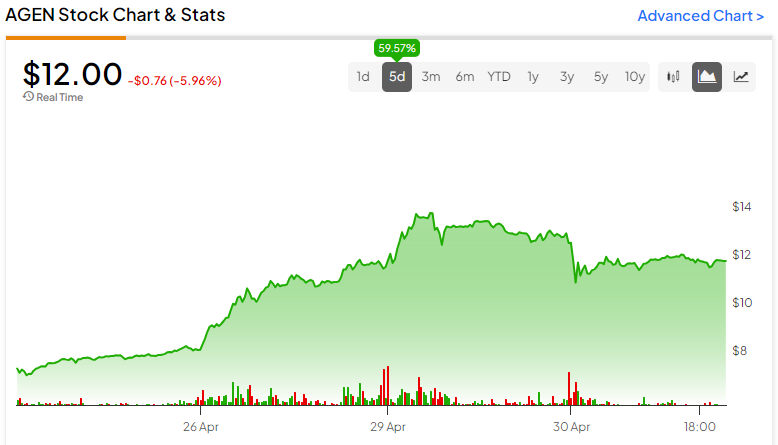

Clinical-stage immuno-oncology company Agenus (NASDAQ:AGEN) recently executed a 1-for-20 reverse stock split to give the company greater flexibility in its future financing needs and increase its stock price. So far, the latter half of that equation appears to be working, as the stock is up roughly 60% in the past week. While financial engineering may be a near-term catalyst, the company’s robust pipeline of clinical-stage candidates, partnerships, and collaborations should drive long-term value. It is an intriguing opportunity for savvy investors willing to speculate on emerging treatments.

Agenus’s Robust Pipeline

Agenus is a clinical-stage immuno-oncology company that develops and commercializes technologies to treat cancers and infectious diseases. It has a robust pipeline of potential treatments targeting colorectal cancer, pancreatic cancer, melanoma, solid tumors, and endometrial cancer.

The lead candidates are Botensilimab (BOT) and Balstilimab (BAT), which the company has in Phase 1/2 for various clinical trials (independently, together, and in combination with other potential treatments). Agenus recently shared updates from its Phase 1 clinical trial for BOT/BAL combination therapy. The results showed that the clinical activity of BOT/BAL in treating nine different forms of cancer was encouraging.

The company has completed enrolment for the Phase 2 trial and is preparing to present the promising interim results to the FDA. Agenus is also planning to submit a Biologics License Application for BOT/BAL in refractory metastatic colorectal cancer (MSS CRC) and will be presenting detailed results from the Phase 2 trial, including response durability and updated Phase 1 survival data, at a key medical conference in the latter half of 2024.

Agenus Recent Financial Results & Outlook — Losses Abound

Agenus reported Q4-2023 revenue of $84 million, which came primarily from collaboration agreements, achieved milestones, and non-cash royalty earnings. However, the company also reported a net loss of $49 million, or -$0.13 per share. For the fiscal year ending on December 31, 2023, the company recorded revenue of $156 million and a net loss of $257 million, translating to a loss of -$0.69 per share.

As of the end of the year, AGEN reported a cash balance of $76.1 million. In January 2024, the firm received a milestone payment of $25 million from BMS following the initiation of a Phase 2 study involving BMS-986442.

Management has given guidance that these developments, along with the expected monetization of non-core assets and future milestones and royalties from existing partnerships, are projected to generate enough cash proceeds by mid-2024 to provide for financial viability through the year.

Management is also actively seeking partnerships with several biopharmaceutical players to co-develop and co-commercialize BOT/BAL.

Is AGEN Stock a Buy?

Analysts following the company have been bullish on AGEN stock. For instance, Baird analyst Colleen Kusy adjusted the price target on Agenus to reflect the 1-for-20 split, setting it at $35 while reiterating an Outperform rating on the shares. She cited the positive BOT/BAT data as indicators of future growth. Overall, Agenus is rated a Strong Buy based on three Buy ratings from analysts in the past three months. The average AGEN stock price target of $98.33 implies 641.55% upside potential.

The stock had been trending downward until the recent reverse split. It now demonstrates positive price momentum, trading above the 20-day (8.06) and 50-day (10.25) moving averages.

Final Analysis of AGEN Stock

Agenus’s recent reverse stock split has catalyzed the share price into positive territory. This may be an event that causes investors to revisit the strength of the company’s pipeline of treatment candidates, further supporting the stock. However, it may take some time for these treatments to work through the clinical testing process, with many possible outcomes at each turn, so investors should view this stock as a long-term speculative opportunity with upside potential.