BlackRock's Bitcoin ETF Snaps 71-Day Inflow Streak, Data Show

BlackRock's spot bitcoin ETF did not draw any investor money on Wednesday, the first such instance since the fund's inception three months ago.

Inflows have slowed this month, taking the wind out of the bitcoin bull run.

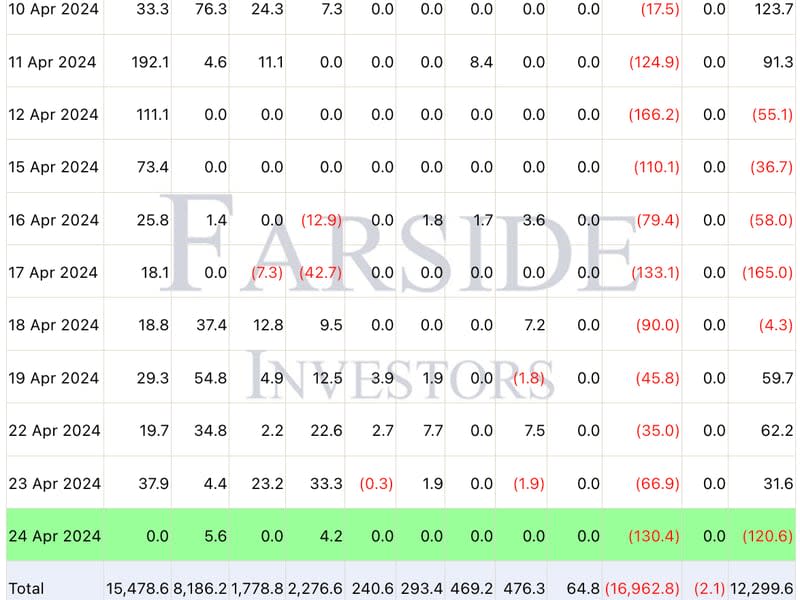

BlackRock’s spot bitcoin exchange-traded fund (ETF), which trades under the ticker IBIT on Nasdaq, fell out of favor on Wednesday, preliminary data published by Farside Investors showed.

For the first time since going live on January 11, the fund did not draw any investor money, snapping a 71-day inflows streak. Seven out of the other ten funds followed IBIT’s lead.

Fidelity’s FBTC and the ARK 21Shares Bitcoin ETF (ARKB) registered inflows of $5.6 million and $4,2 million, respectively, while Grayscale’s GBTC bled $130.4 million, leading to a new cumulative outflow of $120.6 million, the highest since April 17.

Spot ETFs debuted in the U.S. on January 11 with much fanfare, promising to pull billions of dollars in institutional money. To date, BlackRock’s IBIT has alone amassed more than $15 billion, while the 11 funds taken together have registered a net inflow of over $12 billion.

However, most inflows happened in the first quarter, and the uptake has slowed this month, taking the wind out of the bitcoin bull run.

Bitcoin {{BTC}}, the leading cryptocurrency by market value, has traded primarily between $60,000 and $70,000 this month, CoinDesk data show, marking a weak follow-through to the first quarter’s near 70% rally to record highs above $73,500.

Yahoo Finance

Yahoo Finance