Intuitive Surgical (NYSE:ISRG) kicked off FY2024 on a high note. The market leader in minimally invasive, robotic-assisted surgery sustained double-digit revenue growth, with adoption rates remaining robust globally. Further, Intuitive’s latest state-of-the-art systems are gaining traction in the market at a rapid pace, posting robust initial sales figures and signaling a promising growth trajectory ahead. So, despite shares trading near all-time highs and Intuitive’s valuation looking rich, I remain bullish on ISRG stock.

Intuitive’s Growth Remains Robust; Signs of Deceleration are False

Intuitive’s growth remained robust in Q1 2024, with revenue growing by 11.5% to $1.89 billion. At first glance, this may imply a deceleration compared to the previous quarter’s revenue growth of 16.5% and last year’s growth of 14.0%. However, this is hardly the case, and some additional context is needed.

Specifically, the only reason Intuitive’s revenue growth appears slightly weaker against past figures is that Systems revenue came in at $418 million, compared with $427 million last year, despite Intuitive placing 313 da Vinci surgical systems in hospitals compared with 312 systems in Q1-2023. The reason lies in that Q1-2024’s installations included 159 systems (131 last year) placed under operating lease agreements, of which 94 (62 last year) systems were placed under usage-based operating lease agreements.

Essentially, the minor revenue deceleration stemmed from Intuitive receiving less upfront payment for its systems. Yet, this is likely to result in faster sales growth in the long term. This is both due to the revenue-sharing nature of the usage-based agreements and due to the expansion of installations in hospitals that may not have been able to afford a da Vinci system upfront. The higher the number of installed systems, the larger its revenue growth da Vinci instruments and accessory sales will be over time.

Think of it as the “razor and blades” model, where the core product is offered at a low cost or even given away for free (the razor), with profits generated from the sale of complementary products or services (the blades). While initial razor sales might incur losses, the substantial profits from selling high-margin blades more than compensate for the losses.

Evidently, instruments and accessories sales grew by 18% to $1.16 billion in the quarter, largely driven by a 16% increase in da Vinci procedure volume and a 90% increase in Ion procedure (Intuitive’s brand new lung biopsy platform) volumes, as well as higher pricing. Based on this, I would argue that deceleration-related concerns are false.

Strong Revenue Earnings Growth to Persist in FY2024 and Beyond

Intuitive’s strong growth is set to persist through the rest of the year and beyond. This is expected to be driven by growing da Vinci procedures and the company’s latest da Vinci 5 system showing promising initial sales. Specifically, in March, Intuitive obtained FDA clearance for da Vinci 5 and even sold eight systems in Q1 within a few days.

With robotic surgery seeing fast adoption rates globally and da Vinci 5’s capabilities reminiscent of science fiction, it’s fair to assume that installations should pick up, moving forward.

Therefore, Wall Street expects the company to achieve full-year revenue growth of 12.3% to $8.00 billion, with double-digit revenue growth to be sustained at least through 2028. Earnings-wise, EPS growth is also expected to remain strong in the medium term, with consensus estimates pointing to a five-year CAGR of 12% from last year’s earning base.

The Valuation Is Rich but Likely Won’t be Coming Down Soon

Intuitive Surgical stock is currently trading near all-time highs, with investors paying about 60 times the company’s expected EPS of $6.25 for the year. This is, without a doubt, a premium valuation. In fact, one could reasonably argue that despite the company’s anticipated sustained growth trajectory, the low-double-digit figures still don’t justify such an elevated multiple.

Nevertheless, I don’t see Intuitive’s valuation coming down anytime soon. Sure, the company’s growth is strong but not extraordinary. However, that’s not really the point. What truly matters is that Intuitive is essentially creating this market itself while simultaneously dominating it. There is virtually no competition at the level Intuitive is playing, which essentially guarantees market leadership for decades to come. It shouldn’t be surprising, therefore, that investors are willing to pay a hefty price for a piece of the cake.

In the meantime, it’s worth mentioning that Intuitive features one of the most healthy balance sheets in the healthcare sector, with $0 of debt and a $7.3 billion cash position. Such significant dry powder could be invested for future growth or used to boost capital returns, also contributing to Intuitive’s valuation.

Is ISRG Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, Intuitive Surgical features a Moderate Buy consensus rating based on 13 Buys and six Holds assigned in the past three months. At $423.67, the average ISRG stock forecast suggests 12.4% upside potential.

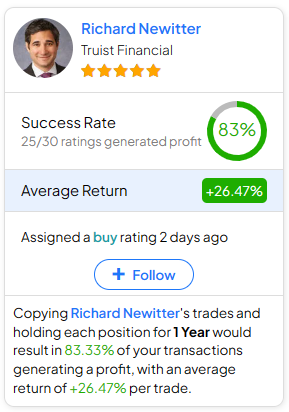

If you have yet to decide which analyst you should follow if you want to buy and sell ISRG stock, the most profitable analyst covering the stock (on a one-year timeframe) is Richard Newitter from Truist Financial, with an average return of 26.47% per rating and an 83% success rate. Click on the image below to learn more.

Final Thoughts on ISRG Stock

To sum up, Intuitive’s Q1-2024 numbers reassured the market of the company’s market-leading position in the space. Despite what can be initially interpreted as a deceleration in revenue growth, the company’s approach to market expansion through innovative leasing agreements and robust sales of instruments and accessories bodes well for sustained growth.

While the stock’s valuation may seem rich, Intuitive’s market dominance and solid financial position are likely to keep encouraging investors to pay a premium for a piece of its future success. Consequently, I remain bullish on the stock.