AbbVie's Options Frenzy: What You Need to Know

AbbVie's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bearish stance on AbbVie.

有很多錢可以花的鯨魚對艾伯維採取了明顯的看跌立場。

Looking at options history for AbbVie (NYSE:ABBV) we detected 15 trades.

查看艾伯維(紐約證券交易所代碼:ABBV)的期權歷史記錄,我們發現了15筆交易。

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 46% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,33%的投資者以看漲的預期開啓交易,46%的投資者持看跌預期。

From the overall spotted trades, 3 are puts, for a total amount of $162,900 and 12, calls, for a total amount of $749,820.

在已發現的全部交易中,有3筆是看跌期權,總額爲162,900美元,12筆看漲期權,總額爲749,820美元。

What's The Price Target?

目標價格是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $75.0 to $185.0 for AbbVie over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將AbbVie的價格定在75.0美元至185.0美元之間。

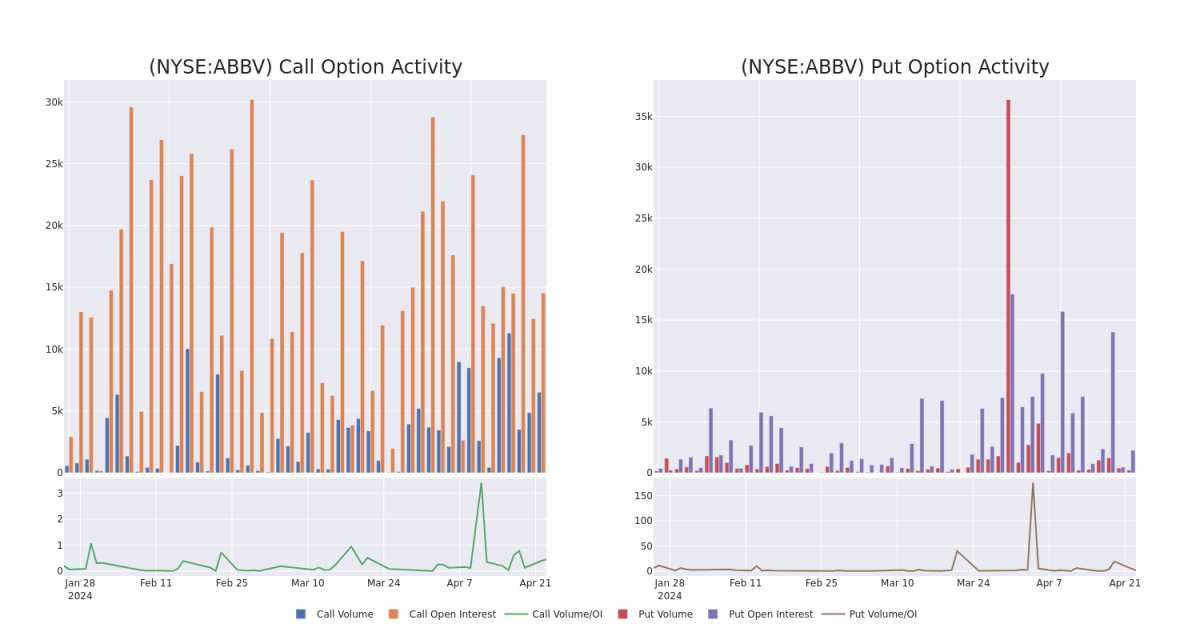

Volume & Open Interest Development

交易量和未平倉合約的發展

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for AbbVie's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across AbbVie's significant trades, within a strike price range of $75.0 to $185.0, over the past month.

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量艾伯維期權在特定行使價下的流動性和利息水平的關鍵。下面,我們簡要介紹了過去一個月艾伯維重大交易的看漲期權和未平倉合約的趨勢,行使價區間爲75.0美元至185.0美元。

AbbVie 30-Day Option Volume & Interest Snapshot

AbbVie 30 天期權交易量和利息快照

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | CALL | SWEEP | BEARISH | 03/21/25 | $9.4 | $8.9 | $8.9 | $185.00 | $347.1K | 6 | 546 |

| ABBV | PUT | TRADE | BEARISH | 06/20/25 | $6.2 | $5.5 | $6.1 | $145.00 | $97.6K | 213 | 160 |

| ABBV | CALL | TRADE | BEARISH | 06/21/24 | $6.5 | $6.35 | $6.41 | $170.00 | $48.0K | 3.7K | 1.5K |

| ABBV | CALL | TRADE | BULLISH | 01/16/26 | $96.0 | $93.9 | $96.0 | $75.00 | $48.0K | 4 | 6 |

| ABBV | CALL | TRADE | BULLISH | 08/16/24 | $6.3 | $6.2 | $6.26 | $175.00 | $46.9K | 1.0K | 1.4K |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | 打電話 | 掃 | 粗魯的 | 03/21/25 | 9.4 美元 | 8.9 美元 | 8.9 美元 | 185.00 美元 | 347.1 萬美元 | 6 | 546 |

| ABBV | 放 | 貿易 | 粗魯的 | 06/20/25 | 6.2 美元 | 5.5 美元 | 6.1 美元 | 145.00 美元 | 97.6 萬美元 | 213 | 160 |

| ABBV | 打電話 | 貿易 | 粗魯的 | 06/21/24 | 6.5 美元 | 6.35 美元 | 6.41 美元 | 170.00 美元 | 48.0 萬美元 | 3.7K | 1.5K |

| ABBV | 打電話 | 貿易 | 看漲 | 01/16/26 | 96.0 美元 | 93.9 美元 | 96.0 美元 | 75.00 美元 | 48.0 萬美元 | 4 | 6 |

| ABBV | 打電話 | 貿易 | 看漲 | 08/16/24 | 6.3 美元 | 6.2 美元 | 6.26 美元 | 175.00 美元 | 46.9 萬美元 | 1.0K | 1.4K |

About AbbVie

關於 AbbVie

AbbVie is a pharmaceutical firm with a strong exposure to immunology (with Humira, Skyrizi, and Rinvoq) and oncology (with Imbruvica and Venclexta). The company was spun off from Abbott in early 2013. The 2020 acquisition of Allergan added several new products and drugs in aesthetics (including Botox).

艾伯維是一家制藥公司,在免疫學(與Humira、Skyrizi和Rinvoq合作)和腫瘤學(與Imbruvica和Venclexta合作)方面有着豐富的經驗。該公司於2013年初從雅培分拆出來。2020年對Allergan的收購增加了幾種美容領域的新產品和藥物(包括肉毒桿菌毒素)。

Following our analysis of the options activities associated with AbbVie, we pivot to a closer look at the company's own performance.

在分析了與AbbVie相關的期權活動之後,我們將轉向仔細研究公司自身的業績。

Present Market Standing of AbbVie

艾伯維目前的市場地位

- With a volume of 2,217,156, the price of ABBV is up 1.13% at $169.78.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 3 days.

- ABBV的價格上漲了1.13%,至169.78美元,交易量爲2,217,156美元。

- RSI 指標暗示,標的股票目前在超買和超賣之間保持中立。

- 下一份業績預計將在3天后公佈。

What Analysts Are Saying About AbbVie

分析師對艾伯維的看法

1 market experts have recently issued ratings for this stock, with a consensus target price of $195.0.

1位市場專家最近發佈了該股的評級,共識目標價爲195.0美元。

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for AbbVie, targeting a price of $195.

- 巴克萊銀行的一位分析師保持立場,繼續維持艾伯維的增持評級,目標價格爲195美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest AbbVie options trades with real-time alerts from Benzinga Pro.

期權交易帶來更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。通過Benzinga Pro的實時提醒,隨時了解最新的AbbVie期權交易。

譯文內容由第三人軟體翻譯。