Are TG Therapeutics, Inc.'s (NASDAQ:TGTX) Mixed Financials Driving The Negative Sentiment?

Are TG Therapeutics, Inc.'s (NASDAQ:TGTX) Mixed Financials Driving The Negative Sentiment?

With its stock down 11% over the past three months, it is easy to disregard TG Therapeutics (NASDAQ:TGTX). It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Fundamentals usually dictate market outcomes so it makes sense to study the company's financials. Particularly, we will be paying attention to TG Therapeutics' ROE today.

TG Therapeutics(納斯達克股票代碼:TGTX)的股票在過去三個月中下跌了11%,很容易被忽視。市場可能忽視了該公司不同的財務狀況,決定傾向於負面情緒。基本面通常決定市場業績,因此研究公司的財務狀況是有意義的。特別是,我們今天將關注TG Therapeutics的投資回報率。

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

投資回報率或股本回報率是評估公司如何有效地從股東那裏獲得投資回報的有用工具。簡而言之,投資回報率顯示了每美元從其股東投資中產生的利潤。

How To Calculate Return On Equity?

如何計算股本回報率?

The formula for ROE is:

ROE 的公式是:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

股本回報率 = 淨利潤(來自持續經營業務)÷ 股東權益

So, based on the above formula, the ROE for TG Therapeutics is:

因此,根據上述公式,TG Therapeutics的投資回報率爲:

7.9% = US$13m ÷ US$161m (Based on the trailing twelve months to December 2023).

7.9% = 1300萬美元 ÷ 1.61億美元(基於截至2023年12月的過去十二個月)。

The 'return' is the amount earned after tax over the last twelve months. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.08 in profit.

“回報” 是過去十二個月的稅後收入。另一種思考方式是,每持有價值1美元的股權,該公司就能獲得0.08美元的利潤。

What Has ROE Got To Do With Earnings Growth?

投資回報率與收益增長有什麼關係?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

到目前爲止,我們已經了解到,投資回報率是衡量公司盈利能力的指標。現在,我們需要評估公司再投資或 “保留” 了多少利潤以用於未來的增長,從而使我們對公司的增長潛力有所了解。假設其他一切保持不變,那麼與不一定具有這些特徵的公司相比,投資回報率和利潤保留率越高,公司的增長率就越高。

A Side By Side comparison of TG Therapeutics' Earnings Growth And 7.9% ROE

TG Therapeutics的收益增長和7.9%的投資回報率的並排比較

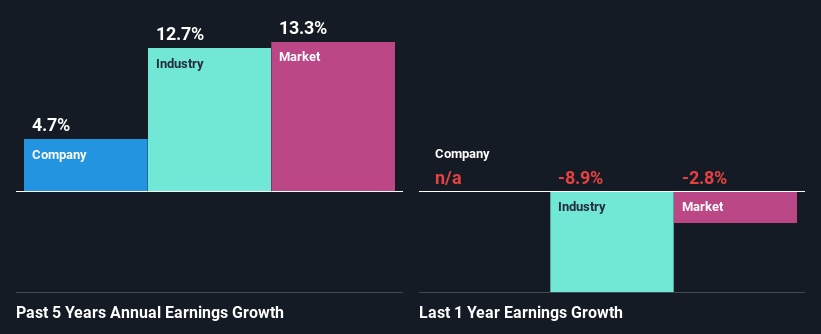

On the face of it, TG Therapeutics' ROE is not much to talk about. Next, when compared to the average industry ROE of 16%, the company's ROE leaves us feeling even less enthusiastic. Thus, the low net income growth of 4.7% seen by TG Therapeutics over the past five years could probably be the result of the low ROE.

從表面上看,TG Therapeutics的投資回報率沒什麼好談的。接下來,與16%的行業平均投資回報率相比,該公司的投資回報率使我們感到不那麼熱情。因此,TG Therapeutics在過去五年中實現了4.7%的低淨收入增長,這可能是投資回報率低的結果。

As a next step, we compared TG Therapeutics' net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 13% in the same period.

下一步,我們將TG Therapeutics的淨收入增長與該行業進行了比較,並失望地看到該公司的增長低於同期13%的行業平均增長。

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if TG Therapeutics is trading on a high P/E or a low P/E, relative to its industry.

收益增長是股票估值的重要因素。投資者接下來需要確定的是,預期的收益增長或缺乏收益是否已經包含在股價中。然後,這可以幫助他們確定股票是爲光明還是暗淡的未來而佈局。衡量預期收益增長的一個很好的指標是市盈率,它根據收益前景決定了市場願意爲股票支付的價格。因此,您可能需要檢查TG Therapeutics相對於其行業的市盈率是高還是低市盈率。

Is TG Therapeutics Making Efficient Use Of Its Profits?

TG Therapeutics是否在有效利用其利潤?

TG Therapeutics doesn't pay any regular dividends, which means that it is retaining all of its earnings. However, this doesn't explain the low earnings growth the company has seen. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

TG Therapeutics不支付任何定期股息,這意味着它將保留所有收益。但是,這並不能解釋該公司的低收益增長。因此,這裏可能還有其他因素在起作用,這些因素可能會阻礙增長。例如,該業務面臨一些阻力。

Conclusion

結論

Overall, we have mixed feelings about TG Therapeutics. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

總的來說,我們對TG Therapeutics的看法喜憂參半。儘管該公司的利潤保留率確實很高,但其低迴報率可能會阻礙其收益增長。話雖如此,最新的行業分析師預測顯示,該公司的收益有望加速。這些分析師的預期是基於對該行業的廣泛預期,還是基於公司的基本面?點擊此處進入我們分析師對公司的預測頁面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

譯文內容由第三人軟體翻譯。