Riot Platforms Inc (RIOT) Surpasses Analyst Revenue Forecasts with Record Q1 Earnings

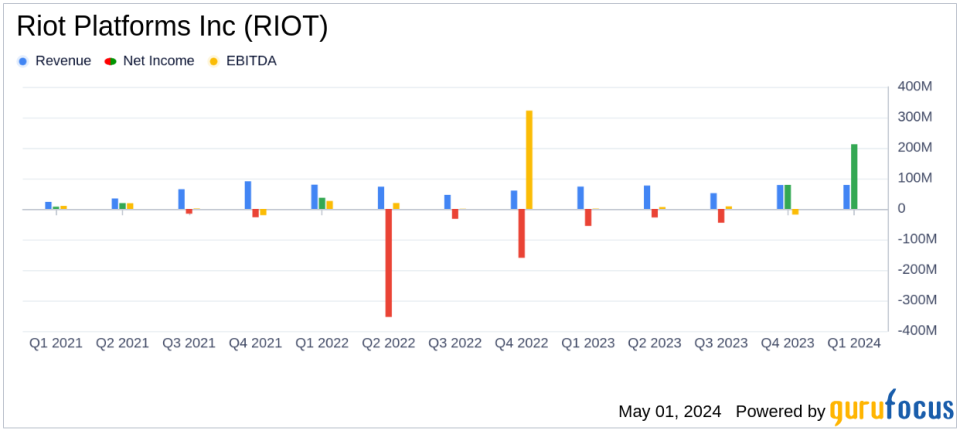

Revenue: Reported $79.3 million, falling short of the estimated $94.86 million.

Net Income: Achieved $211.8 million, significantly exceeding the estimated loss of $30.31 million.

Earnings Per Share (EPS): Recorded at $0.82, surpassing the estimated -$0.14.

Adjusted EBITDA: Reached a record $245.7 million, up from $81.7 million in the same quarter last year.

Bitcoin Mining Revenue: Totalled $74.6 million with a gross margin of 45%, driven by higher Bitcoin prices and expanded mining capacity.

Operational Expansion: Energization of the new Corsicana Facility, set to be the world's largest dedicated Bitcoin mining facility upon full development.

Stock Offering: Generated net proceeds of approximately $345.7 million from at-the-market equity offerings during the quarter.

On May 1, 2024, Riot Platforms Inc (NASDAQ:RIOT), a leader in vertically integrated Bitcoin mining, released its financial results for the first quarter of 2024, showcasing substantial growth and operational achievements. The company announced a total revenue of $79.3 million and a net income of $211.8 million, significantly surpassing analyst expectations. For further details, readers can access the 8-K filing.

About Riot Platforms Inc

Riot Platforms Inc operates primarily through its Bitcoin Mining and Data Center Hosting segments, with the majority of its revenue generated from Bitcoin mining activities. The company's strategic focus on expanding its mining operations has positioned it as a significant player in the blockchain technology industry.

Q1 2024 Performance Overview

The first quarter of 2024 was marked by remarkable financial achievements for Riot, with a reported earnings per share (EPS) of $0.82, a stark contrast to the estimated EPS of -$0.14. This performance is a new record for the company, substantially higher than the same period in 2023. The adjusted EBITDA also reached a new high of $245.7 million, compared to $81.7 million in the previous year, reflecting a robust improvement in operational efficiency and profitability.

Operational Highlights and Future Outlook

During the quarter, Riot announced the energization of its Corsicana Facility, anticipated to be the world's largest dedicated Bitcoin mining facility upon completion. This strategic expansion is expected to nearly triple the company's current self-mining hash rate capacity to 31 EH/s by year-end. The deployment of additional miners at both the Corsicana and Rockdale facilities is set to further enhance Riot's mining capabilities.

Financial Metrics and Analysis

The substantial increase in net income was primarily driven by a significant change in the fair value of Bitcoin, amounting to $234.1 million. The company also benefited from power curtailment credits, which contributed approximately $5.1 million to the Bitcoin Mining revenue, adjusting the cost of revenue to $38.6 million on a non-GAAP basis.

Selling, general, and administrative expenses saw an increase, mainly due to higher stock compensation expenses and costs associated with ongoing growth and expansion efforts. Despite these increases, the company's strategic investments and operational enhancements have clearly paid off, as evidenced by the impressive financial outcomes.

Investor and Market Implications

The significant outperformance of Riot Platforms Inc in both revenue and net income relative to analyst expectations highlights the company's strong operational execution and strategic positioning within the cryptocurrency mining sector. This performance not only enhances investor confidence but also positions Riot as a robust entity in the capital markets, capable of sustaining growth and delivering value.

For more detailed information and to view the full financial statements, visit Riot Platforms Inc's official website or access their recent SEC filings.

Contact Information

Investors and media seeking further information can contact Phil McPherson, Investor Relations, at IR@Riot.Inc or Alexis Brock, Media Relations, at PR@Riot.Inc.

Riot Platforms Inc continues to leverage its innovative approach and community partnerships to drive growth and operational excellence, aiming to maintain its leadership in the rapidly evolving Bitcoin-driven infrastructure sector.

Explore the complete 8-K earnings release (here) from Riot Platforms Inc for further details.

This article first appeared on GuruFocus.