Here's Why You Should Retain Honeywell (HON) in Your Portfolio

Honeywell International Inc. HON has been experiencing strength in its commercial aviation original equipment and aftermarket businesses driven by solid demand in the aviation market. Also, solid momentum in the company’s defense and space business owing to stable U.S. and international defense spend volumes has been proving beneficial for its Aerospace segment.

The company’s Building Technologies segment has been gaining from strong demand for building solutions and a robust backlog level. Strength in advanced materials, process solutions, HPS and UOP businesses bodes well for HON’s Performance Materials and Technologies segment.

Management intends to strengthen and expand its businesses through buyouts. In March 2024, it announced a plan to acquire Civitanavi Systems S.p.A. for about $217 million to boost its portfolio of aerospace navigation solutions.

Also, in December 2023, HON inked a deal to acquire Carrier’s Global Access Solutions business for an all-cash deal of $4.95 billion. This acquisition positions the company to become a leading provider of security solutions for the digital age. In the fourth quarter of 2023, buyouts boosted the Performance Materials and Technologies segment’s sales by 1%.

It remains focused on rewarding shareholders through dividend payouts and share buybacks. In 2023, it paid dividends of $2.86 billion and repurchased shares worth $3.72 billion. Also, the quarterly dividend rate was hiked by 5% in September 2023.

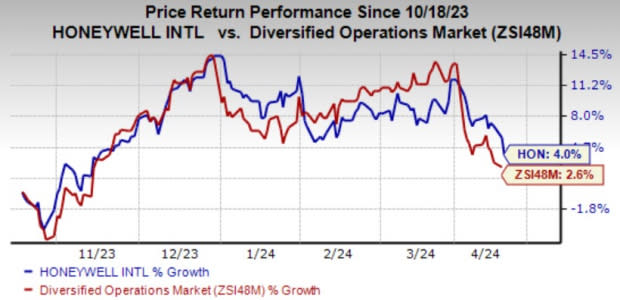

Image Source: Zacks Investment Research

In the past six months, the Zacks Rank #3 (Hold) company has gained 4% compared with the industry’s growth of 2.6%.

However, a persistent softness across its warehouse and workflow solutions, and productivity solutions and services businesses has been affecting the Safety and Productivity Solutions segment's performance. Also, headwinds across the sensing and safety technologies business remain concerning.

High debt levels have also been major concerns for HON as it raises financial obligations and might drain its profitability. Honeywell exited 2023 with long-term debt of $16.6 billion, increasing 9.9% year over year. Also, interest expenses and other financial charges in the fourth quarter remained high at $202 million.

Key Picks

Some better-ranked stocks from the same space are presented below.

Carlisle Companies Incorporated CSL currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CSL delivered a trailing four-quarter average earnings surprise of 7.6%. In the past 60 days, the Zacks Consensus Estimate for CSL’s 2024 earnings has increased 3.7%.

ITT Inc. ITT presently has a Zacks Rank of 2. ITT delivered a trailing four-quarter average earnings surprise of 7%. In the past 60 days, the Zacks Consensus Estimate for its 2024 earnings has increased 0.7%.

Cadre Holdings, Inc. CDRE presently has a Zacks Rank of 2. CDRE delivered a trailing four-quarter average earnings surprise of 45.6%. In the past 60 days, the Zacks Consensus Estimate for Cadre’s 2024 earnings has increased 7.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

ITT Inc. (ITT) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

Cadre Holdings, Inc. (CDRE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance