Cushman & Wakefield PLC (CWK) Q1 2024 Earnings: A Detailed Review Against Analyst Expectations

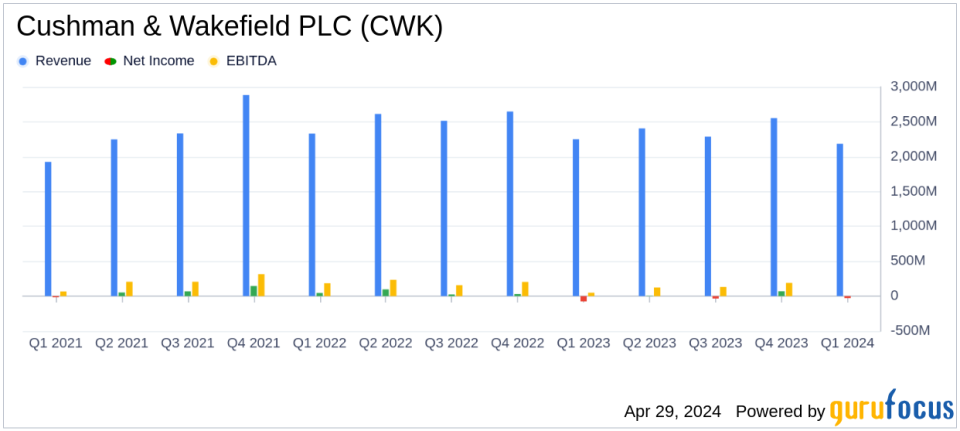

Revenue: Reported at $2.2 billion for Q1 2024, down 3% year-over-year, falling short of estimates of $2178.60 million.

Net Loss: Posted a net loss of $28.8 million, a significant improvement from a net loss of $76.4 million in Q1 2023, but still below the estimated net loss of $3.42 million.

Earnings Per Share: Diluted loss per share was $0.13, underperforming against the estimated loss per share of $0.03.

Adjusted EBITDA: Increased by 28% to $78.1 million, with the margin expanding by 117 basis points to 5.2%.

Free Cash Flow: Recorded a negative $135.6 million, showing an improvement from a negative $231.5 million in the prior year.

Liquidity: Ended the quarter with $1.7 billion in liquidity, including $1.1 billion available from undrawn credit facilities and $0.6 billion in cash and cash equivalents.

Debt Management: Prepaid $50 million of term loans due in 2025 and repriced $1 billion of term loans due in 2030, expected to save approximately $6 million annually in cash interest expenses.

Cushman & Wakefield PLC (NYSE:CWK), a leading global commercial real estate services firm, disclosed its financial outcomes for the first quarter of 2024 on April 29, 2024, through its 8-K filing. The company reported a revenue of $2.2 billion and a net loss of $28.8 million, with a diluted loss per share of $0.13. These figures show a decrease in revenue by 3% and a significant reduction in net loss by 62% compared to the same period last year.

Company Overview

Headquartered in Chicago, Cushman & Wakefield operates as one of the largest commercial real estate services firms globally. The company offers a wide array of services to property owners, occupiers, and investors, including leasing, capital markets sales, valuation, project management, and facilities management. This extensive service portfolio helps Cushman & Wakefield maintain a strong presence in the real estate sector worldwide.

Financial Performance Insights

The reported revenue of $2.2 billion, although a slight decline from the previous year, was accompanied by a notable improvement in the company's net loss position, decreasing from $76.4 million in Q1 2023 to $28.8 million in Q1 2024. This improvement is primarily attributed to robust leasing growth, particularly in the EMEA region, and effective cost management strategies.

Adjusted EBITDA stood at $78.1 million, up 28% year-over-year, driven by the same operational efficiencies that helped mitigate the net loss. The Adjusted EBITDA margin also expanded by 117 basis points to 5.2%, reflecting tighter cost control and operational effectiveness.

Strategic Financial Management

During the quarter, Cushman & Wakefield took significant steps in managing its financial structure. Notably, the company prepaid $50 million of its term loans due in 2025 and repriced $1 billion of its term loans due in 2030, reducing the interest rate spread, which is expected to save approximately $6 million annually in cash interest expenses. These actions underscore the firm's proactive approach to debt management and interest cost reduction.

Challenges and Market Conditions

The company faced challenges from volatility and uncertainty in the interest rate environment, which impacted capital markets revenue. Additionally, the decrease in gross contract reimbursables revenue by 8% was primarily due to changes in client mix, reflecting the dynamic nature of the real estate services market.

Outlook and Forward Movements

Looking ahead, CEO Michelle MacKay emphasized the company's focus on leveraging growth opportunities and continuing the momentum built in the first quarter. The strategic debt management and cost discipline are expected to bolster Cushman & Wakefield's financial stability and operational efficiency in upcoming quarters.

Conclusion

Despite a challenging market environment, Cushman & Wakefield's strategic initiatives and robust service line performance have positioned the company to navigate uncertainties effectively. The focus on cost management and operational efficiencies is likely to support its endeavors to enhance shareholder value and sustain its competitive position in the global real estate market.

Explore the complete 8-K earnings release (here) from Cushman & Wakefield PLC for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance