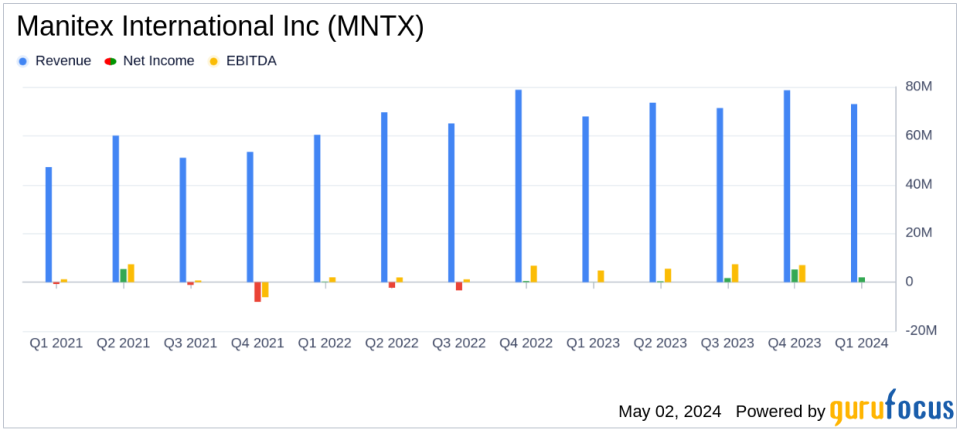

Revenue: Reported $73.3 million, up 8.1% year-over-year, slightly above the estimate of $73.2 million.

Net Income: Achieved $2.3 million, significantly above the estimated $1.2 million.

Earnings Per Share (EPS): Recorded at $0.11, far above the estimated $0.06.

Gross Profit Margin: Increased to 23.0%, up from 21.2% in the prior year period, reflecting improved manufacturing throughput and cost efficiencies.

Operating Income: Rose to $4.9 million from $2.6 million year-over-year, with operating margin improving to 6.7% from 3.8%.

Adjusted EBITDA: Grew 33.5% to $8.4 million, representing 11.4% of sales, driven by strong margin performance and operational efficiencies.

Backlog: Ended the quarter at $154.2 million, down from $170.3 million at the end of the previous fiscal year, indicating robust future revenue potential despite a slight decrease.

On May 2, 2024, Manitex International Inc (NASDAQ:MNTX), a prominent provider of truck cranes and specialized industrial equipment, announced its first quarter results for 2024, revealing a notable increase in revenue and earnings that exceeded market expectations. The company's detailed financial performance can be reviewed in its 8-K filing.

For the first quarter ended March 31, 2024, Manitex reported a revenue of $73.3 million, an 8.1% increase from $67.9 million in the same period last year, and slightly above the analyst's expectation of $73.2 million. This growth was primarily driven by its Lifting Equipment and Rental Equipment segments, with notable improvements in manufacturing throughput and strong market demand.

The company's net income significantly improved to $2.3 million, or $0.11 per diluted share, compared to just under $0.1 million, or $0.00 per diluted share, in the prior year. This performance starkly contrasts with the analyst's estimated earnings per share of $0.06, showcasing a robust improvement in profitability.

Operational Highlights and Strategic Initiatives

CEO Michael Coffey highlighted the success of the company's strategic initiatives under its "Elevating Excellence" strategy, which contributed to an 11.4% Adjusted EBITDA margin, up nearly 220 basis points from the previous year. These initiatives include new product launches, enhanced partnerships, and operational improvements that have led to increased production efficiencies and cost savings.

The company also reported a strong backlog of $155 million, which positions it well for sustained growth. CFO Joseph Doolan emphasized the company's focus on reducing debt, with a net debt to trailing twelve-month adjusted EBITDA ratio improving to 2.7x from 2.9x at the end of 2023.

Financial Position and Future Outlook

Manitex ended the quarter with $5.1 million in cash and a robust liquidity position, with approximately $30 million in cash and availability under its credit facilities. The company reiterated its full-year 2024 guidance, expecting total revenue between $300 million and $310 million and an Adjusted EBITDA margin of approximately 10.5%.

The company's balance sheet remains solid with total assets of $256.2 million as of March 31, 2024. The detailed financial statements and non-GAAP reconciliations provide further insights into the company's financial health and operational efficiency.

Conclusion

Manitex International Inc's first quarter results demonstrate a strong start to 2024, underscored by significant revenue growth and profitability enhancements. With strategic initiatives bearing fruit and a strong market position, Manitex appears well-positioned for continued growth and shareholder value creation.

Investors and stakeholders are encouraged to join Manitex's conference call or access the webcast on the company's website, where further details and strategic plans will be discussed.

Explore the complete 8-K earnings release (here) from Manitex International Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance