Butterfly Network Inc (BFLY) Surpasses Q1 Revenue Expectations and Raises 2024 Guidance

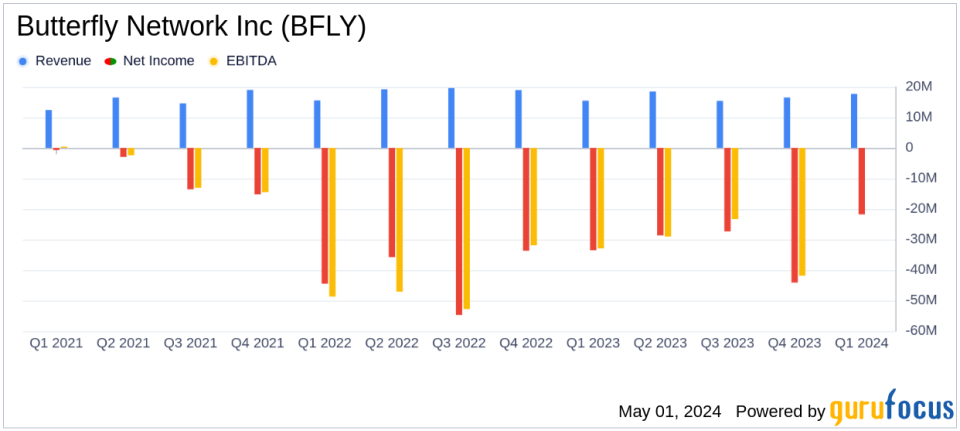

Revenue: $17.7 million, up 14% from $15.5 million in the prior year's first quarter, surpassing the estimate of $16.8 million.

Net Loss: Reduced to $21.8 million from $33.5 million year-over-year, exceeding the estimated loss of $25.26 million.

Adjusted EPS: Improved to -$0.07 from -$0.11 year-over-year, exceeding the estimated -$0.12.

Gross Margin: Slightly decreased to 58.2% from 58.7% in the previous year, influenced by product mix and higher amortization.

Operating Expenses: Decreased by 25% to $32.9 million from $44.1 million, reflecting cost reductions and efficiency improvements.

Cash Position: Ended the quarter with $116.8 million in cash, cash equivalents, and restricted cash.

Full Year Guidance: Raised following strong first quarter performance and operational achievements.

Butterfly Network Inc (NYSE:BFLY), a pioneering digital health company in handheld ultrasound technology, disclosed its financial outcomes for the first quarter ended March 31, 2024, via its 8-K filing on May 1, 2024. The company reported a significant 14% increase in revenue, reaching $17.7 million, surpassing the analyst's expectation of $16.80 million. This performance marks the strongest first quarter in Butterfly's history, attributed to robust sales across all channels and the successful launch of its third-generation handheld system, Butterfly iQ3.

Company Overview

Butterfly Network Inc is at the forefront of transforming healthcare with its innovative Ultrasound-on-Chip technology. Its flagship product, the Butterfly iQ+, is a handheld device capable of conducting whole-body imaging with a single probe. This technology not only makes ultrasound more accessible but also integrates seamlessly into clinical workflows through cloud-connected software and mobile applications, making it a critical tool in global healthcare.

Financial Highlights and Operational Achievements

The company's revenue growth was driven by a 22% increase in probe volume and the introduction of the Butterfly iQ3 in the U.S. market. Notably, U.S. revenue surged by 19% to $12.2 million. International sales also saw a healthy increase of 14% to $4.2 million. Despite these gains, the gross margin slightly dipped to 58.2% from 58.7% due to product mix changes and higher amortization costs.

Butterfly Network has effectively controlled its expenses, with operating expenses decreasing by 25% to $32.9 million, thanks to strategic reductions in workforce and rationalized spending across the board. This prudent financial management contributed to a reduced net loss of $21.8 million, down from $33.5 million in the same period last year.

Strategic Developments and Future Outlook

Joseph DeVivo, Butterflys Chairman and CEO, expressed optimism about the company's trajectory, highlighting the EU MDR certification which paves the way for expanded features in the European market. The company also launched ScanLab, an AI-powered educational application, enhancing its educational offerings and supporting wider adoption of its technology.

Following these positive developments, Butterfly Network has raised its full-year 2024 guidance, reflecting confidence in sustained growth and operational efficiency.

Challenges and Market Position

Despite its progress, Butterfly Network faces challenges, including compliance with NYSE listing standards due to its stock price dipping below $1.00. The company has a six-month period to regain compliance, planning a potential recovery through improved stock performance or a reverse stock split. This situation underscores the volatile nature of the market and the pressures on emerging tech companies in the healthcare sector.

Investor and Analyst Perspectives

With a reduced net loss and a strong start to the year, Butterfly Network is positioning itself as a leader in point-of-care ultrasound technology. The company's ability to innovate and strategically manage resources bodes well for its future, particularly as it expands its global footprint and enhances product offerings.

Investors and stakeholders are encouraged to join the upcoming conference call scheduled for 5:00 pm ET on May 1, 2024, to discuss these first quarter results and operational progress in more detail.

Butterfly Network's first quarter performance, marked by revenue growth and strategic advancements, sets a positive tone for its 2024 outlook, making it a noteworthy entity in the medical devices and instruments industry.

Explore the complete 8-K earnings release (here) from Butterfly Network Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance