Is There Reason for Alarm as Cava Group Investors Sell?

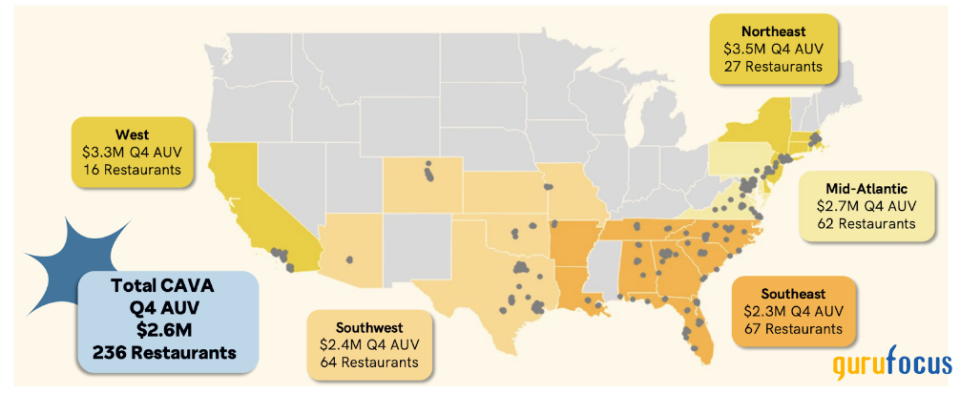

Cava Group Inc. (NYSE:CAVA) operates Mediterranean-style fast-casual restaurants primarily in the East Coast and Southern regions of the United States. They operate over 300 locations under two brand names, CAVA and Zoe's Kitchen, which it acquired in 2018.

Source: 2023 annual investor presentation

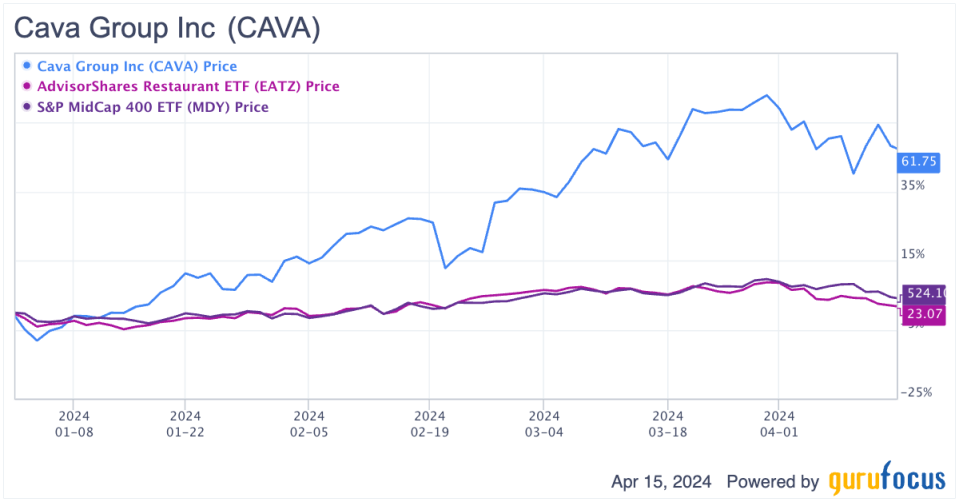

The stock performance recently has been outstanding, rising almost 50% so far this year. Compared to small caps and the restaurant industry being relatively flat for the year, Cava Group has been a darling in an underperforming sector.

CAVA Data by GuruFocus

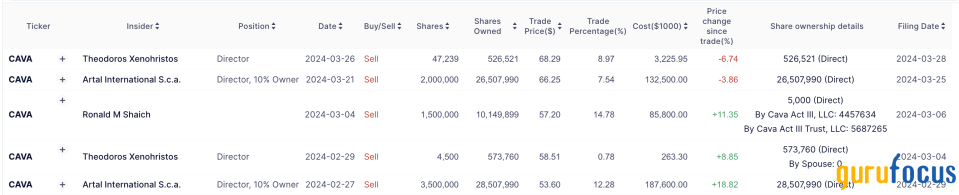

This all sounds wonderfulexcept some investors have sold a significant amount of their stake in the company over the past few months. This is not necessarily a bad thing, but it certainly warrants a closer look.

Who is jumping ship?

Two major investors are responsible for almost all of the selling.

Ron Shaich is chairman of the board of directors for Cava Group and sold 1.50 million shares in March. This dropped his share count from 11.60 million to just over 10.10 million (13% drop in ownership).

Artal International S.C.A. is an investment firm based in Luxembourg. It has sold 5.50 million shares so far in 2024. This dropped its share count from 32 million to 26.50 million (17% drop in ownership). Even after the selling, Artal owns over 20% of CAVA Group and has two members on the board of directors.

Source: Insider page on GuruFocus

That is a lot of shares being sold. Regardless, it is important to note this type of selling is not necessarily a bad thing.

Large investors might sell their positions to make a large purchase or rebalance their investment portfolio rather than because of a pessimistic outlook on the company. It should also be noted that Cava Group first started trading less than a year ago and this could be one of the first opportunities for investors to divest some of their shares.

Is there reason for alarm?

Even though these investors still hold a large position in CAVA Group, it is important to do our due diligence to make sure it is still a good investment.

CAVA Group had its initial public offering in June 2023, which means doing historical comparisons is not going to be a viable way to value the stock. Instead, we need to look at the current valuation as well as potential growth in the future.

Key Statistics (as of: 4/12/2024) | CAVA Group | Restaurant Industry Median |

P/E | 1,063 | 23.5 |

P/B | 12.7 | 2.8 |

Net Margin | 1.2 | 2.4 |

ROE | 11.4 | 8.3 |

Debt/Equity | 0.6 | 0.94 |

Source: GuruFocus

The return on equity and debt-equity numbers look pretty good compared to peers, but the valuation ratios really jump out as a red flag. A price-earnings ratio of just over 1,000 is astronomical. Does this mean Cava Group is overvalued?

It is not that simple. The company not only went public in 2023, but also recorded its first profit in the same year. With earnings per share of just 6 cents and a recent IPO, it should not be too surprising to get some wonky valuation numbers.

Looking to the future

It is always important to look at the future prospects of a company. CAVA Group is looking to grow fast. At the end of 2023, it had over 300 restaurants, but is looking to grow its number of locations by at least 15% per year until it reaches over 1,000 in 2032. That is significant growth, and the company has the room to do it.

CAVA Group's largest competitor is Chipotle Mexican Grill Inc. (NYSE:CMG), which operates over 3,000 restaurants across the United States. It has a huge part of the market share and Cava Group has an opportunity to chip away to grow the company.

Another place that Cava Group really stands out is same-restaurant sales growth. This measures the sales growth in existing restaurants and thus excludes sales growth derived from opening new locations.

Same-Restaurant Sales Growth Rate | 2023 | 2022 |

CAVA Group | 17.9 | 14.2 |

Chipotle Mexican Grill | 7.9 | 8.0 |

Industry Average | 1.7 | 5.9 |

Source: Annual reports, Industry average from Restaurant Business

Cava Group is way ahead of Chipotle as well as the overall industry. Even with the industry growth slowing in 2023, the company's same-restaurant sales growth is accelerating.

One can see the restaurant's two-pronged approach to growth. On one side, it will be opening new restaurants at a very fast pace over the next decade. On the other side, it has double-digit revenue growth in its existing stores. Combined, this strategy led to 30% growth in revenue in 2023.

Final thoughts

As an investor, it can be difficult to balance data that tells two different stories. The valuation metrics for Cava Group are significantly worse than its peer competitors, but its growth prospects are phenomenal. What to do?

In this situation, it makes sense to circle back to the large investors discussed earlier. Artal and Shaich sold a combined 7 million shares so far this year, but they still have a significant ownership stake in Cava Group (over 35 million shares combined). With a recent, large run-up in price, their selling appears to be rebalancing and taking profits rather than running for the hills.

Investors should consider the same strategy. Taking some profits while valuation ratios are high is a great way to lessen your exposure to a potentially overvalued stock, but still have an opportunity for additional gains if the company is able to execute its growth strategy. If the stock falls, you will be pleased you sold some, but if the stock rises, you will be happy to gain more profits. Either way, it is a smart idea to follow what these large investors are doing.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance