Cactus Inc (WHD) Q1 2024 Earnings: Modestly Exceeds Revenue Expectations, Misses EPS Estimates

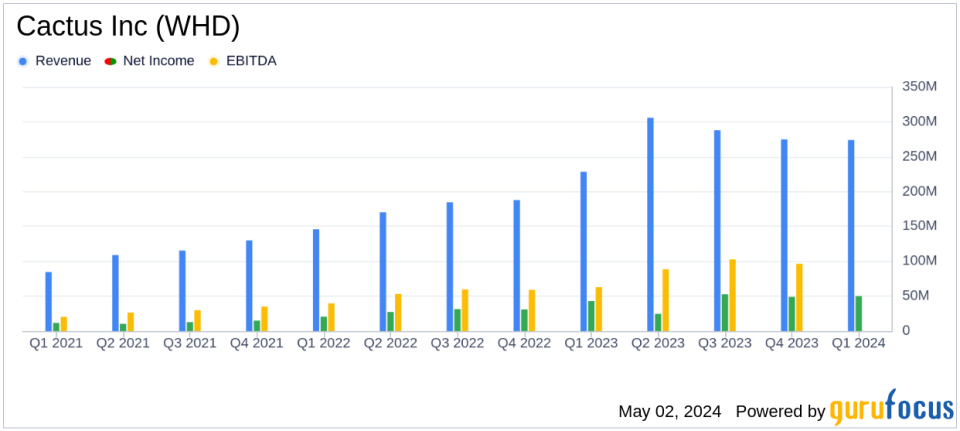

Revenue: Reported at $274.1 million, slightly above estimates of $270.65 million.

Net Income: Totaled $49.8 million, falling short of estimates of $54.93 million.

Earnings Per Share (EPS): Diluted EPS recorded at $0.59, below the estimated $0.70.

Adjusted EBITDA: Reached $95.3 million with an Adjusted EBITDA margin of 34.8%.

Cash Flow: Cash flow from operations stood at $86.3 million, with a robust cash and cash equivalents balance of $194.3 million as of March 31, 2024.

Dividend: A quarterly cash dividend of $0.12 per Class A share was declared.

Future Outlook: Anticipates lower U.S. land activity levels and flat revenue in the Pressure Control segment for the second quarter of 2024.

Cactus Inc (NYSE:WHD) disclosed its financial outcomes for the first quarter of 2024 on May 1, 2024, revealing a mix of surpassing revenue forecasts while falling short on earnings per share (EPS) expectations. The detailed financial metrics can be reviewed in the company's recent 8-K filing.

Cactus Inc, a prominent player in the oil and gas sector, specializes in the design, manufacture, and sale of wellheads and pressure control equipment. The company's offerings include the innovative Cactus SafeDrill wellhead systems, conventional wellheads, and production valves. Cactus also delivers critical field services ranging from installation to maintenance and repair, predominantly serving the onshore unconventional oil and gas wells during their various operational phases.

Quarterly Financial Highlights

The company reported a revenue of $274.1 million for Q1 2024, a slight increase from the previous quarter's $274.9 million and significantly higher than $228.4 million from the same quarter last year. This performance modestly exceeded analyst expectations of $270.65 million. However, the EPS of $0.59 fell short of the estimated $0.70, despite adjusted EPS hitting $0.75 due to non-GAAP adjustments.

Operational and Segment Performance

Cactus experienced mixed results across its segments. The Pressure Control segment saw a slight decline in revenue, down by 3.0% sequentially, primarily due to decreased customer activity. Conversely, the Spoolable Technologies segment reported a 5.0% increase in revenue, attributed to heightened activity levels from large customers. Despite these gains, the segment faced challenges, including a significant expense from the remeasurement of the FlexSteel earn-out liability, impacting overall profitability.

Strategic Moves and Future Outlook

Scott Bender, CEO of Cactus, expressed satisfaction with the company's revenue growth, particularly in the Spoolable Technologies business. Looking forward, the company anticipates a slight downturn in U.S. land activity levels due to ongoing gas commodity weakness and global uncertainties. However, Bender remains optimistic about internal cost improvements and revenue expansion opportunities, including the rollout of a new wellhead system and advancements in international markets.

Financial Position and Dividend Declaration

Cactus reported a robust balance sheet with $194.3 million in cash and no outstanding bank debt as of March 31, 2024. The firm's operational cash flow stood strong at $86.3 million for the quarter. Reflecting confidence in its financial health, Cactus' Board of Directors declared a quarterly cash dividend of $0.12 per Class A share, payable in June 2024.

Analysis and Investor Outlook

While Cactus Inc has demonstrated a solid revenue stream and strategic growth initiatives, the EPS miss could concern investors looking for consistent profitability enhancements. However, the company's strong cash position and proactive management strategies, aimed at cost reduction and market expansion, provide a balanced view for potential investors. The ongoing developments in product offerings and market reach might offset the current earnings dip and set a positive trajectory for future quarters.

For detailed financial figures and further information on Cactus Inc's performance, stakeholders and interested parties are encouraged to review the full earnings report and supplementary financial data provided by the company.

Explore the complete 8-K earnings release (here) from Cactus Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance