LSB Industries Inc (LXU) Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts

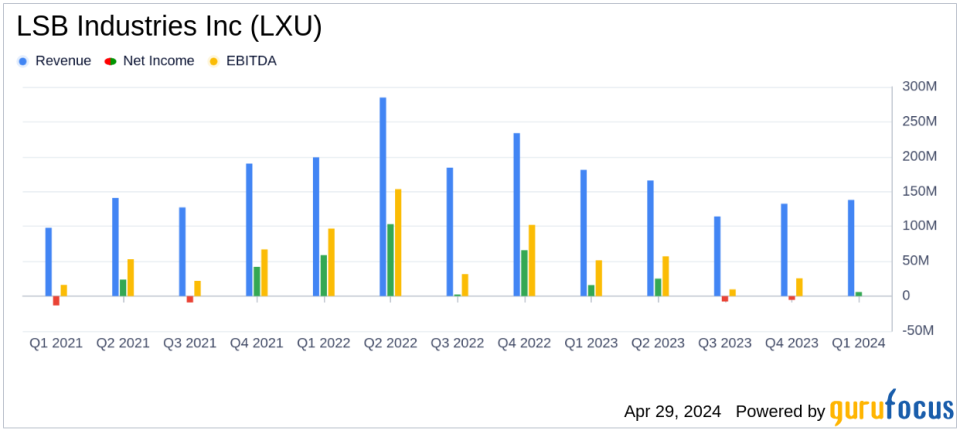

Revenue: Reported at $138 million, down from $181 million in the same quarter the previous year, falling short of estimates of $127.66 million.

Net Income: Achieved $6 million, down from $16 million year-over-year, but exceeded estimates of $3.93 million.

Earnings Per Share (EPS): Recorded at $0.08, down from $0.21 in the prior year's quarter, surpassing the estimated $0.05.

Adjusted EBITDA: Totaled $33 million, a decrease from $51 million in the first quarter of 2023.

Cash Flow from Operations: Generated $24 million with capital expenditures amounting to $18 million.

Share Repurchases: Bought back approximately 0.7 million shares of common stock during the quarter.

Total Cash and Short-term Investments: Stood at approximately $265 million as of March 31, 2024.

On April 29, 2024, LSB Industries Inc (NYSE:LXU) released its 8-K filing, revealing the financial results for the first quarter ended March 31, 2024. The company reported net sales of $138 million, surpassing the analyst's estimated revenue of $127.66 million. However, the net income stood at $6 million, slightly above the estimated $3.93 million, with a diluted EPS of $0.08, outperforming the anticipated $0.05.

LSB Industries Inc, headquartered in Oklahoma City, Oklahoma, operates in the chemical manufacturing sector, focusing on products for agricultural, industrial, and mining markets. The company's product line includes ammonia, urea ammonia nitrate (UAN), and nitric acids, essential for various applications across these sectors.

Financial and Operational Highlights

The first quarter of 2024 saw a decrease in net sales from $181 million in the same quarter of the previous year to $138 million. This decline was attributed to lower selling prices across all product categories despite a significant increase in sales volumes, driven by robust demand for fertilizers and enhanced commercial strategies. Notably, the company achieved a healthy cash flow from operations amounting to $24 million and engaged in strategic shareholder value enhancement through stock repurchases and bond buybacks.

President and CEO Mark Behrman commented on the quarter's outcomes, highlighting the alignment with expectations and pointing out the strategic moves enhancing production volumes and shareholder value. Behrman also expressed optimism about LSB's clean ammonia initiatives, which are set to position the company as a leader in the global energy transition.

Market and Future Outlook

The market outlook remains favorable for nitrogen fertilizers, with stable ammonia pricing and strong UAN demand expected to continue. The company's strategic initiatives, including the development of low-carbon ammonia projects and partnerships with industry giants like Samsung Engineering and Air Liquide, underscore its commitment to sustainability and innovation.

Looking ahead, LSB Industries plans significant capital deployments for facility turnarounds and projects expected to boost EBITDA and shareholder value. The ongoing developments in clean ammonia and carbon capture technologies are particularly noteworthy, as they align with global environmental goals and offer new business avenues.

Analysis of Challenges and Strategic Moves

Despite the challenges posed by lower product prices and global supply chain disruptions, LSB Industries' strategic focus on operational efficiency and market-driven product development has allowed it to maintain a strong financial position. The company's proactive management of its product portfolio and capital investments are crucial in navigating the current market dynamics and setting the stage for future growth.

Overall, LSB Industries Inc (NYSE:LXU) has demonstrated resilience and strategic foresight in its Q1 2024 performance. With solid financial results that exceeded analyst expectations and a clear vision for future growth initiatives, the company is well-positioned to continue its trajectory towards becoming a leader in the chemical industry, particularly in the environmentally crucial sector of low-carbon products.

Explore the complete 8-K earnings release (here) from LSB Industries Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance