Here's Why We Think K&S (ASX:KSC) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like K&S (ASX:KSC). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide K&S with the means to add long-term value to shareholders.

View our latest analysis for K&S

K&S' Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's easy to see why many investors focus in on EPS growth. K&S' EPS has risen over the last 12 months, growing from AU$0.19 to AU$0.22. There's little doubt shareholders would be happy with that 14% gain.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. K&S reported flat revenue and EBIT margins over the last year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

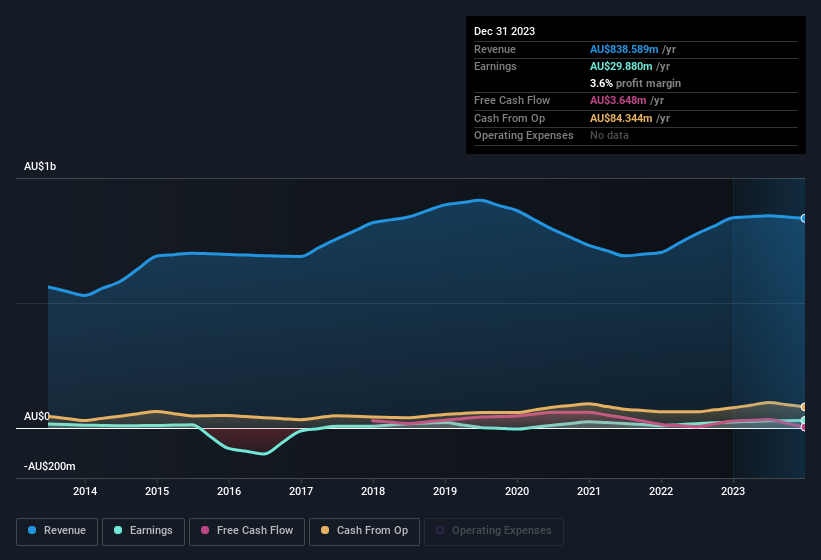

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since K&S is no giant, with a market capitalisation of AU$438m, you should definitely check its cash and debt before getting too excited about its prospects.

Are K&S Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's nice to see that there have been no reports of any insiders selling shares in K&S in the previous 12 months. With that in mind, it's heartening that Paul Sarant, the CEO, MD & Executive Director of the company, paid AU$25k for shares at around AU$2.40 each. It seems that at least one insider is prepared to show the market there is potential within K&S.

Is K&S Worth Keeping An Eye On?

One important encouraging feature of K&S is that it is growing profits. While some companies are struggling to grow EPS, K&S seems free from that morose affliction. Despite there being a solitary insider adding to their holdings, it's enough to consider adding this to the watchlist. We should say that we've discovered 1 warning sign for K&S that you should be aware of before investing here.

The good news is that K&S is not the only growth stock with insider buying. Here's a list of growth-focused companies in AU with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.