A Closer Look at Starbucks's Options Market Dynamics

A Closer Look at Starbucks's Options Market Dynamics

Investors with a lot of money to spend have taken a bearish stance on Starbucks (NASDAQ:SBUX).

有大量资金可以花的投资者对星巴克(纳斯达克股票代码:SBUX)采取了看跌立场。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

今天,当交易出现在我们在本辛加追踪的公开期权历史记录上时,我们注意到了这一点。

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with SBUX, it often means somebody knows something is about to happen.

我们不知道这是一个机构还是仅仅是一个富人。但是,当SBUX发生如此大的事情时,通常意味着有人知道某件事即将发生。

Today, Benzinga's options scanner spotted 25 options trades for Starbucks.

今天,本辛加的期权扫描仪发现了星巴克的25笔期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 20% bullish and 80%, bearish.

这些大额交易者的整体情绪分为20%看涨和80%(看跌)。

Out of all of the options we uncovered, 24 are puts, for a total amount of $2,289,431, and there was 1 call, for a total amount of $67,777.

在我们发现的所有期权中,有24个是看跌期权,总额为2,289,431美元,还有1个看涨期权,总额为67,777美元。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $85.0 and $90.0 for Starbucks, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场走势者将注意力集中在星巴克过去三个月的85.0美元至90.0美元的价格区间上。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

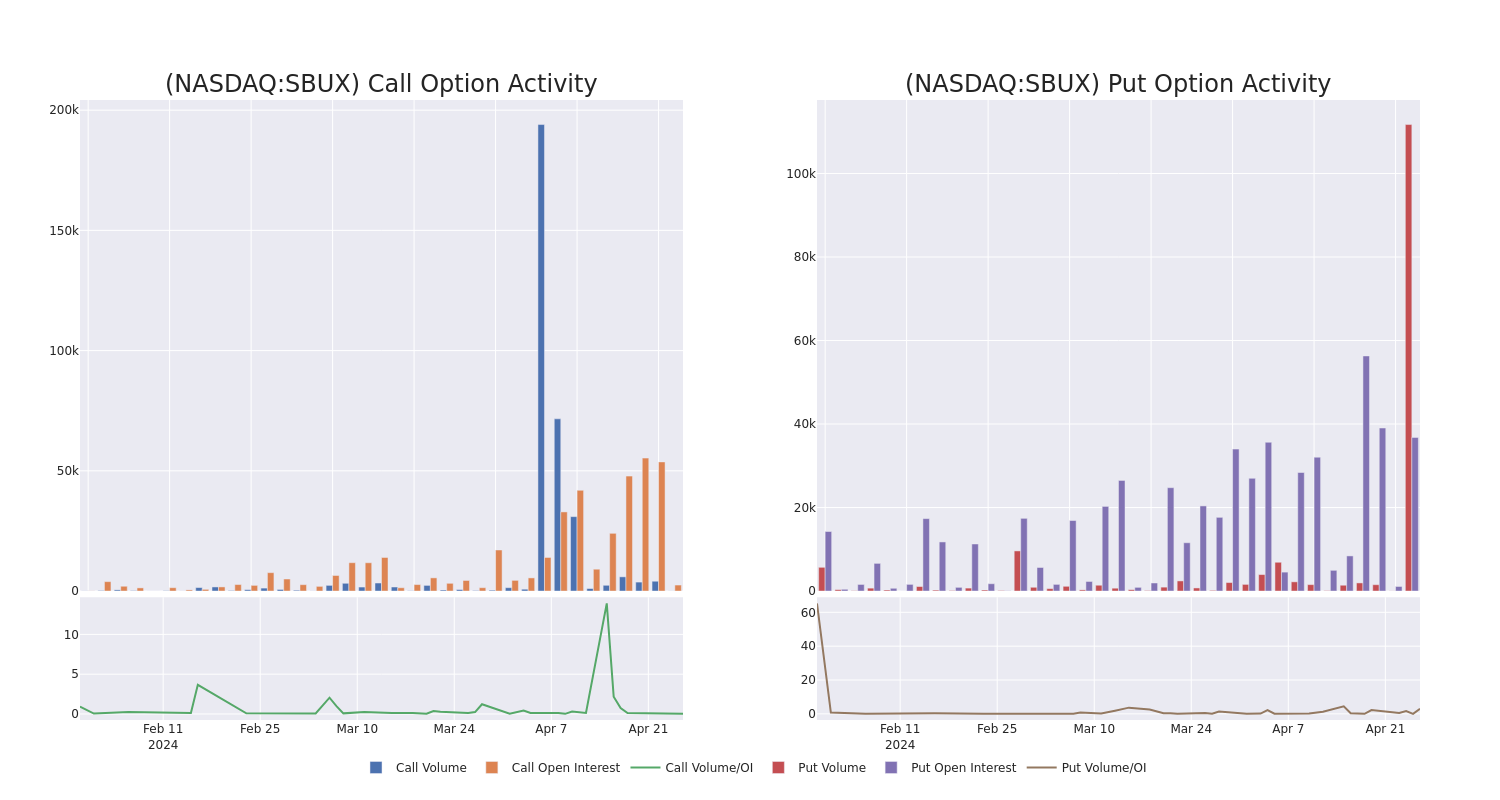

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Starbucks's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Starbucks's significant trades, within a strike price range of $85.0 to $90.0, over the past month.

检查交易量和未平仓合约为股票研究提供了至关重要的见解。这些信息是衡量星巴克期权在特定行使价下的流动性和利息水平的关键。下面,我们简要介绍了过去一个月星巴克重大交易的看涨期权和未平仓合约的趋势,行使价区间为85.0美元至90.0美元。

Starbucks Option Activity Analysis: Last 30 Days

星巴克期权活动分析:过去 30 天

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SBUX | PUT | TRADE | BULLISH | 06/21/24 | $2.73 | $2.63 | $2.63 | $85.00 | $129.1K | 36.7K | 4.2K |

| SBUX | PUT | TRADE | BEARISH | 06/21/24 | $2.68 | $2.44 | $2.63 | $85.00 | $127.2K | 36.7K | 2.9K |

| SBUX | PUT | TRADE | BEARISH | 06/21/24 | $2.57 | $2.35 | $2.57 | $85.00 | $126.4K | 36.7K | 1.1K |

| SBUX | PUT | TRADE | BULLISH | 06/21/24 | $2.66 | $2.6 | $2.6 | $85.00 | $126.1K | 36.7K | 7.8K |

| SBUX | PUT | TRADE | BEARISH | 06/21/24 | $2.67 | $2.48 | $2.62 | $85.00 | $124.7K | 36.7K | 5.0K |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SBUX | 放 | 贸易 | 看涨 | 06/21/24 | 2.73 美元 | 2.63 美元 | 2.63 美元 | 85.00 美元 | 129.1 万美元 | 36.7K | 4.2K |

| SBUX | 放 | 贸易 | 粗鲁的 | 06/21/24 | 2.68 美元 | 2.44 美元 | 2.63 美元 | 85.00 美元 | 12.72 万美元 | 36.7K | 2.9K |

| SBUX | 放 | 贸易 | 粗鲁的 | 06/21/24 | 2.57 美元 | 2.35 美元 | 2.57 美元 | 85.00 美元 | 126.4 万美元 | 36.7K | 1.1K |

| SBUX | 放 | 贸易 | 看涨 | 06/21/24 | 2.66 美元 | 2.6 美元 | 2.6 美元 | 85.00 美元 | 126.1 万美元 | 36.7K | 7.8K |

| SBUX | 放 | 贸易 | 粗鲁的 | 06/21/24 | 2.67 美元 | 2.48 美元 | 2.62 美元 | 85.00 美元 | 124.7 万美元 | 36.7K | 5.0K |

About Starbucks

关于星巴克

Starbucks is one of the most widely recognized restaurant brands in the world, operating more than 38,000 stores across more than 80 countries as of the end of fiscal 2023. The firm operates in three segments: North America, international markets, and channel development (grocery and ready-to-drink beverage). The coffee chain generates revenue from company-operated stores, royalties, sales of equipment and products to license partners, ready-to-drink beverages, packaged coffee sales, and single-serve products.

星巴克是世界上认可度最高的餐厅品牌之一,截至2023财年末,星巴克在80多个国家经营着38,000多家门店。该公司在三个领域开展业务:北美、国际市场和渠道开发(杂货和即饮饮料)。这家咖啡连锁店的收入来自公司经营的门店、特许权使用费、向许可合作伙伴销售设备和产品、即饮饮料、包装咖啡销售和一次性产品。

Where Is Starbucks Standing Right Now?

星巴克现在在哪里?

- With a volume of 153,010, the price of SBUX is down -0.23% at $87.64.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 4 days.

- SBUX的价格下跌了0.23%,至87.64美元,交易量为153,010美元。

- RSI 指标暗示标的股票可能已接近超卖。

- 下一份收益预计将在4天内公布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

译文内容由第三方软件翻译。