Xcel Energy Inc. (XEL) Q1 2024 Earnings: Surpasses Analyst EPS Estimates

Earnings Per Share (EPS): Reported Q1 EPS of $0.88, surpassing the estimated $0.78.

Net Income: Achieved $488 million, exceeding the forecast of $439.04 million.

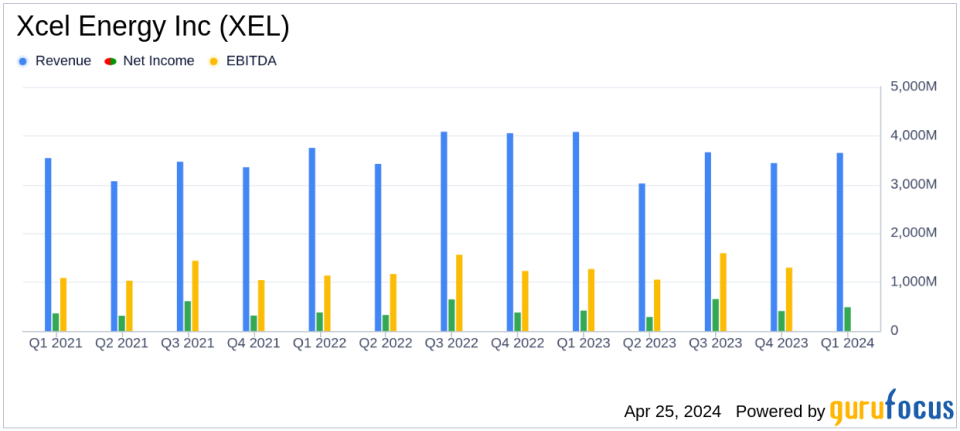

Revenue: Totalled $3.649 billion, falling short of the expected $4.128 billion.

Year-over-Year EPS Growth: Increased from $0.76 in Q1 2023 to $0.88 in Q1 2024.

Infrastructure Investments: Increased recovery of infrastructure investments contributed to higher earnings.

Operational Efficiency: Lower operation and maintenance expenses partially offset by higher interest charges and depreciation.

2024 EPS Guidance: Reaffirmed at $3.50 to $3.60, aligning closely with annual EPS estimates.

Xcel Energy Inc. (NASDAQ:XEL), a major player in the regulated utility sector, released its 8-K filing on April 25, 2024, revealing a strong performance for the first quarter of the year. The company reported a notable increase in GAAP and ongoing diluted earnings per share (EPS) to $0.88, up from $0.76 in the same quarter of the previous year, surpassing the analyst estimate of $0.78. This earnings growth was primarily fueled by increased recovery of infrastructure investments and reduced operation and maintenance (O&M) expenses, although partially offset by higher interest charges and depreciation.

Xcel Energy manages utilities serving 3.8 million electric customers and 2.1 million natural gas customers across eight states. With a significant focus on renewable energy, the company is a leading owner and supplier of carbon-free energy in the United States.

Financial Highlights and Operational Performance

The company's net income for the quarter stood at $488 million, compared to $418 million in the prior year. Total operating revenues were $3,649 million, a decrease from $4,080 million in 2023, primarily due to lower natural gas revenues which fell by $347 million, reflecting the impact of market price fluctuations and regulatory outcomes.

Operating expenses saw a reduction, totaling $2,970 million compared to $3,507 million in the previous year, driven by lower costs of natural gas sold and transported, and electric fuel and purchased power expenses. These decreases highlight effective cost management and the impact of regulatory recovery mechanisms that help stabilize earnings against fuel price volatility.

Strategic Developments and Future Outlook

Xcel Energy reaffirmed its EPS guidance for 2024, projecting earnings to be between $3.50 and $3.60 per share. The company's strategic initiatives, including significant investments in infrastructure and renewable energy projects, are expected to support sustained growth. Xcel Energy's commitment to enhancing wildfire mitigation and system resiliency, especially in regions like the Texas Panhandle affected by recent wildfires, underscores its focus on operational safety and reliability.

Bob Frenzel, Xcel Energys Chairman, President, and CEO, emphasized the ongoing efforts to advance wildfire risk reduction initiatives, stating,

We have already advanced a number of wildfire risk reduction initiatives including preventive power shutoffs during high-risk conditions, non-reclose and fast-trip safety settings, and accelerated pole inspections and replacements and will continue to enhance our wildfire mitigation efforts."

Challenges and Regulatory Updates

The utility sector is inherently linked to regulatory changes and environmental challenges. Xcel Energy is navigating these with a proactive approach, particularly in its comprehensive resource planning and rate case proceedings across different states. The outcomes of these regulatory reviews will be crucial in determining the company's ability to recover costs and achieve its financial objectives.

In conclusion, Xcel Energy Inc. (NASDAQ:XEL) has demonstrated a strong start to 2024, with earnings surpassing analyst expectations and a solid foundation for continued growth. The company's strategic focus on infrastructure and renewable energy investments, coupled with effective cost management and regulatory engagement, positions it well to navigate the challenges of the utility sector and deliver value to its shareholders.

Explore the complete 8-K earnings release (here) from Xcel Energy Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance