Archer-Daniels Midland Co (ADM) Q1 2024 Earnings: Surpasses Analyst EPS Forecasts

Reported EPS: $1.42, surpassing the estimated earnings per share of $1.36.

Adjusted EPS: $1.46, also exceeding the quarterly estimate.

Segment Operating Profit: Reported at $1,311 million, reflecting a year-over-year decrease of 24%.

Adjusted Segment Operating Profit: Slightly higher at $1,317 million, yet down 24% compared to the previous year.

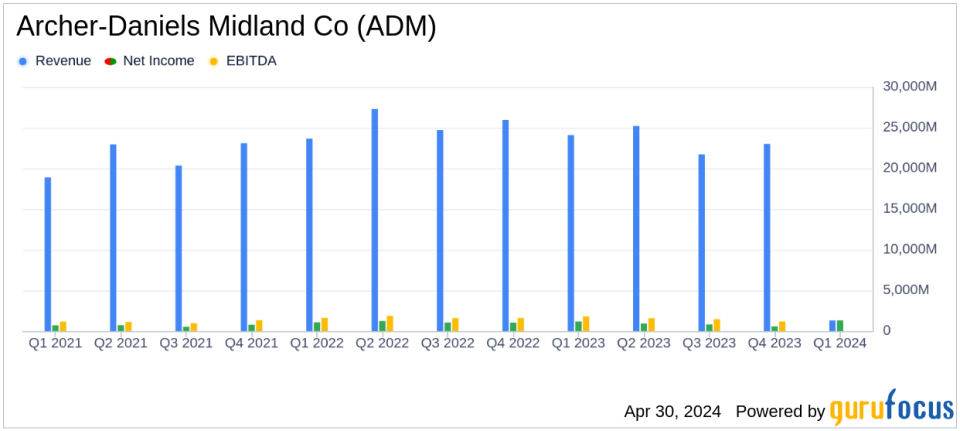

Revenue and Net Income: Specific figures not disclosed in the provided text, comparison to estimates cannot be made.

Ag Services & Oilseeds: Operating profit for this segment fell by 29% to $864 million.

Nutrition Segment: Operating profit significantly decreased by 39% to $84 million.

On April 30, 2024, Archer-Daniels Midland Co (NYSE:ADM) released its 8-K filing, detailing the financial outcomes for the first quarter ended March 31, 2024. The company reported earnings per share (EPS) of $1.42 on a GAAP basis and $1.46 on an adjusted basis, surpassing the analyst estimate of $1.36 per share. However, the company faced a 24% decrease in adjusted segment operating profit compared to the previous year, highlighting some operational challenges amidst a complex market environment.

Archer-Daniels Midland is a pivotal player in the global agricultural sector, specializing in the processing of oilseeds, corn, wheat, and other commodities. The company also excels in grain merchandising and possesses a robust nutritional business that caters to both human and animal markets. This diverse portfolio allows ADM to maintain a significant presence in the consumer packaged goods industry.

Quarterly Financial Highlights

The reported quarter saw ADM achieving a segment operating profit of $1,311 million, with adjusted figures slightly higher at $1,317 million. Despite these strong numbers, this represents a 24% decrease from the previous year, primarily due to lower crush and origination margins and less favorable mark-to-market timing impacts. However, some positives were noted, such as improved input and manufacturing costs, which contributed to a $0.15 per share increase, and volume improvements adding $0.20 per share.

Segment Performance Insights

The Ag Services & Oilseeds (AS&O) segment experienced a significant decline, with profits falling 29% to $864 million. This was mainly due to reduced global trade and risk management results and lower export volumes and margins in South America. The Carbohydrate Solutions segment also saw a decrease, with profits down 11% to $248 million, affected by lower domestic ethanol margins. Conversely, the Nutrition segment faced the steepest decline of 39%, earning just $84 million, as unplanned downtime and a normalizing market impacted margins negatively.

Strategic Initiatives and Outlook

ADM's CEO, Juan Luciano, emphasized the company's strategic initiatives such as the ramp-up of the Green Bison JV and expanding efforts in regenerative agriculture and BioSolutions. These initiatives are part of ADM's broader strategy to navigate through challenging market conditions effectively. The company remains confident in its full-year EPS guidance, projecting adjusted earnings per share in the range of $5.25 to $6.25.

Investor and Analyst Perspectives

Despite the mixed financial results, ADM's strategic positioning and operational adjustments provide a solid foundation for future growth. The company's focus on reducing supply chain complexity and enhancing shareholder returns through measures like accelerated share repurchase programs are positive signs for investors. Additionally, ADMs commitment to sustainability and innovation in providing solutions for a healthier planet continues to resonate well with value-driven investors.

Overall, Archer-Daniels Midland's first-quarter earnings for 2024 reflect a company adept at navigating a complex global market, with strategic foresight and a robust operational framework that promises resilience and growth in the challenging consumer packaged goods industry.

For more detailed financial analysis and future updates on ADM, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Archer-Daniels Midland Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance