SiriusPoint Ltd (SPNT) Reports Q1 2024 Earnings: A Detailed Analysis

Net Income: $90.8 million, a decrease from $131.9 million in the prior year, falling short of quarterly EPS estimates of $0.35 with actual EPS at $0.49.

Core Combined Ratio: Improved to 91.4%, indicating a 5% enhancement from the previous year, reflecting stronger underwriting discipline.

Net Investment Income: Increased to $78.8 million, demonstrating robust growth in investment returns, aligning with strategic financial management.

Book Value Per Diluted Share: Grew by 2.2% to $13.64, showcasing continued asset value appreciation and financial health.

Debt Restructuring: Successfully reduced financial leverage by approximately 2.5 points through refinancing activities, enhancing balance sheet strength.

Return on Equity: Achieved a strong return on average common equity of 15.4%, aligning with the medium-term guidance of 12-15%.

Service Fee Income: From Consolidated MGAs rose by 8.2%, with an improved service margin of 30.1%, indicating efficient operations and profitability in managed services.

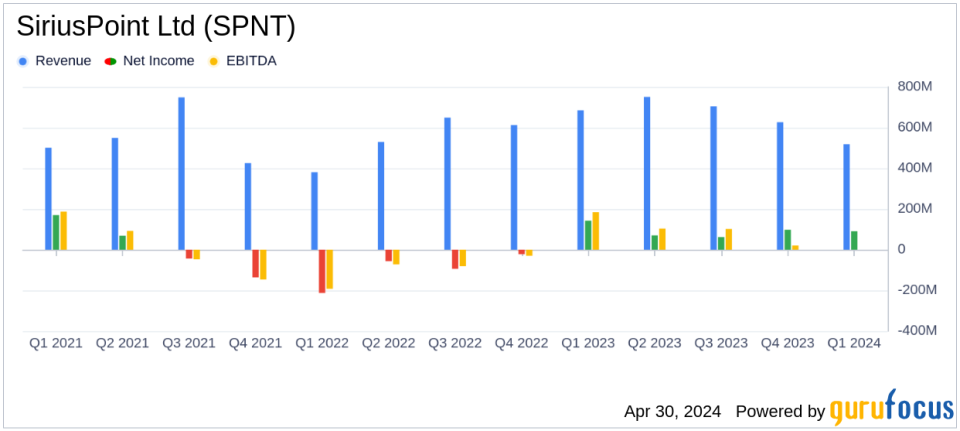

On April 30, 2024, SiriusPoint Ltd (NYSE:SPNT) disclosed its financial results for the first quarter ended March 31, 2024, through an 8-K filing. The company, a prominent provider of property and casualty reinsurance and insurance services globally, reported a net income of $90.8 million, or $0.49 per diluted share. This performance compares favorably against analyst estimates which projected earnings of $0.35 per share for the quarter.

Company Overview

SiriusPoint Ltd operates through two segments: Reinsurance, and Insurance & Services, offering a range of products including property insurance, workers' compensation, and professional liability insurance, among others. The majority of its revenue is derived from the Insurance & Services segment, highlighting its strategic focus on these areas.

Financial Highlights and Strategic Developments

The first quarter of 2024 saw SiriusPoint achieving a core combined ratio of 91.4%, indicating a 5% improvement year-over-year. The company's book value per diluted share also grew by 2.2% to $13.64. These metrics underscore the company's operational efficiency and growing profitability.

Significant to its strategic financial management, SiriusPoint completed a debt restructuring during the quarter, which is expected to reduce its financial leverage by approximately 2.5 points. This move not only strengthens the balance sheet but also supports future financial flexibility.

Operational Performance

SiriusPoint's underwriting income stood at $44.3 million with a combined ratio of 91.4% for the core operations. The net investment income was robust at $78.8 million, surpassing the full-year guidance for 2024. Furthermore, the company reported a 15.4% return on average common equity, aligning with its medium-term ROE guidance of 12-15%.

Challenges and Market Conditions

Despite the positive outcomes, the company faced challenges such as decreased favorable prior year loss reserve development, which impacted the consolidated underwriting income, now at $89.6 million compared to $156.5 million in the prior year. However, excluding specific adjustments, the net underwriting income saw an increase, driven by lower other underwriting expenses and the absence of catastrophe losses.

Investor and Analyst Insights

CEO Scott Egan commented on the quarter's results, stating:

"Building on the momentum from 2023, we report our sixth consecutive quarter of positive underwriting result... We are seeing good progress as we continue to execute strongly against our strategic priorities."

This statement reflects the company's ongoing focus on operational excellence and strategic growth initiatives.

Future Outlook

Looking ahead, SiriusPoint appears well-positioned to maintain its growth trajectory and meet its financial targets, supported by strategic partnerships and operational optimizations. The company's proactive management of its investment portfolio and cost structure should help sustain its competitive edge in the evolving insurance landscape.

In conclusion, SiriusPoint Ltd's Q1 2024 performance presents a solid start to the year, marked by strategic financial maneuvers and robust operational outcomes. Investors and stakeholders might view these results as a positive indicator of the company's direction and management efficacy.

For more detailed financial analysis and future updates on SiriusPoint Ltd, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from SiriusPoint Ltd for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance